Bypassing United Super Markets Holdings For One Attractive Dividend Stock

Dividend stocks can be a tempting option for those looking to generate regular income from their investments. However, it's essential to evaluate the sustainability of these dividends. Companies with excessively high payout ratios, such as United Super Markets Holdings, might not be able to maintain their dividend levels without compromising financial stability or future growth prospects. This article will explore both an attractive dividend stock and one that may pose risks due to its high payout ratio.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.77% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.57% | ★★★★★★ |

Globeride (TSE:7990) | 3.77% | ★★★★★★ |

Nihon Tokushu Toryo (TSE:4619) | 3.85% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.43% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.02% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.42% | ★★★★★★ |

Innotech (TSE:9880) | 3.98% | ★★★★★★ |

Click here to see the full list of 377 stocks from our Top Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

Seibu Electric & Machinery

Simply Wall St Dividend Rating: ★★★★★★

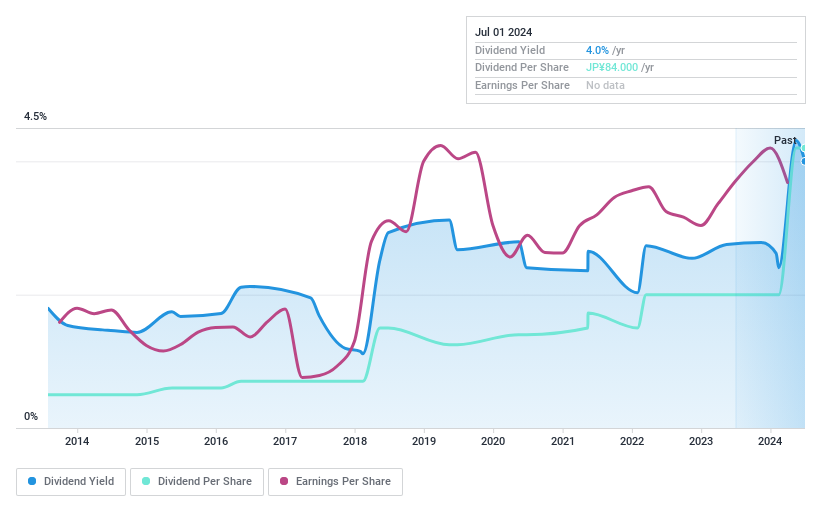

Overview: Seibu Electric & Machinery Co., Ltd. operates in Japan, focusing on the manufacture and sale of mechatronics, with a market capitalization of ¥32.02 billion.

Operations: Seibu Electric & Machinery generates revenue primarily through three segments: Conveyor Machine Business (¥11.33 billion), Precision Machinery Business (¥13.57 billion), and Industrial Machinery Business (¥6.58 billion).

Dividend Yield: 4%

Seibu Electric & Machinery maintains a strong position in dividend sustainability with a modest payout ratio of 30.6%, ensuring dividends are well-covered by earnings, unlike companies with excessively high ratios that risk cuts. Its dividend yield stands at 3.96%, above the market average of 3.4%, supported by a decade of stable and growing payouts. The dividends are also adequately backed by cash flows, with an 83.3% cash payout ratio, reflecting prudent financial management over the past ten years.

One To Reconsider

United Super Markets Holdings

Simply Wall St Dividend Rating: ★☆☆☆☆☆

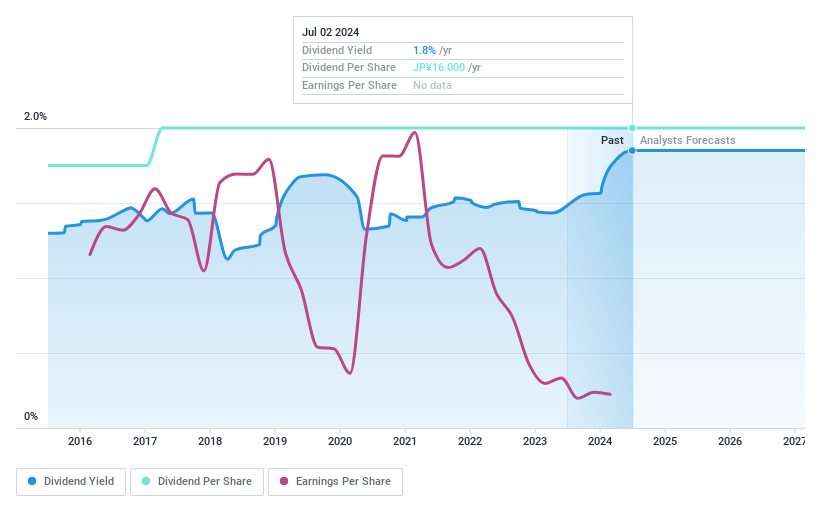

Overview: United Super Markets Holdings Inc. operates a supermarket business in Japan with a market capitalization of approximately ¥111.05 billion.

Operations: The company generates its revenue primarily from supermarket operations across Japan.

Dividend Yield: 1.8%

United Super Markets Holdings faces challenges with its dividend sustainability, marked by a high payout ratio of 203.8%, indicating dividends are not well covered by earnings. Additionally, the company lacks free cash flows to support ongoing dividend payments. Despite a track record of reliable and growing dividends over nine years, the yield remains low at 1.85%, underperforming against the top quartile of Japanese dividend stocks at 3.4%. Large one-off items further cloud earnings quality, complicating future dividend reliability.

Turning Ideas Into Actions

Unlock our comprehensive list of 377 Top Dividend Stocks by clicking here.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:6144 and TSE:3222.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance