Buy into the Growth of These Tech Stocks as Earnings Approach

The Nasdaq is receiving a nice boost as several big tech companies have been able to beat earnings expectations this week.

As the sentiment towards tech stocks continues to grow this year, here are two top-rated Zacks Computer and Technology sector stocks that investors may want to consider before earnings next week.

Arista Networks (ANET)

Set to report its first-quarter earnings report on Monday, May 1, Arista Networks stock is worthy of investors’ consideration and currently sports a Zacks Rank #2 (Buy).

Arista has continued to expand the cloud networking solutions that it provides to data centers and cloud computing environments with strong growth expected during the quarter. Furthermore, Arista has beaten earnings expectations for 35 consecutive quarters since it went public in 2014.

Image Source: Zacks Investment Research

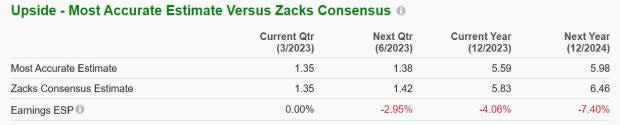

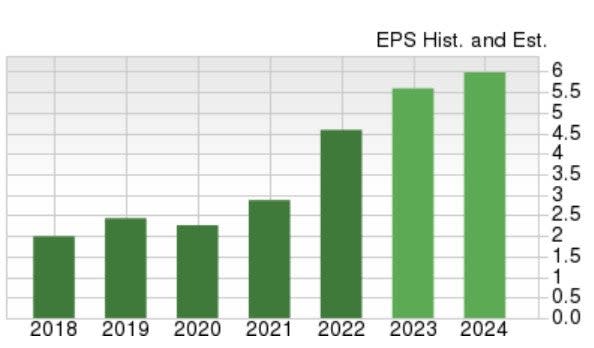

Q1 Preview: Arista’s Q1 earnings are expected to climb 61% at $1.35 per share compared to EPS of $0.84 in Q1 2022. The Zacks Expected Surprise Prediction (ESP) indicates Arista should reach its bottom-line expectations with the Most Accurate Estimate also having Q1 EPS at $1.35. Sales for the quarter are forecasted to jump 49% year over year at $1.31 billion.

Image Source: Zacks Investment Research

Overall, Arista’s earnings are projected to soar 27% in fiscal 2023 at $5.83 per share compared to EPS of $4.58 in 2022. Even better, fiscal 2024 earnings are anticipated to rise another 18%. Total sales are expected to climb 25% this year and jump another 10% in FY24 at $6.05 billion.

Image Source: Zacks Investment Research

Trading at $155 a share, Arista stock is up +28% year to date to easily beat the S&P 500’s +6%, the Nasdaq’s +15%, and the Communications Components Markets’ +13%. More impressive, Arista stock has soared +185% over the last there years with shares of ANET typically soaring after topping EPS estimates as shown in the chart below.

Image Source: Zacks Investment Research

Lattice Semiconductor (LSCC)

Also set to report Q1 results on May 1, Lattice Semiconductor is standing out with a Zacks Rank #2 (Buy). Offering high-performance programmable logic devices and related development system software, Lattice’s niche and growth in the electronics and semiconductors space has continued to expand.

To that point, Lattice has now topped EPS estimates for 11 consecutive quarters going into its first-quarter earnings report.

Image Source: Zacks Investment Research

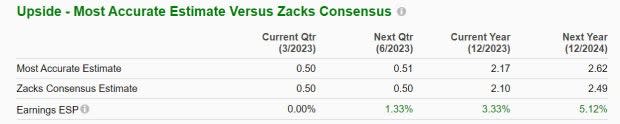

Q1 Preview: First-quarter earnings are projected to be up 35% YoY at $0.50 per share compared to EPS of $0.37 in Q1 2022. Lattice is expected to meet its Q1 earnings expectations with the Most Accurate Estimate also having Q1 EPS at $0.50. Sales are forecasted to rise 19% from the prior year quarter at $179.93 million.

Image Source: Zacks Investment Research

Even better, annual earnings are anticipated to jump 20% this year at $2.10 per share compared to EPS of $1.75 in 2022. Plus, fiscal 2024 earnings are projected to leap another 18%. On the top line, sales are expected to be up 13% in FY23 and rise another 13% in FY24 to $849.83 million.

Image Source: Zacks Investment Research

Trading around $79 per share, Lattice stock is up +20% YTD to top the broader indexes and the Electronics-Semiconductors Markets +14%. Better still, Lattice stock has skyrocketed +298% over the last three years with shares of LSCC having extended rallies after beating earnings expectations.

Image Source: Zacks Investment Research

Takeaway

Considering the strong price performances of Arista Networks and Lattice Semiconductor stock after beating earnings expectations and their ability to consistently top estimates is very appealing to investors.

Now may be an ideal time to buy both stocks with stellar growth expected for the first quarter. Furthermore, it's quite plausible that both companies will offer positive guidance during their quarterly reports as annual top and bottom-line expansion is anticipated and earnings estimate revisions have gone up.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance