Buy Struggling Slack (WORK) Stock Before Earnings Despite Microsoft Competition?

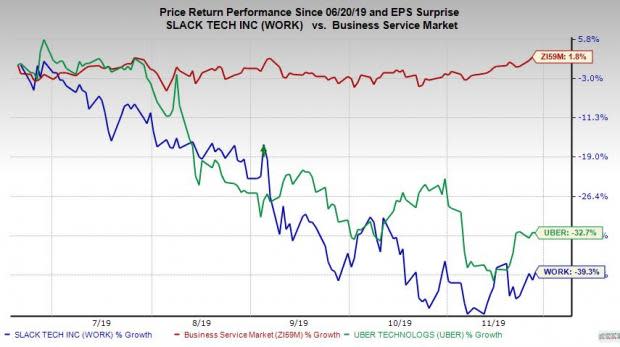

Slack Technologies, Inc. WORK stock has plummeted since its June IPO, which is not uncommon for young tech firms, and follows alongside similar drops from much splashier names such as Uber UBER. The firm’s revenue growth appears solid, but its digital work-based communication services face stiff competition from giants such as Microsoft MSFT.

Now the question is should investors consider buying Slack stock before it reports its Q3 fiscal 2020 financial results on Wednesday, December 4?

What’s Going On?

Slack is a work communication platform that allows users to send messages, images, documents, and more to groups or individuals without email. The San Francisco-based firm also lives in the broader cloud-computing/customer relationship management space and hopes it is able to attract more paying business clients through its apps and “robust” API. WORK’s business is pretty straight forward, which is also part of the problem.

Wall Street and investors are worried that Slack won’t be able to compete long-term and continue to attract paid subscriptions in a work-place communication industry dominated by Microsoft and Google GOOGL. For instance, Microsoft announced recently that its Teams service, which launched in 2017 and is similar to Slack, now has 20 million daily active users.

Slack last reported in early October that 12 million people actively use its platform every day, up 37% from the year-ago period. The firm has also fought back against MSFT’s growing user figures in a company blog post titled "Not all Daily Active Users are created equal: Work is fueled by true engagement."

It is worth noting that Microsoft can package Teams with its popular Office 365 suite. And Slack Chief Executive Stewart Butterfield has said that more than 70% of his company’s top 50 customers also use Office 365 and seemed to suggest that they prefer Slack over Microsoft’s offering.

On top of that, fellow tech firms such as IBM IBM and Splunk SPLK and retailers like Target TGT all utilize Slack, along with 65 of the Fortune 100. Plus, the Wall Street Journal reported earlier this month that Slack and Microsoft have actually collaborated behind the scenes and that Slack “uses Microsoft’s open-source software to make its collaboration tool work seamlessly with parts of Office 365.”

Q3 Outlook & Beyond

Moving on, our Zacks Consensus Estimates call for Slack’s third quarter fiscal 2020 revenue to come in at $155.12 million. This comes in at the high-end of Slack’s own guidance that called for quarterly sales between $154 million to $156 million, which would mark year-over-year growth of between 46% to 48%.

Last quarter, Slack’s revenue jumped 58% to $145 million. This expected top-line growth slowdown is hardly a good sign for a company that has already failed to inspire investor confidence.

Overall, Slack’s full-year fiscal 2020 revenue is projected to climb 51.7% from $400.5 million to $607.7 million. Peeking further ahead, WORK’s fiscal 2021 sales are expected to surge 38% higher to $843.2 million.

At the bottom end of the income statement, Slack is projected to post an adjusted quarterly loss of $0.09 a share. This would mark an improvement from the second quarter’s -$0.14 per share loss, which actually came in well above our estimate that called for an adjusted loss of -$0.19 per share.

The company is then projected to post an adjusted loss of -$0.43 per share this year. In fiscal 2021, Slack is expected to post a much smaller loss, with our current EPS projection at -$0.27 a share, which might make some investors more optimistic.

Bottom Line

Clearly, investors can see that Slack stock has been crushed since it went public and this dismal run is likely to continue unless it can really wow Wall Street. With this in mind, investors need to pay close attention to Slack’s user growth.

For reference, Slack’s paid customers jumped nearly 40% last quarter to over 100,000, while its paid customers “greater than $100,000 in annual recurring revenue” soared 75%. However, WORK’s larger client figure only came in at 720.

Slack is currently a Zacks Rank #2 (Buy) heading into its Q3 earnings report, based on some of its longer-term earnings revision activity. This rank could change if analysts provided any updated guidance close to Wednesday, December 4.

In the end, beaten-down Slack stock might be worth taking a small bite out for riskier investors in the hopes that it can see some small post-release bounce. WORK shares are also a bet that “channel-based collaboration is so superior to email-based communication for work, that this shift is inevitable,” as CEO Stewart Butterfield’s puts it.

Still, Slack doesn’t seem that it has given investors reason to believe it is a longer-term play at the moment.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Click to get this free report International Business Machines Corporation (IBM) : Free Stock Analysis Report Alphabet Inc. (GOOGL) : Free Stock Analysis Report Splunk Inc. (SPLK) : Free Stock Analysis Report Microsoft Corporation (MSFT) : Free Stock Analysis Report Target Corporation (TGT) : Free Stock Analysis Report Slack Technologies, Inc. (WORK) : Free Stock Analysis Report Uber Technologies, Inc. (UBER) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance