CACI Wins $138M ICE Communication Engineering Support Contract

CACI International CACI recently secured a single-award mission expertise task order worth $138 million from the U.S. Immigration and Customs Enforcement (ICE). As part of the contract, the company will continue to provide tactical communications (TACCOM) engineering and maintenance support services for the ICE.

The company revealed that it got the task order in the first quarter of fiscal 2022. Under the terms of the contract, CACI will be responsible for providing system lifecycle development and maintenance activities per the Department of Homeland Security’s system engineering lifecycle.

The TACCOM program provides critical voice communications capabilities for the ICE mission. The newly signed contract further expands the scope and size of CACI’s ICE support and enhances its business in the Communications market area.

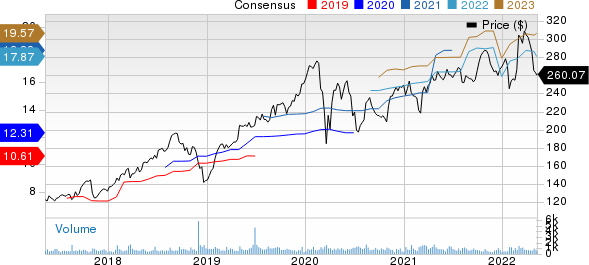

CACI International, Inc. Price and Consensus

CACI International, Inc. price-consensus-chart | CACI International, Inc. Quote

CACI Continues to Win Federal Contracts

CACI has been winning several deals, reflecting its disciplined business development actions, consistent operational excellence and high customer satisfaction. The reliability provided by the company’s services makes it a preferred choice among contractors.

In the recently concluded third quarter of fiscal 2022, CACI secured several notable contracts that totaled approximately $1.2 billion. These include a $323-million five-year, single-award task order from a classified customer for continue providing high-end research and development support for some particular mission objectives.

It also secured a $258-million three-year, single-award task order for providing enterprise technology support and continuing modernization efforts for the Defense Agencies Initiative (DAI) program office’s financial management and end-to-end business processes.

Last week, CACI secured a $20.4-million task order from the Defense Advanced Research Projects Agency. Per the contract, CACI will provide technology, research, development and innovation solutions in support of the agency’s Mission-Integrated Network Control program.

In April, the company announced receiving a three-year task order worth $258 million from the DAI to provide enterprise technology support and continue modernization efforts for a variety of Department of Defense activities.

These back-to-back wins are key catalysts driving success for the company. CACI has a large pipeline of new projects and continues to win deals at regular intervals. As of Mar 31, 2022, its total backlog was $23.5 billion.

Zacks Rank & Stocks to Consider

CACI currently carries a Zacks Rank #3 (Hold). Shares of CACI have rallied 0.1% in the past year.

Some better-ranked stocks from the broader technology sector are Semtech SMTC, MaxLinear MXL and Analog Devices ADI. Semtech sports a Zacks Rank #1 (Strong Buy), while MaxLinear and Analog Devices each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Semtech's first-quarter fiscal 2023 earnings has been revised to 76 cents per share from 70 cents over the past 60 days. For fiscal 2023, earnings estimates have moved north by 8% to $3.38 per share in the past 60 days.

Semtech's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 2.8%. Shares of SMTC have declined 3.6% in the past year.

The Zacks Consensus Estimate for MaxLinear's second-quarter 2022 earnings has been revised upward by three cents to 10 cents per share over the past 30 days. For 2022, MaxLinear's earnings estimates have moved north by 36 cents to $4.07 per share in the past 30 days.

MaxLinear's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 7.1%. Shares of MXL have soared 23.8% in the past year.

The Zacks Consensus Estimate for Analog Devices' second-quarter fiscal 2022 earnings has been revised upward by 4 cents to $2.12 per share over the past 60 days. For fiscal 2022, earnings estimates have moved north by 11 cents to $8.43 per share in the past 60 days.

Analog Devices' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6%. Shares of ADI have increased 2.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

CACI International, Inc. (CACI) : Free Stock Analysis Report

MaxLinear, Inc (MXL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance