Bypassing Sturm Ruger for One Attractive Dividend Stock

Dividend-paying stocks are often sought after for their potential to provide investors with a consistent stream of income. However, the stability of these dividends is paramount; companies like Sturm Ruger, which have experienced significant cuts in their dividends, raise concerns about the reliability of their payouts. Such fluctuations can signal underlying financial difficulties or a lack of commitment to returning value to shareholders, making it crucial for investors to tread carefully when selecting dividend stocks for their portfolios.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Premier Financial (NasdaqGS:PFC) | 6.41% | ★★★★★★ |

Lakeland Bancorp (NasdaqGS:LBAI) | 5.02% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 7.20% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.39% | ★★★★★★ |

Arrow Financial (NasdaqGS:AROW) | 4.91% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.65% | ★★★★★★ |

Evans Bancorp (NYSEAM:EVBN) | 5.00% | ★★★★★★ |

CVB Financial (NasdaqGS:CVBF) | 4.97% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 6.22% | ★★★★★★ |

Citizens & Northern (NasdaqCM:CZNC) | 6.53% | ★★★★★★ |

Click here to see the full list of 278 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one to avoid.

Top Pick

Macatawa Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The company operates as a bank holding entity, offering commercial and consumer banking along with trust services, with a market capitalization of approximately US$329.53 million.

Operations: The company generates its revenue primarily through commercial banking activities, amounting to US$105.34 million.

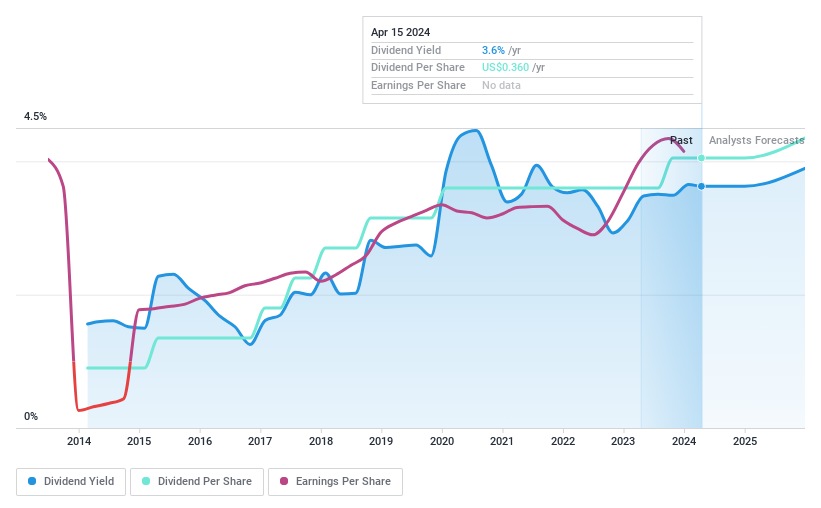

Dividend Yield: 3.6%

Macatawa Bank Corporation showcased a robust performance in 2023, with net interest income rising to US$87.45 million from US$70.15 million the previous year and net income increasing to US$43.22 million from US$34.73 million. Despite a slight dip in fourth-quarter earnings, the bank has consistently grown its dividends over the past decade, maintaining a reliable payout with a current yield of 3.63%. The dividend is well-covered by earnings, evidenced by a low payout ratio of 26.2%, and analysts predict stock price appreciation of 24.2%. However, its dividend yield is below the top quartile for U.S dividend payers, indicating potential areas for improvement in attractiveness to income-focused investors.

One To Reconsider

Sturm Ruger

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: The company is a U.S.-based firearms manufacturer known for its Ruger-branded products, with a market capitalization of approximately US$0.81 billion.

Operations: The company generates its revenue primarily through two segments: Castings, which brought in US$36.11 million, and Firearms, contributing US$540.75 million.

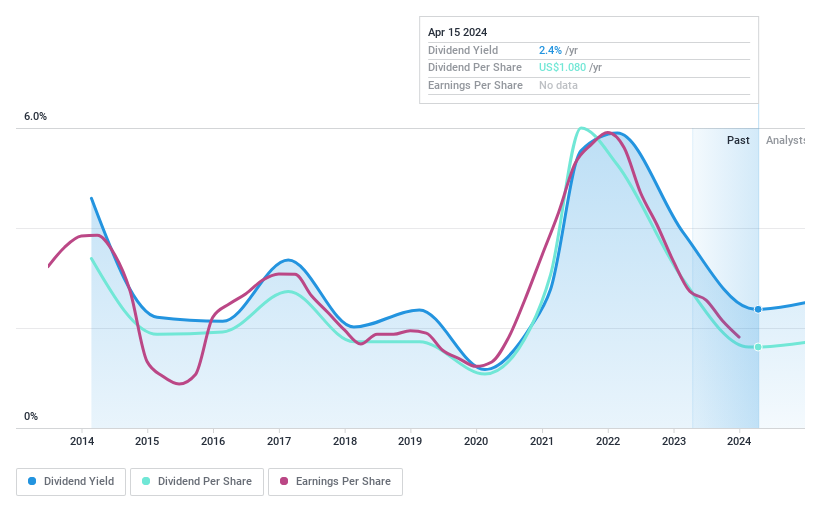

Dividend Yield: 2.4%

Sturm, Ruger & Company experienced a decrease in revenue to US$543.77 million and net income to US$48.22 million for the year ended December 31, 2023, from higher figures last year. Despite this downturn, it declared a quarterly dividend of $0.23 per share. However, concerns arise as the dividend yield stands at 2.37%, below the top quartile of U.S dividend payers at 4.83%. Additionally, its dividends have shown volatility and a lack of growth over the past decade, with a high cash payout ratio of 105.4% indicating that dividends are not well covered by cash flows despite a reasonable earnings coverage with a payout ratio of 39.6%. This financial scenario suggests caution for those considering Sturm Ruger as an attractive dividend stock option due to its underperformance in revenue and net income alongside sustainability concerns regarding its dividend payments.

Where To Now?

Reveal the 278 hidden gems among our Top Dividend Stocks screener with a single click here.

Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:MCBC and NYSE:RGR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance