Caesars Entertainment (NASDAQ:CZR) Misses Q2 Sales Targets

Hotel and casino entertainment company Caesars Entertainment (NASDAQ:CZR) missed analysts' expectations in Q2 CY2024, with revenue down 1.7% year on year to $2.83 billion. It made a GAAP loss of $0.56 per share, down from its profit of $4.26 per share in the same quarter last year.

Is now the time to buy Caesars Entertainment? Find out in our full research report.

Caesars Entertainment (CZR) Q2 CY2024 Highlights:

Revenue: $2.83 billion vs analyst estimates of $2.88 billion (1.6% miss)

EPS: -$0.56 vs analyst estimates of $0.12 (-$0.68 miss)

Gross Margin (GAAP): 53.3%, down from 53.8% in the same quarter last year

Market Capitalization: $7.90 billion

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “On a consolidated basis, the Company generated $1 billion of Adjusted EBITDA. Our operating results reflect year over year growth in Adjusted EBITDA in our Las Vegas segment driven by record same store revenues, hotel occupancy and Average Daily Rate (ADR). Our Caesars Digital segment posted a new second-quarter Adjusted EBITDA record, driven by strong revenue growth and solid flow through. Regional segment results reflect competition in new markets partially offset by our temporary facility in Danville, Virginia and our property in Columbus, Nebraska. We remain optimistic for the balance of 2024 driven by strong operating trends in our Las Vegas and Caesars Digital segments and the expected openings of the permanent facility in Danville coupled with our $430 million capital investment in our newly rebranded Caesars New Orleans property.”

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

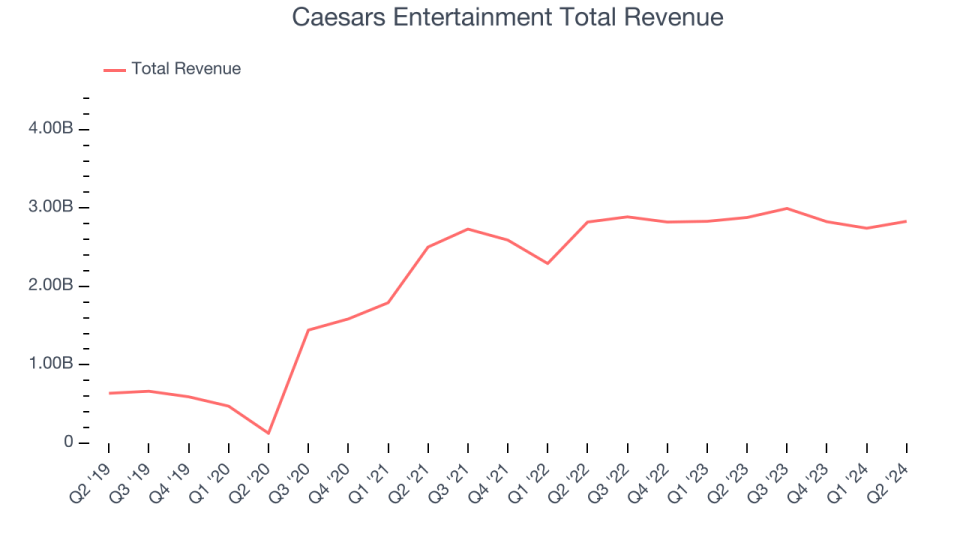

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Thankfully, Caesars Entertainment's 36.2% annualized revenue growth over the last five years was incredible. This shows it expanded quickly, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Caesars Entertainment's recent history shows its demand slowed significantly as its annualized revenue growth of 4.5% over the last two years is well below its five-year trend. Note that COVID hurt Caesars Entertainment's business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Caesars Entertainment missed Wall Street's estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $2.83 billion of revenue. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

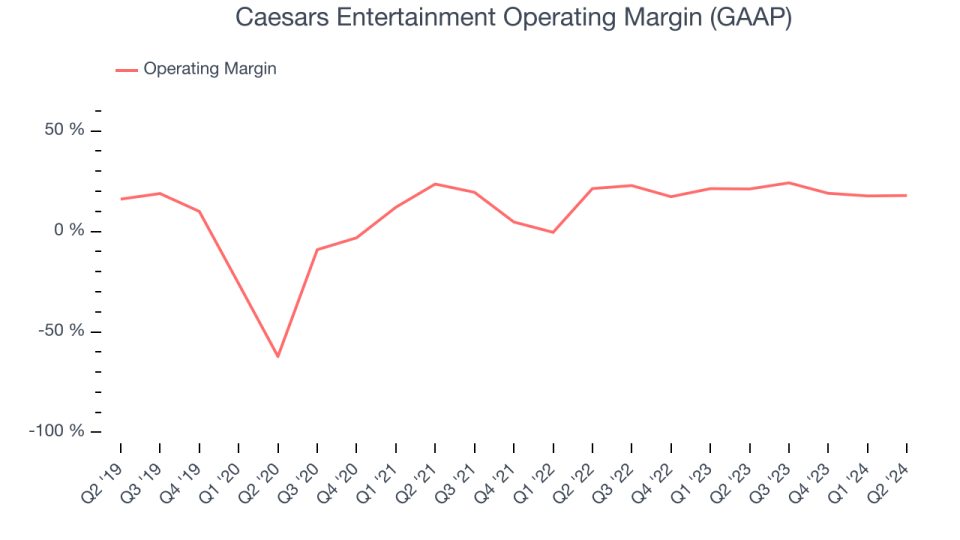

Operating Margin

Caesars Entertainment's operating margin might have seen some fluctuations but has generally stayed the same over the last year, averaging 20.2%. Its profitability was top-notch for a consumer discretionary business, showing it's an optimally-run company with an efficient cost structure.

In Q2, Caesars Entertainment generated an operating profit margin of 17.9%, down 3.3 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Key Takeaways from Caesars Entertainment's Q2 Results

We struggled to find many strong positives in these results. Its EPS missed and its revenue fell short of Wall Street's estimates. Overall, this quarter could have been better. The stock remained flat at $36.90 immediately following the results.

So should you invest in Caesars Entertainment right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.