Should You Buy or Hold Costco Stock Ahead of Q4 Earnings Release?

As Costco Wholesale Corporation COST gears up to unveil its fourth-quarter fiscal 2024 results on Sept. 26 after the closing bell, investors are faced with a key question: Is now the time to add Costco to your portfolio, hold your position or initiate a new investment? Whether you are a long-term shareholder or seeking to capitalize on potential growth, evaluating the stock ahead of its earnings report is essential for making informed investment decisions.

Costco's strategic investments, customer-centric approach, merchandise initiatives and focus on membership growth have enabled it to navigate the the competitive retail landscape. These strengths have resulted in decent sales and earnings growth, positioning COST as a resilient consumer defensive stock.

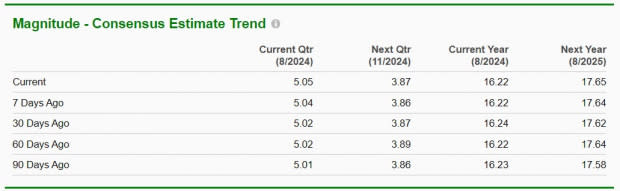

Analysts are optimistic about Costco's upcoming earnings. The Zacks Consensus Estimate for fourth-quarter revenues stands at $79.75 billion, which indicates an increase of 1% from the prior-year reported figure. On the earnings front, the consensus estimate has risen by a penny to $5.05 per share over the past seven days, implying a 3.9% year-over-year increase.

Image Source: Zacks Investment Research

Costco has a trailing four-quarter earnings surprise of 2.3%, on average. In the last reported quarter, this Issaquah, WA-based company surpassed the Zacks Consensus Estimate by a margin of 2.2%.

Costco Wholesale Corporation Stock Price, Consensus and EPS Surprise

Costco Wholesale Corporation price-consensus-eps-surprise-chart | Costco Wholesale Corporation Quote

What the Zacks Model Indicates for COST’s Q4 Earnings

As investors prepare for Costco's fourth-quarter earnings, the question looms regarding earnings beat or miss. Our proven model predicts that Costco is likely to beat earnings this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco has an Earnings ESP of +0.48% and carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors Shaping Costco's Q4 Outcome

Costco’s growth strategies, better price management and membership-based business model have been contributing to its performance. The company’s strategy to sell products at discounted prices has helped attract customers who have been seeking both value and convenience. These factors are expected to have a favorable impact on the overall results.

The company's bulk purchasing power and efficient inventory management allow it to keep prices low. This competitive pricing strategy helps Costco maintain steady store traffic and robust sales volumes. We expect a 4.5% increase in comparable sales for the fourth quarter.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

The company boasts high membership renewal rates, often exceeding 90%, which indicates strong customer loyalty and a steady stream of recurring revenues. Membership fees provide a stable income regardless of economic conditions. We anticipate Costco's total paid membership to reach approximately 76 million by the end of the quarter under discussion, marking an increase of 7% from the prior-year quarter.

Costco continuously adapts to market trends and consumer preferences. The company regularly updates its product offerings to include a mix of everyday essentials and unique, high-demand items. Through market analysis and tailored offerings, Costco has expanded its presence, both domestically and internationally. The company has been steadily opening new club locations while operating e-commerce sites across various countries, including the United States, Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

With a clear emphasis on delivering value-oriented offerings, Costco remains well-positioned for continued success in the dynamic retail landscape. However, it is essential to acknowledge the presence of certain headwinds, including underlying inflationary pressures, which may pose challenges. Moreover, margins remain a critical area to monitor, with potential concerns stemming from any deleverage in the SG&A rate.

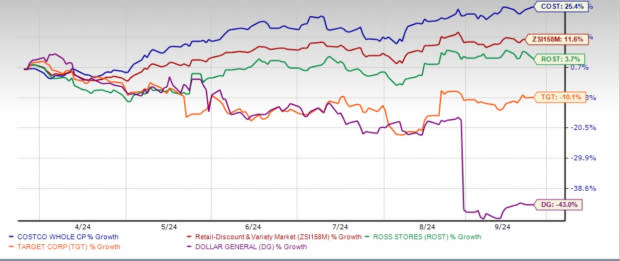

Costco's Recent Stock Gains Leave Rivals Behind

Costco has witnessed an impressive surge in its stock price over the past six months, with the stock rallying 25.5%, outpacing the industry’s rise of 11.7%.

COST has outperformed its competitors, including Dollar General Corporation DG, Target Corporation TGT and Ross Stores ROST.

While ROST shares have climbed 3.7% during the said time frame, DG and TGT have faced declines of 43% and 10.1%, respectively.

Image Source: Zacks Investment Research

Does Costco Present a Strong Case for Value Investing?

From a valuation standpoint, Costco currently trades at a premium relative to its industry peers. The company’s forward 12-month price-to-earnings (P/E) ratio is 51.71, higher than the industry average of 30.41 and the S&P 500’s 21.80. The stock is also trading above its median P/E level of 44.09, observed over the past year. This elevated valuation suggests that investors might be paying a premium relative to the company's anticipated earnings growth.

Image Source: Zacks Investment Research

Costco Stock Analysis: Best Moves for Investors Now

Costco’s impressive performance, backed by a robust membership model, competitive pricing and continuous adaptation to market trends, places it in a strong position within the retail sector. While the stock's premium valuation may give some investors pause, Costco's consistent growth, solid financial health and strategic initiatives suggest that there may still be room for further upside. For new investors, the high valuation suggests it might be wise to wait for a more attractive entry point. Current stakeholders should consider holding their positions while staying cautious of any shifts that could signal a change in momentum.

Costco’s Strategic Moves Signal Promising Q4 Outcome

Costco is poised to deliver a decent fourth-quarter fiscal 2024 earnings report, supported by its strategic growth initiatives and loyal customer base. The anticipated growth in revenues and earnings highlights the strength of its membership-driven model and pricing strategy, which continue to attract value-seeking consumers. As investors consider their options, the combination of positive analyst sentiment and Costco’s resilience in the retail space reinforces its position as a compelling candidate for consideration in any investment portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report