Canadian Natural Resources And Two More TSX Dividend Stocks

Amidst a backdrop of moderating inflation and anticipated rate cuts by the Bank of Canada, the Canadian market presents a unique landscape for investors considering dividend stocks. In such an environment, companies with strong fundamentals and a history of consistent dividend payments can offer both stability and potential income growth.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.69% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.27% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.49% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.44% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.99% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.52% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.44% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.31% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.24% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Canadian Natural Resources

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited, with a market cap of CA$99.07 billion, is engaged in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids.

Operations: Canadian Natural Resources Limited generates revenue primarily through its segments in Oil Sands Mining and Upgrading (CA$15.80 billion), Exploration and Production - North America (CA$17.43 billion), with smaller contributions from Midstream and Refining (CA$0.97 billion), Exploration and Production - North Sea (CA$0.58 billion), and Exploration and Production - Offshore Africa (CA$0.57 billion).

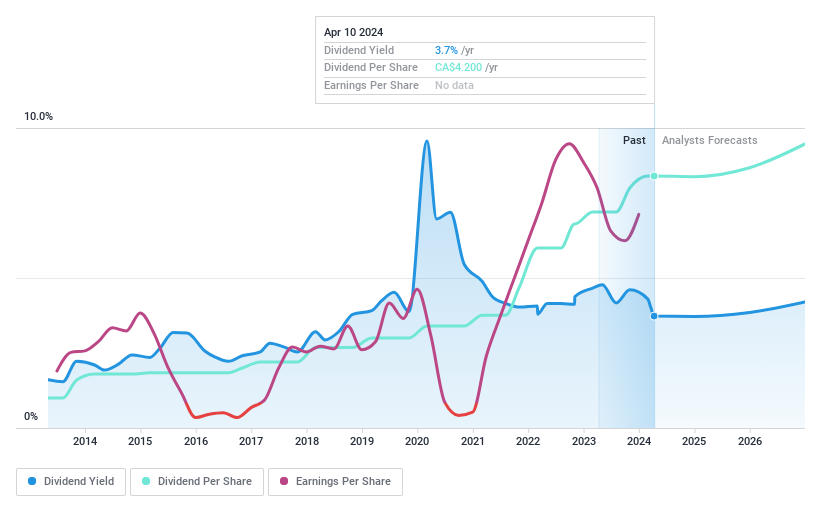

Dividend Yield: 4.4%

Canadian Natural Resources (CNQ) maintains a steady dividend yield of 4.44%, underpinned by a decade of stable payouts and growth. Despite earnings forecasted to grow by 3.37% annually, the recent financial performance shows a dip, with Q1 2024 net income at CAD 987 million, down from CAD 1,799 million year-over-year. The dividends are well-covered with an earnings payout ratio of 56.2% and cash payout ratio of 49.1%. However, its dividend yield remains lower than the top Canadian dividend payers. Recent corporate actions include a two-for-one stock split effective June 11, 2024, and ongoing share buybacks enhancing shareholder value.

Leon's Furniture

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, a Canadian retailer specializing in home furnishings, mattresses, appliances, and electronics, has a market capitalization of approximately CA$1.47 billion.

Operations: Leon's Furniture Limited generates CA$2.50 billion in revenue primarily from the sale of home furnishings, mattresses, appliances, and electronics.

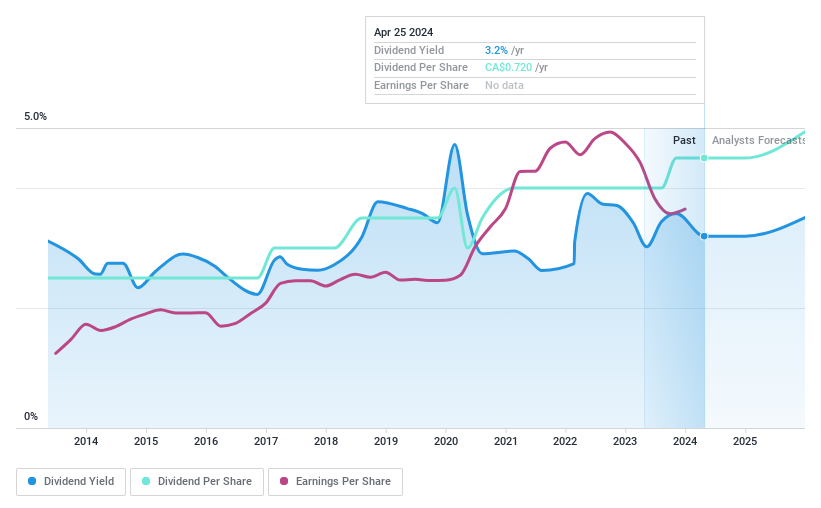

Dividend Yield: 3.1%

Leon's Furniture Limited has shown a mixed performance in dividend reliability, with a history of volatile payments over the past decade. Despite this, recent financial results from Q1 2024 indicate robust sales growth and an increase in net income, suggesting potential stability. The company maintains a low payout ratio of 31.9% and cash payout ratio of 25.1%, indicating that dividends are well-covered by both earnings and cash flows. However, its dividend yield at 3.07% is relatively low compared to leading Canadian dividend stocks. Recent executive changes include the appointment of Victor Diab as CFO, following the departure of Constantine Pefanis.

Total Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company with operations mainly in Canada, the United States, and Australia, boasting a market capitalization of approximately CA$375.35 million.

Operations: Total Energy Services Inc. generates its revenue primarily through four segments: Contract Drilling Services at CA$286.01 million, Compression and Process Services at CA$397.05 million, Well Servicing at CA$93.37 million, and Rentals and Transportation Services at CA$82.87 million.

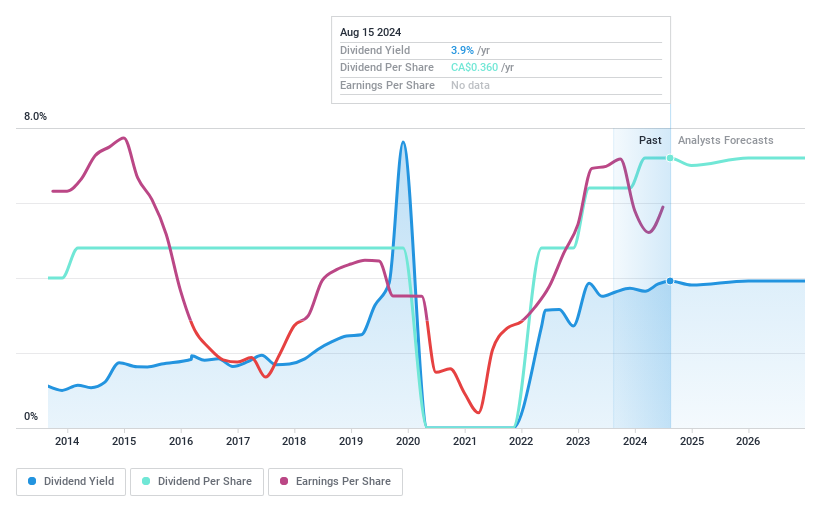

Dividend Yield: 3.9%

Total Energy Services has experienced fluctuations in its dividend reliability over the past decade, with a history of both increases and volatility. Recently, it declared a quarterly dividend of CAD 0.09 per share, maintaining its payout amidst a backdrop of declining sales and net income as reported in Q1 2024. Despite these challenges, Total Energy's dividends are sustainably covered by earnings and cash flows, with payout ratios at 40% and 18.1%, respectively. However, its current yield of 3.92% remains below the top Canadian dividend payers' average.

Where To Now?

Unlock our comprehensive list of 32 Top TSX Dividend Stocks by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CNQTSX:LNFTSX:TOT and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance