Buy These Standout Large-Cap Stocks for Long-Term Upside?

Today’s episode of Full Court Finance at Zacks dives into where the stock market stands in the back half of May as we close out the first quarter earnings season. The bulls remain in control of the market right now, and debt-ceiling positivity helped send stocks higher on Wednesday and Thursday.

The great start to 2023 might have some investors nervous about “chasing” stocks right now. But long-term investors don’t need to worry too much about market timing. Plus, there are many great stocks with proven and resilient businesses that investors should feel comfortable buying now at rather attractive levels and holding for the long haul. The two stocks we dive into today are Thermo Fisher Scientific Inc. (TMO) and Visa Inc. (V).

Debt-ceiling talks have taken over Wall Street in recent days even as Walmart, Target, and other huge names round out the first quarter earnings season. President Biden and House Speaker McCarthy finally started to talk positively about a deal mid-week to help send stocks climbing. Stocks then dipped on Friday on reports that talks are stalling again.

Thankfully, a debt-ceiling deal is almost certain to get done despite all of the worrisome partisan discourse and back and forth because defaulting could be catastrophic.

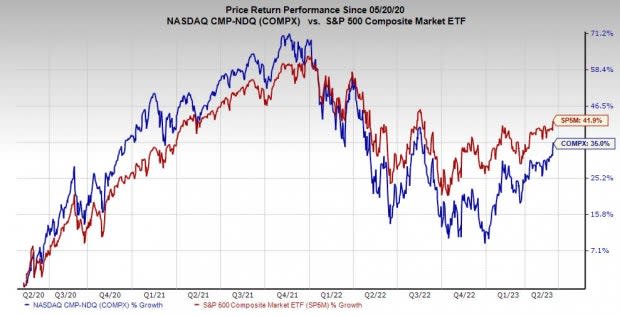

Image Source: Zacks Investment Research

The market is also telling investors not to worry too much, with the S&P 500 currently up 9% in 2023 and the Nasdaq about 21% higher. Both indexes also still trade well off their record highs, which leaves room for plenty of potential near-term upside if earnings outlooks hold steady in the coming months and inflation continues to cool.

Better yet, there are tons of great, proven large-cap stocks trading at potentially attractive levels right now that long-term investors should feel comfortable buying and holding even if the market hits a few roadblocks later this year.

Thermo Fisher Scientific (TMO) is a diversified global leader in medical and lab equipment, specialty diagnostics tools, reagents and consumables, and much more. TMO’s offerings serve the broader biotech, healthcare, and pharmaceutical sector, operating under units such as Life Sciences Solutions, Analytical Instruments, and beyond.

Thermo Fisher benefitted immensely from Covid-19 testing. But TMO’s sales and earnings were surging long before the pandemic and its near-term outlook for FY23 and FY24 showcases top and bottom line expansion even as it faces a very difficult to compete against stretch.

Image Source: Zacks Investment Research

Thermo Fisher, which lands a Zacks Rank #3 (Hold) right now, topped our Q1 earnings and revenue estimates in late April. The $200 billion market cap titan is currently trading around 20% below its highs and its average Zacks price target. And 12 of the 16 brokerage recommendations Zacks has for TMO stock are “Strong Buys.”

TMO shares are still up 55% in the last three years and 500% in the last decades vs. the S&P 500’s 160% and its Zacks Medical Instruments industry’s 190%. Plus, TMO is trading around 30% below its 10-year highs at 21.1X forward earnings and at an even larger discount vs. its industry despite its big outperformance. And TMO raised its dividend by 17% earlier this year.

Visa Inc. (V) is a credit card giant that remains hugely influential in the U.S. and around the world despite all of the ‘disruptions’ from fintech. Visa operates an extensive and powerful payment and processing network and it takes a piece of the endless number of credit card payments in a world that is growing more cashless by the day.

Visa beat our quarterly earnings estimates in late April on the back of rising payment volume. The company is also benefitting from surging international travel alongside rival Mastercard.

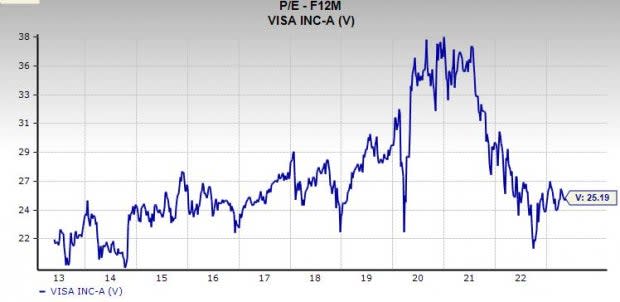

Image Source: Zacks Investment Research

Visa’s FY23 and FY24 consensus earnings estimates have popped slightly since its release and it lands a Zacks Rank #3 (Hold) right now. Zacks estimates call for Visa to post 14% adjusted earnings growth this year and 13% higher earnings next year, driven by roughly 11% sales growth both this year and next.

Visa stock has unperformed the market over the last three years, up 20% vs. the S&P 500’s 40%. But it could be poised to break out with it back above both its 200-day and 50-day moving averages. On top of that, Visa has more than doubled the benchmark over the last 10 years, up 415%. And Visa is trading slightly below its 10-year median and at a roughly 35% discount to its own highs at 25.2X forward earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance