California Bancorp (CALB) Q1 Earnings: Misses Analyst Projections Amid Merger Expenses

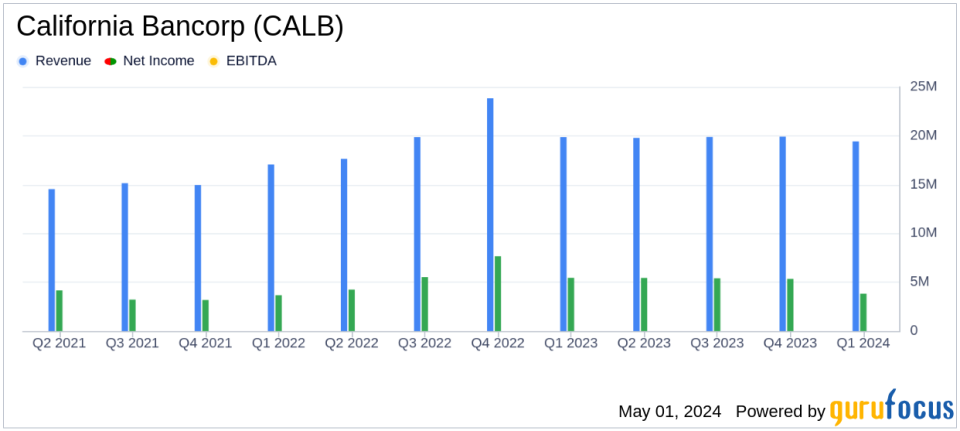

Net Income: Reported at $3.8 million for Q1 2024, falling short of the estimated $4.73 million.

Earnings Per Share (EPS): Achieved $0.45, below the estimated $0.55.

Revenue: Total revenue reached $19.4 million, slightly below the estimated $19.94 million.

Net Interest Income: Declined to $17.7 million, a decrease from both the previous quarter and the same quarter last year.

Non-Interest Income: Increased to $1.7 million, showing growth from both the previous quarter and Q1 2023.

Efficiency Ratio: Deteriorated to 70.57%, up from 61.36% in the previous quarter, indicating higher costs relative to revenue.

Asset Quality: Non-performing assets to total assets improved to 0.08%, down from 0.19% at the end of the previous quarter.

On April 29, 2024, California Bancorp (NASDAQ:CALB) disclosed its financial results for the first quarter ended March 31, 2024, revealing a net income of $3.8 million, a decrease from previous quarters, primarily due to merger-related expenses. The earnings per share (EPS) stood at $0.45, falling short of the analyst's expectation of $0.55. This financial overview is detailed in the company's recent 8-K filing.

About California Bancorp

California Bancorp operates as the holding entity for California Bank of Commerce, catering predominantly to business and professional corporations in Northern California. The bank offers a comprehensive suite of financial services focused on commercial banking, including various deposit products, loans, and treasury management services.

Financial Performance Insights

The reported net income of $3.8 million marks a 30% decrease year-over-year and a 29% decrease from the previous quarter. Adjusted for merger-related expenses, the net income would have been $4.8 million. Total revenue for the quarter was reported at $19.4 million, slightly below the estimated $19.94 million, with net interest income also experiencing a decline from both the previous quarter and the same quarter last year.

The bank's net interest margin slightly decreased to 3.89% from 4.02% in the previous year, reflecting challenges in earning asset balances and increased deposit costs. Non-interest income showed improvement, rising to $1.7 million due to higher service charges and loan-related fees.

Operational Challenges and Strategic Initiatives

California Bancorp faced several challenges this quarter, including a conservative approach to loan production and seasonal outflows in demand deposits. However, the bank has successfully added new commercial relationships, enhancing its noninterest-bearing deposits.

Significant attention is being directed towards the integration with Southern California Bancorp, expected to close in the third quarter of 2024. CEO Steven Shelton emphasized the focus on a smooth integration to realize projected synergies and strengthen the bank's market position post-merger.

Balance Sheet and Asset Quality

Total assets decreased to $1.92 billion, with a reduction in gross loans reflecting the bank's conservative lending approach. The asset quality has remained robust, with non-performing assets at a minimal 0.08% of total assets. The allowance for credit losses on loans stood at 1.05% of total loans.

Capital and Liquidity

The bank reported strong capital adequacy ratios, with a total risk-based capital ratio of 13.93%, well above the regulatory requirement for a well-capitalized institution. This financial strength positions California Bancorp to manage potential economic fluctuations effectively.

Conclusion

Despite the challenges posed by merger-related expenses and a conservative lending strategy, California Bancorp continues to maintain a solid financial base and is strategically positioning itself for future growth through its impending merger. Investors and stakeholders are advised to keep an eye on the integration progress and its impact on the bank's financial health and market position.

For more detailed financial information and future updates on California Bancorp, visit the official website.

Explore the complete 8-K earnings release (here) from California Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance