Canadian Natural (CNQ) Scales Up 2020 Capex & Production View

Reeling under discounted crude prices and pipeline crisis, the Canadian energy sector is struggling to find a path to progress. Amid this growing crisis, one of the country’s leading energy companies Canadian Natural Resources Limited CNQ recently increased its capital budget by C$250 million.

This Zacks Rank #3 (Hold) company’s capital expenditure for 2020 is estimated at C$4.05 billion, indicating a 6.57% rise from its projected investment for 2019. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Canadian Natural expects its 2020 oil and natural gas liquid production at 910-970 million barrels per day (Mbbl/d), higher than the 2019 forecast level of 839-888 Mbbl/d. However, natural gas output for next year is expected within 1.36-1.42 billion cubic feet per day, suggesting a decline of approximately 8% from the year-ago reported figure.

Overall, production is targeted within 1.13-1.20 billion barrels of oil equivalent (comprising 80% liquids and 20% gas), implying a slight uptick above this year’s envisioned output.

Notably, the government of Alberta curbed output from the start of 2019 in a bid to improve prices and reduce differentials between Western Canadian Select and U.S. benchmarks as well as deal with the supply glut. Canadian Natural’s output guidance for 2020 includes the effects of Alberta’s decision.

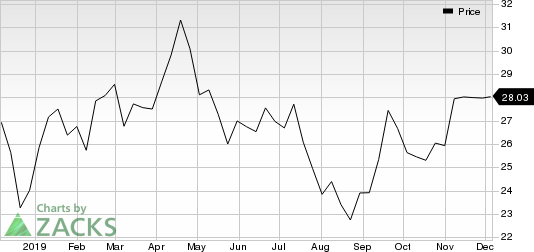

Canadian Natural Resources Limited Price

Canadian Natural Resources Limited price | Canadian Natural Resources Limited Quote

Based on Alberta administration’s decision to eliminate certain conventional drilling curtailments in the province, Canadian Natural raised its 2020 capital guidance while constructing nearly 60 drilling sites all over the region and activating three extra drilling rigs. This, in turn, provides ample employment opportunities with a scope of roughly 1,000 full-time similar jobs for the local populace.

In fact, considering the current state of affairs in the Canadian oil industry, it would not come much as a surprise if most of the company’s peers like Imperial Oil Limited IMO, Encana Corporation ECA, Cenovus Energy Inc CVE, et al make similar capex announcements.

As we know, pipeline building in Canada failed to keep pace with the rising domestic oil output, forcing producers to sell their products at a slashed rate. While oil production is surging in Canada, the country's exploration and production entities remain out of favor, primarily due to pipeline scarcities.

The infrastructural bottlenecks induced surplus supply, which in turn, compelled producers to let go their products in the United States (Canada’s major market) at a lower price. The price gap between Alberta’s Western Canada Select and the New York-traded West Texas Intermediate is currently around $20 a barrel.

However, with quite a few pipelines coming online in 2020 along with the government’s plans to rein in production and eliminate certain conventional drilling curtailments in the province, things may gradually look up for the Canadian oil industry.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Encana Corporation (ECA) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance