Canadian Imperial (CM) Q2 Earnings Fall, Stock Down 3.7%

Shares of Canadian Imperial Bank of Commerce CM declined 3.7% on the NYSE after the company reported second-quarter fiscal 2020 (ended Apr 30) results. Adjusted earnings per share came in at 94 cents, significantly down 68% from the prior-year quarter reported tally.

Results were impacted by higher provisions, expenses and lower non-interest income. However, increase in net interest income and strong balance-sheet position acted as tailwinds.

After considering several non-recurring items, net income was C$441 million ($316 million), reflecting a slump of 68% year over year.

High Adjusted Revenues Partly Offset Rise in Costs

Adjusted total revenues were up around 1% year over year to C$4.58 billion ($3.28 billion). This increase was driven by higher net interest income, partly muted by lower non-interest income.

Net interest income was C$2.76 billion ($1.98 billion), up 12.2% from the year-ago quarter. Non-interest income decreased 12.5% year over year to C$1.82 billion ($1.3 billion).

Adjusted non-interest expenses totaled C$2.65 billion ($1.9 billion), flaring up 3.1% from the year-ago quarter.

Adjusted efficiency ratio was 57.2% at the end of the reported quarter, up from 56.1% as of Apr 30, 2019. A rise in the efficiency ratio indicates a decline in profitability.

Total provision for credit losses rose significantly year over year to C$1.41 billion ($1.01 billion) on coronavirus concerns.

Improving Balance Sheet & Capital Ratios

Total assets were C$759.1 billion ($551.9 billion) as of Apr 30, 2020, up 12.9% from the prior quarter. Net loans and acceptances grew 4.5% sequentially to C$420.6 billion ($305.8 billion) and deposits climbed 9.2% sequentially to C$543.8 billion ($395.4 billion).

As of Apr 30, 2020, Common Equity Tier 1 ratio was 11.3%, up from the prior-year quarter reported figure of 11.2%. Furthermore, Tier 1 capital ratio was 12.5% compared with 12.6% as of Apr 30, 2019. Total capital ratio was 14.5%, in line with the prior-year quarter.

Adjusted return on common shareholders’ equity was 4.5% at the end of the fiscal second quarter, down from the prior year’s 15.9%.

Our Viewpoint

Given an expectation of improving economy and loan growth, Canadian Imperial is anticipated to witness steady improvement in revenues. However, elevated expenses and a challenging operating backdrop remain major concerns.

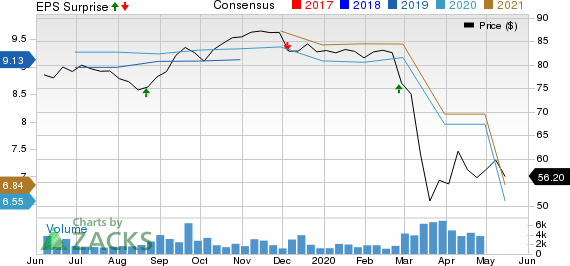

Canadian Imperial Bank of Commerce Price, Consensus and EPS Surprise

Canadian Imperial Bank of Commerce price-consensus-eps-surprise-chart | Canadian Imperial Bank of Commerce Quote

Canadian Imperial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

The Bank of Nova Scotia BNS reported second-quarter fiscal 2020 (ended Apr 30) adjusted net income of C$1.4 billion ($1 billion), down 39% year over year. Results excluded certain one-time items.

Royal Bank of Canada RY delivered second-quarter fiscal 2020 (ended Apr 30, 2020) net income of C$1.5 billion ($1.09 billion), significantly down 54% from the prior-year quarter’s reported tally.

Bank of Montreal’s BMO second-quarter fiscal 2020 (ended Apr 30) adjusted net income was C$715 million ($519.9 billion), down 53% year over year. The results were hurt by lower revenues and a significant rise in credit costs.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of Nova Scotia The (BNS) : Free Stock Analysis Report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance