Should You Buy Seagate After its First Quarter Surprise?

Seagate Technology's (NASDAQ: STX) stock rallied by about 13% after the hard drive maker posted better-than-expected first quarter earnings on Oct. 23. But even after that pop, Seagate's stock remains down about 25% over the past six months.

Seagate's headline numbers were unremarkable, but they still beat analyst expectations. Its revenue fell 6% annually to $2.63 billion, topping estimates by $110 million. Non-GAAP earnings slipped 3% to $0.96 per share, but also beat expectations by $0.11.

Image source: Getty Images.

But if we dig deeper into Seagate's quarter, we'll understand why buyers came back to this unloved stock. Let's examine the bullish catalysts to see if the stock is a worthy buy at current prices.

Understanding Seagate's predicament

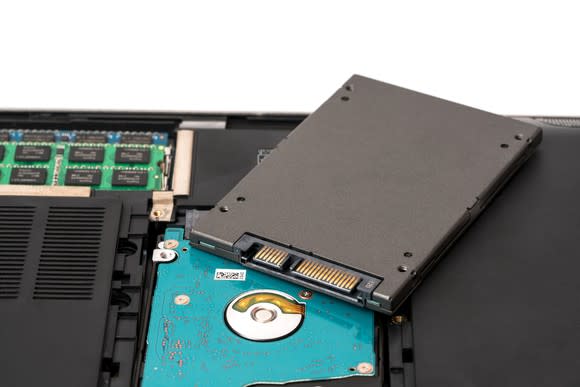

Seagate is the second largest maker of platter-based HDDs (hard disk drives) in the world after Western Digital (NASDAQ: WDC). This market is a tough one for two reasons -- it's heavily commoditized, and HDDs are gradually being displaced by SSDs (solid state drives).

SSDs store data on NAND flash memory chips instead of platters, so they're smaller, faster, less prone to damage, and consume less power. This makes them ideal for high-end laptops, PCs, and data centers. SSDs are pricier on a per gigabyte basis, but many industry analysts believe that they'll achieve price parity with HDDs within the next few years.

Image source: Getty Images.

To escape that inevitable downturn, Western Digital acquired flash memory and SSD maker SanDisk for nearly $19 billion last year. That was a smart move, since surging NAND prices lifted SanDisk's revenue and offset WD's softer sales of traditional HDDs.

Seagate acquired some NAND chips through its acquisition of Samsung's HDD unit and partnerships with Micron and SK Hynix. It was also part of the consortium, led by Bain Capital and SK Hynix, which recently agreed to buy Toshiba's memory chipmaking business for $18 billion.

However, none of those deals helped it keep pace with market leaders Samsung and Western Digital, which together control over half of the entire SSD market. Seagate's partners, Micron, SK Hynix, and Toshiba, each control single-digit shares of that market.

Focusing on the growing need for high-capacity HDDs

Without a meaningful foothold in the SSD market, Seagate focused on boosting the capacity of its existing HDDs for enterprise customers. The main idea is that while enterprise HDDs will never beat SSDs in terms of performance, demand for high-capacity HDDs should keep rising as a surge in data from streaming media, apps, and other cloud services causes data center operators to prioritize capacity over raw speed.

Image source: Getty Images.

That's precisely what we saw during the first quarter, as Seagate's HDD shipments rose 5% annually and its average capacity per hard drive rose 12% to 1.9 terabytes per drive. However, its average selling price still fell three dollars to $64, and its non-GAAP gross margin dipped from 29.5% to 29% -- but those declines came in lighter than expected.

Analysts expect Seagate's revenue and earnings to respectively slip 4% and 3% this year, so its turnaround won't take shape anytime soon. But its numbers are stabilizing, and the company isn't sitting idly by as HDDs become obsolete. Instead, it's expanding its portfolio with its aforementioned NAND partnerships, which could eventually help it gain a bigger slice of the SSD market.

Seagate could also fare better than Western Digital if NAND prices, which are approaching a cyclical high, crash. That's because Seagate purchases NAND chips from partners instead of directly selling them like SanDisk, so lower NAND prices would boost its margins instead of crushing them.

What about the valuations and dividends?

Seagate looks fairly cheap at 11 times next year's earnings. But Western Digital has a lower forward P/E of 7 thanks to the accretive boost from its SanDisk acquisition.

As for the dividend, Seagate's forward yield of 6.4% is much higher than WD's 2.3% yield. Seagate spent just 73% of its earnings and 38% of its free cash flow on that payout over the past 12 months, so its high yield shouldn't be considered a red flag.

So is it time to buy Seagate?

Seagate's first quarter numbers reveal that its core business is stabilizing, and that the bearish thesis of SSDs completely wiping out HDDs might be overblown. Looking ahead, Seagate could tread water with higher capacity HDDs as it gradually expands into SSDs or hybrid storage solutions.

Until that happens, its low valuation and high dividend should also set a floor under the stock. I'm not completely confident that Seagate is returning to growth yet, but these factors indicate that it probably wouldn't hurt to nibble on the stock at current prices.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance