Under-fire Burford Capital rebounds after 'false and misleading' short-seller attack

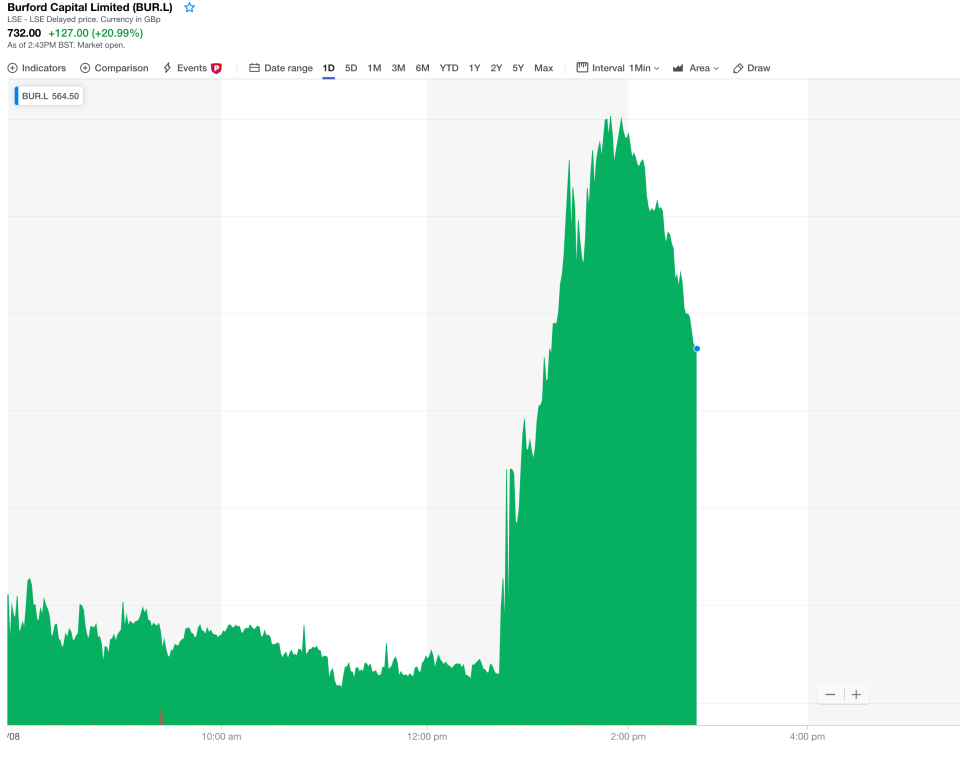

Shares in litigation finance company Burford Capital (BUR.L) bounced by over 30% on Thursday after the company published a detailed response to a critical report published the day prior.

Burford, a darling on London’s AIM market, crashed by almost 50% on Wednesday after Muddy Waters Research, a well-known US short seller, published a critical report on the business.

Muddy Waters accused Burford “actively misleads investors” and said it was “arguably insolvent.” Burford denied the claims and said it would published a detailed response to the 25-page report as soon as possible.

Its full response was published at just after lunchtime on Thursday. The company said the Muddy Waters report was “false and misleading” and contained “many factual inaccuracies, simple analytical errors and selective use of information.”

“Burford is solvent, generates strong cash flow and has good access to expansion capital,” the company said.

“Burford's accounting and financial reporting is transparent, appropriate and has been consistent for many years.

“Burford's governance is robust and serves the business well - Burford has been listening to investors and is actively considering their feedback.”

READ MORE: Short-selling attack costs stricken fund manager Neil Woodford £118m

The company also reiterated that senior management plan to buy additional shares in the business as a show of faith in its strength.

Shares in Burford Capital rose as much as 30% in response to the rebuttal. The stock was up 22% at 2.50pm UK.

Short sellers bet that company’s share price is going to fall. Activist short sellers like Muddy Waters take a short position and then publish reports pointing out what they see as the weaknesses in the company in a bid to try and bring the share price down.

Disclosures show that Muddy Waters took a short position equivalent to 0.71% of Burford’s shares on Monday. London-based Gladstone Capital Market is also shorting Burford and raised its bet against the company by 0.15% on Tuesday.

“Short attacks such as this are a fundamental menace to an orderly market and to the value inherent in long-term investing in companies such as Burford that are revolutionising industries,” the company said.

“Burford is well equipped to investigate and pursue market manipulators, and as stewards of investor capital, we are exploring doing so here, cognisant of the substantial losses our investors have suffered.

“Our early investigation already shows the hallmarks of market manipulation.”

One of Burford’s biggest investors is under-fire fund manager Neil Woodford. Wednesday’s share price decline cost Woodford £118m in paper losses, according to Yahoo Finance’s calculations.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Hargreaves Lansdown CEO: 'Right thing' for Woodford to axe fees on frozen fund

Burford Capital crashes 48% after attack from US short seller Muddy Waters

Yahoo Finance

Yahoo Finance