Canadian Pacific (CP) Touches New 52-Week High: Here's Why

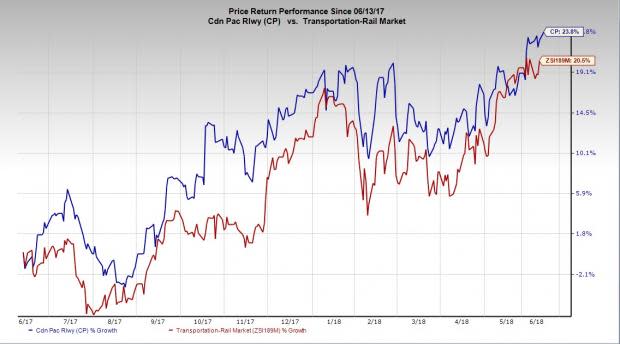

Shares of Canadian Pacific Railway Limited CP hit a 52-week high of $194.74 during the trading session on Jun 11, before retracing a bit to close at $193.79. Notably, the stock has performed impressively in a year with a 23.8% gain, outperforming the industry’s rally of 20.4%.

Catalysts Behind the Upsurge

Most recently, the company reached a tentative four-year agreement with its labor union Teamsters, thus putting an end to the labor strike, which posed a threat to the freight traffic in Canada. Following the deal, shares of the company were positively impacted. The stock should be boosted further post ratification of the deal.

The ongoing freight upswing has also been benefitting the company. Notably, last reported quarter, both earnings and revenues improved substantially from the year-ago figures. Freight revenues accounting for the bulk (97.8%) of the top line rose 4% year over year. This bullish scenario is anticipated to aid results in the current quarter as well.

The company’s measures to reward shareholders through dividends and share buybacks are another positive. Over the last couple of years, the company increased its annual dividend by more than 20%. In fact, last month, the company raised its quarterly dividend per share by 15.5% to C$0.65 per share.

Canadian Pacific is also active on the buyback front. This January, the company repurchased 134,000 common shares for $29.48 billion under a share repurchase program announced in December 2017.

Zacks Rank & Stocks to Consider

Canadian Pacific carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Transportation sector are GATX Corporation GATX, SkyWest, Inc. SKYW and Expeditors International of Washington, Inc. EXPD. While GATX and SkyWest hold a Zacks Rank #2 (Buy), Expeditors sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of GATX, SkyWest and Expeditors have rallied more than 10%, 51% and 37%, respectively, in a year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance