What do businesses want if there is a no-deal Brexit?

As Britain's trade talks with the European Union edge closer to collapse, the Chancellor's autumn headache swells.

The Budget will need to deal with a Covid-19 jobs crisis that is expected when the furlough scheme ends in October, as well as cushioning the blow to businesses hit by higher tariffs and non-tariff barriers if Britain trades with the EU on World Trade Organisation terms - the chances of which are rising by the day.

David Gauke, the former cabinet minister and critic of the current administration, has warned that the Government's plan to over-ride elements of the Brexit Withdrawal Agreement with Brussels suggested that a deal was unlikely. "They do not seem to be bluffing," he added.

For Andrew Goodwin, of Oxford Economics, though, the move appears to be mere "sabre-rattling". He estimates the chance of a deal being struck is still 60pc "given the strong motivations for the UK to reach an agreement".

The next five weeks, leading up to the European Council meeting in mid-October, which both sides have set as a hard deadline for reaching an agreement, will be crucial.

Goodwin's inbox is clogged with notes from anxious clients who want to understand the consequences of no trade deal being reached.

He estimates that, relative to staying in the EU, if a deal is struck, GDP would fall by 3.1 percentage points over the next decade. Failing to reach a deal would cut GDP by 3.9 percentage points.

"This is clearly not good news for business confidence and looks set to further weigh on business investment, which is already clearly the weak link in the economy's bounce back," Howard Archer, chief economic adviser to the EY Item Club, a forecasting group, says.

"It may also very well fuel concerns over employment and increase the already serious risk that there will be a sharp rise in joblessness in the fourth quarter."

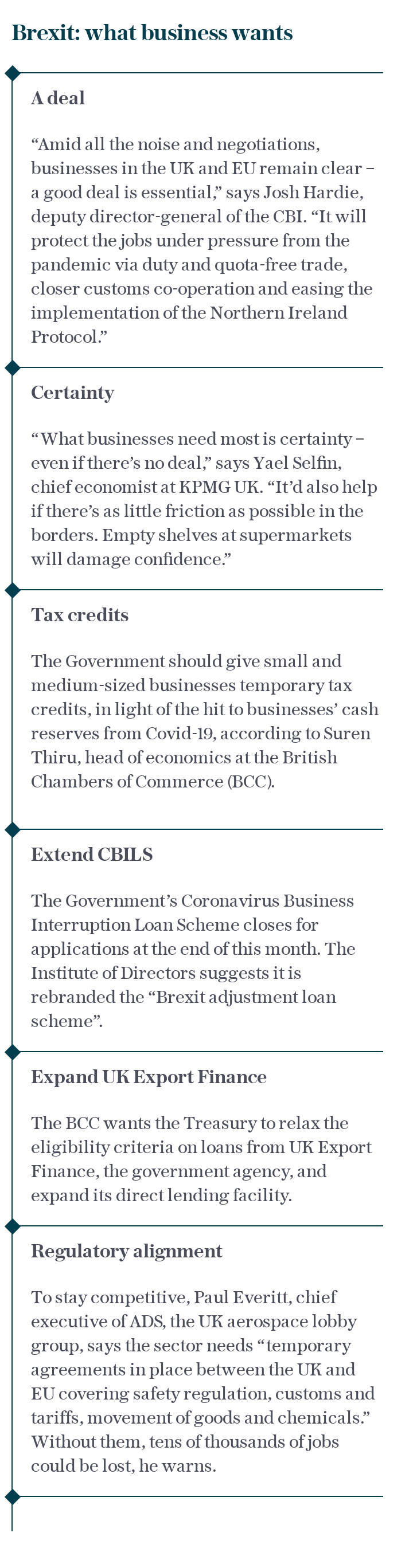

For Philip Rush, economist and data scientist at Heteronomics, many of the measures the Treasury has used to deal with the economic fallout of the pandemic would find more demand if there is no EU trade deal.

"By doing a lot more of the same, some of the costs of a no-deal scenario would then be conveniently subsumed within the existing package," he argues.

Despite recent worries about Britain's spiralling debt – the Office for Budget Responsibility forecasts a potential rise of public sector net debt above 300pc of GDP by about 2060 – Archer says there will need to be more loosening of fiscal policy if there is no Brexit trade deal.

"At the very least, there will be more of a feeling that Sunak needs to further support the economy getting on a stable, firm footing before he really gets down to setting out how he intends to restore the public finances to sustainable health over the longer term," he says.

Goodwin agrees: "The constraints on fiscal policy have been overstated. More fiscal loosening is more likely under the current government than previous administrations because they are not conservative in their outlook on fiscal policy. They're more tolerant of high deficits and high debt levels."

Fiscal policies could include tax breaks for small and medium-sized enterprises. They could be sector-specific, as was the Eat Out to Help Out scheme, but instead target industries such as chemicals, motor manufacturing and aerospace, Goodwin suggests.

However, for Yael Selfin, chief economist at KPMG UK, "there's not much point in throwing money around when you can’t get the goods. You need to create the conditions that make it easier to trade or give us a proposition that is ahead of everyone else, either by investing in technology or skills."

She argues that the Government's "levelling up" agenda should be reconfigured: "People are doing business in a different way. When you think about investment, you really need to not just go for ‘shovel-ready’ projects you’d planned earlier on.

"Access to very strong broadband is potentially much more important now than better commuting links to city centres. The majority of people are travelling less and working more remotely and they need to be able to do that effectively."

Indeed, Goodwin points out that the areas expected to be hardest hit by a no-trade-deal are those the Government has targeted for levelling up.

"The Government is making the job harder for itself – it'll have to spend more to achieve the same benefits it was seeking to achieve at the start," he adds.

Monetary policy will be less effective than fiscal help, Selfin says, and more quantitative easing will be preferable to negative interest rates. Goodwin expects an extra £100bn of QE next year if there's no trade deal.

Buckle up, Britons.

Yahoo Finance

Yahoo Finance