Buyers Are Swarming These 3 Retail Stocks

Investors can find favorable trends within the market by focusing on sectors witnessing positive earnings estimate revisions.

That’s precisely what the Zacks Retail and Wholesale sector has enjoyed lately, which has pushed it up to the #2 spot out of all Zacks 16 sectors.

Stocks within the same sector tend to move in a herd-like fashion, further reflecting the importance of focusing on areas analysts have recently become bullish on.

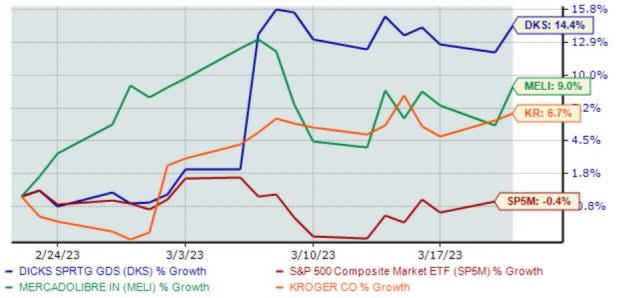

Three stocks from the Zacks Retail and Wholesale sector – Dick’s Sporting Goods DKS, Kroger KR, and Mercado Libre MELI – have all seen their earnings outlooks improve, helping lift shares.

As we can see in the chart below, all three stocks have widely outperformed the S&P 500 over the last month, indicating buying pressure.

Image Source: Zacks Investment Research

For those interested in tapping into the relative strength these stocks have been displaying, let’s take a closer look at each.

Mercado Libre

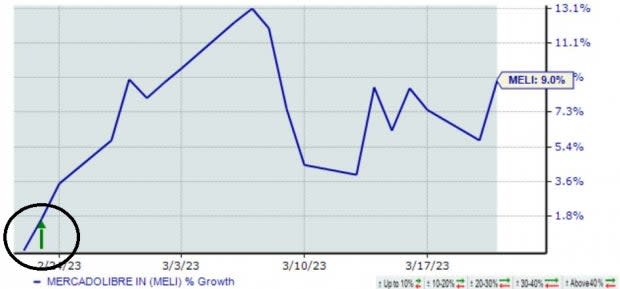

Mercado Libre is one of the largest e-commerce platforms in Latin America, offering a total of six integrated e-commerce services. The stock presently sports the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

MELI posted strong results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 50%. Quarterly revenue totaled $3 billion, ahead of estimates and growing an impressive 56% year-over-year.

There were several big highlights from the quarter; Total Payment Volume totaled $36 billion, up an impressive 80% Y/Y. Further, Gross Merchandise Volume was reported at $9.6 billion, growing 34.7% from the year-ago quarter (both on an FX-neutral basis).

The market cheered on the results, sending shares soaring. This is illustrated by the green arrow circled in the chart below.

Image Source: Zacks Investment Research

Dick’s Sporting Goods

Dick’s Sporting Goodsis a significant omnichannel sporting goods retailer offering athletic shoes, apparel, accessories, and a broad selection of outdoor and athletic equipment. DKS is currently a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Like MELI, Dick’s Sporting Goods posted better-than-expected results in its latest release; DKS posted EPS of $2.93, 2.5% ahead of expectations and reflecting the 11th consecutive bottom line beat. Further, the sports retailer generated nearly $3.6 billion in revenue, well above expectations and growing 7% year-over-year.

Image Source: Zacks Investment Research

And in a very shareholder-friendly manner, DKS increased its annualized dividend to $4.00 per share, reflecting a massive 105% increase compared to $1.95 per share in 2022. The dividend is payable on March 31st, 2023, to shareholders of record at the close of March 17th, 2023.

Kroger

Kroger is one of the world's largest food retailers, with store formats including supermarkets, price-impact warehouse stores, and multi-department stores. KR presently ranks as a Zacks Rank #2 (Buy).

The company’s shares are cheap on a relative basis, with the current 10.6X forward earnings multiple sitting well beneath the 12.4X five-year median and the Zacks Retail and Wholesale sector average.

Image Source: Zacks Investment Research

And similar to DKS, Kroger rewards its shareholders handsomely; the company’s annual dividend presently yields 2.2%.

Impressively, the retailer has consistently increasingly rewarded its shareholders, boasting a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

As many investors know, 50% of a stock’s price movement can be attributed to its group, making it easier to understand the importance of targeting sectors seeing earnings outlooks drift higher.

Currently, the Zacks Retail and Wholesale sector is #2 out of all 16 Zacks Sectors, indicating that analysts have recently become bullish on its outlook.

And all three stocks above from the space – Dick’s Sporting Goods DKS, Kroger KR, and Mercado Libre MELI – have enjoyed positive price action over the last month thanks to improved earnings outlooks, outperforming the general market handily.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance