Should You Buy Hewlett Packard Enterprise Stock Ahead of Q3 Earnings?

Hewlett Packard Enterprise Company HPE is slated to report third-quarter fiscal 2024 results after market close on Sep. 4.

For the fiscal third quarter, Hewlett Packard Enterprise projects revenues between $7.4 billion and $7.8 billion. The Zacks Consensus Estimate for quarterly revenues is pegged at $7.64 billion, which suggests an increase of 9.1% from the year-ago period.

HPE expects non-GAAP earnings per share (EPS) between 43 and 48 cents. The consensus mark for EPS has remained unchanged at 46 cents over the past 60 days, which indicates a year-over-year decline of 6.1%.

Image Source: Zacks Investment Research

The company’s earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6.9%.

Hewlett Packard Enterprise Company Price and EPS Surprise

Hewlett Packard Enterprise Company price-eps-surprise | Hewlett Packard Enterprise Company Quote

Let’s see how things are shaping up for this announcement.

Factors Shaping HPE’s Upcoming Results

Hewlett Packard Enterprise’s fiscal third-quarter results are likely to benefit from the growing demand for artificial intelligence (AI) servers. Increased availability of NVIDIA Corporation’s NVDA H100 graphic processing units (GPUs) and strong executions are likely to have aided HPE in meeting the growing demand for its AI servers.

The company's ability to deliver NVIDIA H100 GPUs within a lead time of six to 12 weeks positions it favorably to capitalize on the burgeoning AI market. The cumulative AI system orders stood at $4.6 billion at the second quarter end, with enterprise orders comprising more than 15%, reflecting a threefold increase in the enterprise AI customer base year over year.

The increasing adoption of the Aruba Edge Services Platform and HPE GreenLake is expected to have driven Hewlett Packard Enterprise’s revenues in the to-be-reported quarter. The HPE GreenLake solution is likely to have benefited from the company’s efforts to simplify its cloud strategy by including all related products in the hybrid cloud segment. This initiative is expected to have simplified the customer adoption of the solution and added to the top line.

The company has been benefiting from persistent growth in sales of its accelerator processing unit, primarily driven by the rising demand for HPE Cray EX, Cray XT and HPE ProLiant Gen11 AI-optimized servers.

However, benefits from the aforementioned factors are likely to have been somewhat offset by a soft IT spending environment. Enterprises have been postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues. The ongoing transition to the more software-intensive Alletra platform is likely to have continued hurting HPE's traditional storage business in the to-be-reported quarter.

HPE Stock Price Performance & Valuation

Year to date (YTD), Hewlett Packard Enterprise shares have risen 14.1%, underperforming the Zacks Computer – Integrated Systems industry’s growth of 18.4%. Compared with its peers, HPE stock has underperformed Dell Technologies’ DELL YTD gain of 51% but outperformed Cisco Systems’ CSCO flat share price performance.

YTD Price Return Performance

Image Source: Zacks Investment Research

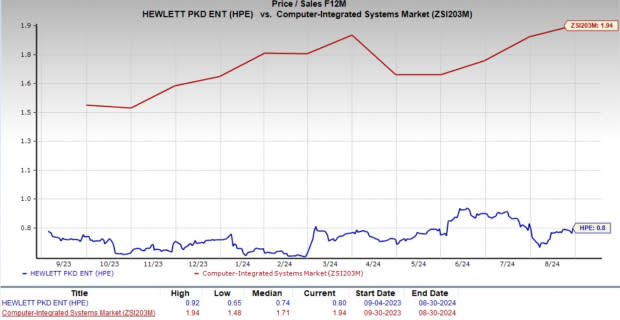

Now, let’s look at the value Hewlett Packard Enterprise offers investors at the current levels. HPE stock is trading at a discount with a forward 12-month P/S of 0.8X compared with the industry’s 1.94X.

Image Source: Zacks Investment Research

Investment Consideration for HPE Stock

Hewlett Packard Enterprise is benefiting from strong execution in clearing backlogs and increased customer acceptance. The company’s latest agreement to acquire Juniper Networks is not just a financial move but a strategic leap to elevate its competitive stance by expanding its networking domain, particularly in the realms of AI, cloud and hybrid solutions.

Its multi-billion-dollar investment plan across expanding networking capabilities will help diversify the business from server and hardware storage markets and boost margins over the long run. Efforts to shift its focus to higher-margin offerings like Intelligent Edge and Aruba and cost-saving initiatives will aid bottom-line growth over the long run.

However, a softened IT spending environment amid macroeconomic headwinds and rising competition might undermine HPE’s near-term growth prospects.

Conclusion: Hold HPE Stock for Now

Hewlett Packard Enterprise’s initiatives in AI, cloud and hybrid solutions, along with the strategic acquisition of Juniper Networks, position it for long-term growth. HPE's efforts to strengthen its market position and expand its networking capabilities are likely to drive sustained performance improvements.

However, the softened IT spending environment amid the ongoing macroeconomic uncertainties might undermine Hewlett Packard Enterprise’s near-term prospects. The ongoing transition to the more software-intensive Alletra platform is anticipated to lock in future recurring revenues for this Zacks Rank #3 (Hold) company’s storage business but at the cost of current performance. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We believe that it’s prudent to avoid new purchases of HPE stock for now. For existing shareholders, holding on to Hewlett Packard Enterprise stock is the best course of action, as the long-term growth drivers are still firmly in place.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report