Bypass Kolte-Patil Developers For One Attractive Dividend Stock

In the search for passive income through dividend stocks in India, investors often come across options that offer high yields. However, it is crucial to evaluate the sustainability of these dividends. Companies with excessively high payout ratios, such as Kolte-Patil Developers, may not be prudent choices as their dividend coverage could be at risk. This article will discuss two such companies, highlighting one as an attractive investment and advising caution against another due to its challenging dividend cover situation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.15% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 3.11% | ★★★★★★ |

D. B (NSEI:DBCORP) | 3.82% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.46% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.20% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.53% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.35% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.67% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.23% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.75% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to potentially avoid.

Top Pick

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is engaged in manufacturing, marketing, and trading lubricants for the automotive and industrial sectors in India, with a market capitalization of approximately ₹61.49 billion.

Operations: The company generates its revenue primarily from the lubricants segment, totaling approximately ₹33.01 billion.

Dividend Yield: 3.2%

Gulf Oil Lubricants India has demonstrated a solid financial performance with a significant increase in earnings, reporting a 32.6% growth over the past year and robust annual results for FY 2024. Its dividend yield at 3.2% ranks well above the Indian market average of 1.12%. Despite its volatile dividend history, current dividends are well-covered by both earnings and cash flows, with payout ratios of 57.4% and 62.7%, respectively, ensuring sustainability compared to firms with excessive payout issues. Recent leadership changes and statutory auditor rotation reflect ongoing corporate governance adjustments.

One To Reconsider

Kolte-Patil Developers

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Kolte-Patil Developers Limited is a real estate company in India with a market capitalization of approximately ₹32.44 billion.

Operations: The company generates its revenue primarily from the development of real estate property, totaling approximately ₹13.71 billion.

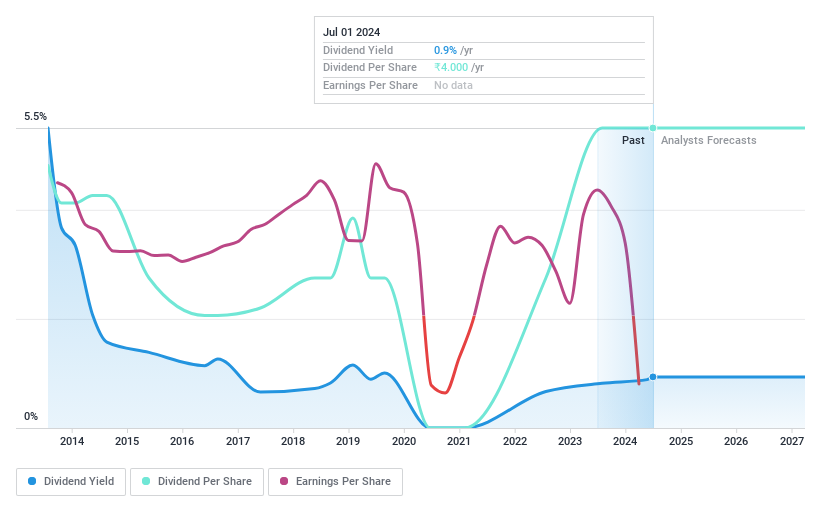

Dividend Yield: 0.9%

Kolte-Patil Developers faces significant challenges as a dividend stock to avoid. Despite declaring a final dividend, the company's financial health raises concerns; it reported a substantial net loss of INR 693.5 million for FY 2024 and lacks free cash flows to sustain its dividend payments, evidenced by an unprofitable recent fiscal year and insufficient earnings coverage. Additionally, its dividends have been unreliable over the past decade, further complicating its appeal to dividend-focused investors.

Where To Now?

Delve into our full catalog of 18 Top Dividend Stocks here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GULFOILLUBNSEI:KOLTEPATIL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance