Canadian Solar (CSIQ) Arm Gets $160M Fund for 127MW Project

Canadian Solar Inc.’s CSIQ subsidiary, Recurrent Energy, recently secured a project financing worth $160 million for its 127 megawatts direct current (MWdc) Bayou Galion Solar project in Northeast Louisiana. Once completed, this project should further strengthen CSIQ’s footprint in the solar market.

Mitsubishi UFJ Financial Group, Inc. was the Coordinating Lead Arranger for the financing.

Details of the Project

The Bayou Galion project is expected to generate enough clean electricity to power more than 20,500 Louisiana homes. Recurrent Energy began construction of the project in December 2023 and selected Primoris Renewables Energy, Inc. as its engineering, procurement and construction partner. The project is expected to be operational by fall 2024.

Per the agreement, Microsoft will be the sole purchaser of energy and renewable energy credits produced by the Bayou Galion Solar project, thus supporting its goal to be carbon-negative by 2030.

Canadian Solar’s Prospects in the U.S. Solar Market

With the United States rapidly adopting renewable energy as its preferred source of energy, solar power has emerged as the largest constituent of this transition. Resultantly, the nation’s solar industry is projected to grow manifold in the coming days. To this end, a Mordor Intelligence report estimates the U.S. solar energy market will register a CAGR of more than 16.5% during the 2024-2029 period.

To reap the benefits of such solid growth opportunities offered by the U.S. solar market, Canadian Solar has been investing heftily in ramping up its manufacturing capacity as well as engaging in project construction, like the Bayou Galion project.

Evidently, in October 2023, Canadian Solar announced the construction of a solar photovoltaic cell production facility at the River Ridge Commerce Center in Jeffersonville, IN. The facility boasts an investment of $800 million and has a manufacturing capacity of nearly 20,000 high-power modules per day.

The solar cells produced at this facility will be used at the previously announced 5 GW module assembly plant in Mesquite, TX, when operational. Moreover, as of Sep 30, 2023, Canadian Solar’s Recurrent Energy had a 6,975 megawatt (MW) peak of solar development project pipeline in North America. This region accounted for 23% of CSIQ’s total revenues in third-quarter 2023.

Peer Moves

Other solar players in the industry that are undertaking expansion strategies to meet the growing demand of the U.S. solar market are as follows:

Enphase Energy ENPH: The company is actively looking to expand manufacturing capacity in the United States. It has existing contract manufacturing partners in South Carolina and Texas. In fourth-quarter 2023, Enphase began shipping IQ8P microinverters with peak output AC power of 480 watts (W) for the small-commercial market in North America and IQ8X microinverters with peak output AC power of 384 W for panels with high DC voltage in the United States.

ENPH’s long-term (three-to five-years) earnings growth rate is 14.5%. The firm delivered an average earnings surprise of 11.97% in the last four quarters.

SolarEdge SEDG: The company has a good presence in the United States, with 28.9% of its total revenues in third-quarter 2023 coming from this region. SolarEdge shipped 744 MW of solar energy to North America in the last quarter. In September 2023, it introduced the new high-power, three-phase SolarEdge 330 kilowatt inverter and its complementing H1300 Power Optimizer in the United States.

SEDG boasts a long-term earnings growth rate of 16.4%. Its share price has surged 55% in the past five years.

First Solar FSLR: In third-quarter 2023, First Solar witnessed total booking opportunities of 52.4 GW in North America. The new Alabama and Louisiana facilities are expected to commence operations in 2024 and 2025, respectively. On Jan 19, 2024, FSLR acquired a 1.2 million square foot facility in Ohio to be repurposed into a new distribution center.

These expansions will grow its manufacturing footprint to approximately 14 GW in the United States by 2026.

The Zacks Consensus Estimate for FSLR’s 2024 sales implies a rise of 31.7% over 2023’s estimated figure. The stock delivered an average earnings surprise of 28.97% in the last four quarters.

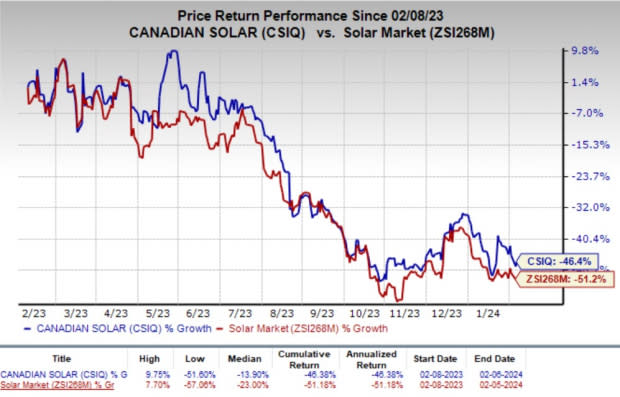

Price Performance

In the past year, shares of CSIQ have lost 46.4% compared with the industry’s 51.2% decline.

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance