CACI International (CACI) to Upgrade the US Army's Networking

CACI International CACI recently secured a contract worth $239 million from the U.S. Army to modernize its Global Secure Internet Protocol Router Network. The company is set to upgrade the latter’s commercial solutions for classified technology.

This is an ENCORE-3 indefinite delivery, indefinite quantity contract with a one-year base period and four one-year option periods. Under this agreement, CACI will enhance the U.S. Army's network infrastructure by deploying its wireless and uniquely wired technology.

The technology will enable the army to draw insights from the growing data. Moreover, it will allow users to work from any location on classified networks. The company will use its Archon technology to securely access classified networks. Archon was added to CACI’s portfolio through the acquisition of ID Technologies in 2021.

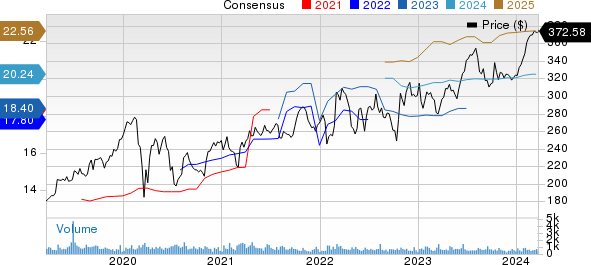

CACI International, Inc. Price and Consensus

CACI International, Inc. price-consensus-chart | CACI International, Inc. Quote

Department of Defense Deals to Aid CACI’s Growth

CACI International’s Department of Defence (DoD) revenues have been growing organically from continuous business deals with the U.S. Army. The company earns a large portion of its revenues from the DoD, comprising more than two-thirds of its revenues from the segment. In 2023, the DoD contributed 71.9% of the total revenues.

CACI also gains from the increasing number of $1-billion-plus contracts. The company secured three such contracts in fiscal 2023. In the first half of fiscal 2024, it secured one such contract.

The $1-billion-plus deals were mostly offered by the DoD. These contracts include a $5.7 billion deal by the Air Force, $2.7 billion agreement by the National Security Agency and a $1.2 billion contract by the Naval Information Warfare Systems Command.

On its latest earnings call, the company stated that it has a long pipeline of such deals. These large deals that span over multiple years provide CACI the benefit of low fluctuation in revenues and stability to its business.

CACI International anticipates its 2024 revenues in the range of $7.3-$7.5 billion. The Zacks Consensus Estimate for 2024 revenues is pegged at $7.39 billion, suggesting 10.3% year-over-year growth.

Zacks Rank and Stocks to Consider

Currently, CACI International carries a Zacks Rank #3 (Hold). Shares of CACI have gained 32.2% in the past year.

Some better-ranked stocks from the broader technology sector are BlackLine BL, Amazon AMZN and Dell Technologies DELL, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for BlackLine’s fiscal 2024 earnings has been revised upward by 7 cents per share to $2.06 in the past 60 days. Shares of BL have lost 0.5% in the past year.

The Zacks Consensus Estimate for Amazon’s fiscal 2024 earnings has been revised by 5 cents northward to $4.08 per share in the past 30 days. Shares of AMZN have rallied 80.5% in the past year.

The Zacks Consensus Estimate for DELL’s fiscal 2024 earnings has been revised upward by 60 cents to $7.64 per share in the past 30 days. Shares of DELL have skyrocketed 201.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

CACI International, Inc. (CACI) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance