Should You Buy Delta Air Lines Stock Ahead of Q2 Earnings?

Investors will get a glimpse at how the travel industry is fairing with Delta Air Lines DAL set to report its Q2 results on Thursday, July 11.

Entering the busy summer travel season reports from other prominent domestic carriers such as American Airlines AAL and United Airlines UAL will roll in later in the month.

That said, let’s see if it’s time to buy Delta’s stock and take a look at how it compares to its peers.

Q2 Expectations for Delta Airlines

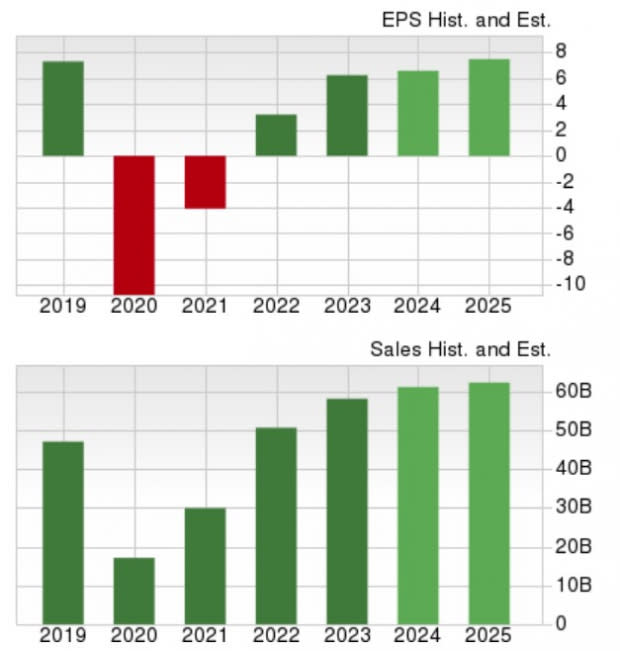

Following a very tough to-compete-against prior-year quarter, Delta’s Q2 sales are still projected to rise 4% to $16.28 billion. However, Q2 earnings are thought to have dipped 11% to $2.38 per share. Notably, Delta has exceeded top and bottom-line expectations for four straight quarters posting an average earnings surprise of 12.72%.

Image Source: Zacks Investment Research

Recent DAL Stock Performance

In regards to the post-pandemic recovery and performance of the travel industry among airliners, Delta shares are up +8% in the last three years which is subpar to the more than 28% gain for the S&P 500. But DAL's stock gains beat the Zacks Transportation-Airline Market 3-year returns, which declined 1%. During the same time period, United Airlines stock is down 8% while American Airlines plummetted 47%.

Image Source: Zacks Investment Research

More intriguing, Delta’s stock has spiked +15% this year to narrowly trail the benchmark while topping United’s +13% and American’s -20%.

Image Source: Zacks Investment Research

Delta's Valuation Comparison

In terms of P/E valuation, Delta’s stock looks cheap trading at 6.9X forward earnings which is above United’s 4.7X and American’s 5.3X but is well below the S&P 500’s 23.5X.

It’s also noteworthy that DAL trades 77% beneath its decade-long high of 30.6X forward earnings while offering a slight discount to the median of 8.8X.

Image Source: Zacks Investment Research

DAL's Growth & Outlook

Overall, Delta’s total sales are expected to be up 5% in fiscal 2024 and are projected to rise another 2% in FY25 to $62.21 billion. Plus, annual earnings are forecasted to rise 5% this year and are projected to jump another 14% in FY25 to $7.49 per share.

Image Source: Zacks Investment Research

Bottom Line

Ahead of its Q2 results on Thursday, Delta’s stock currently lands a Zacks Rank #3 (Hold). While the recovery in Delta’s top and bottom lines remains intriguing more upside in DAL will largely rely upon the ability to reach or exceed Q2 expectations but more importantly, offering positive guidance that reconfirms the company’s attractive outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance