‘Buy-to-let in Britain is dead – now I’m earning 18pc from property abroad’

The Government’s buy-to-let crackdown has hammered investor returns and forced landlords to come up with more radical strategies.

One London landlord has worked out a way to earn 18pc yields – and help refugees – by investing abroad.

Tax changes and the cladding crisis have removed the incentive to continue investing in British buy-to-lets for Danial Abbas, 35, who has a portfolio of 12 domestic properties.

“Britain’s buy-to-let market has been deliberately broken. I wouldn’t enter as a new landlord today, no way. The long-term let business is dead in the water," said Mr Abbas.

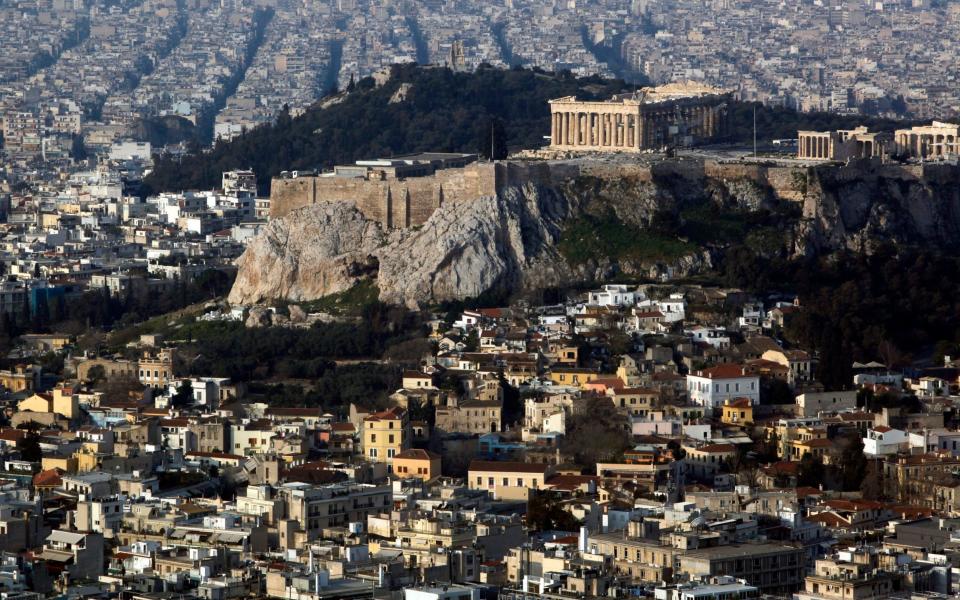

Instead of buying in the UK, Mr Abbas has turned his portfolio global, making investments in Pakistan, Mexico, Greece and Dubai. Of these, his most unconventional strategy is one of his best investments.

In December 2019, Mr Abbas bought two city centre flats in Athens for a total of €35,000 (£29,800). He employed refugees to refurbish them and then to manage and maintain them. He lets these properties exclusively to refugees at a 10pc discount on local market rates, which are around €250 to €300 per month.

In Britain, Mr Abbas's yields are between 4pc and 8pc. In Athens, his net yield is 18pc.

This winter, Mr Abbas plans to visit Athens again to purchase a building shell of 30 units for €300,000. He will spend a further €300,000 employing refugees to redevelop it and then manage the 30 flats. Each will be let for a minimum of €300 per month.

Mr Abbas thought of the idea in 2018, after volunteering in Athens with non-governmental organisations assisting with the refugee crisis. “I was teaching refugees with business ideas, mentoring them and helping them write their CVs. But not a single person I helped was able to land a job,” said Mr Abbas.

One of the roots of the problem was housing. There are schemes whereby NGOs will pay rent for refugees, but even with this backing, few local landlords will lease properties to refugees, said Mr Abbas. This means they have to put the refugee camp as their address on their job applications. “It just kills it,” said Mr Abbas.

With a city centre address, it is much easier for them to apply for jobs and attend interviews. But the set up is win-win.

Yields are so high because property prices are still well below their pre-financial crash peak.

Francis Prantounas, of Engel & Völkers estate agents in Athens, said: “During the Euro crisis, from 2008 to 2018, prices fell about 50pc.”

Values bottomed out in 2017 and by 2019 were rising 7.2pc year-on-year. In 2020, during the pandemic, they fell 4.3pc. Mr Prantounas said: “Now they’re slowly going up again, but I think it will take five to seven years before they reach pre-crisis levels.”

Meanwhile, the rental market is strong. During the pandemic, Airbnb landlords shifted their short-term lets onto the long-term market en masse, said Mr Prantounas. But they were not prepared to cut prices and could afford to wait for the market to return, as it has more recently. “There is a big movement of people coming back to the city centre,” said Mr Prantounas. In the city centre, rents have jumped 5pc.

“For someone sitting in London right now, there is a very compelling business argument. I can diversify my income from sterling into euros, increase my yields and make an income,” said Mr Abbas.

In the future, he plans to set up a business helping people obtain Greece’s "golden visa" by investing in property that provides homes for refugees.

“Some of the people working with NGOs are extremely sceptical of me because I am taking money. But I’m not extremely wealthy and I can’t just give the properties away for free. This way I am making a difference but I am also making it sustainable. I am making money from humanitarian work, but that means that I can do more,” said Mr Abbas.

Reader Service: Interested in buying property abroad? Discover some of the best ways to exchange large amounts of currency overseas.

Yahoo Finance

Yahoo Finance