Is Canadian Solar Inc. a Buy?

2017 was a surprisingly strong year for the solar industry, and one of the biggest beneficiaries was Canadian Solar Inc. (NASDAQ: CSIQ). The company is expected to sell a whopping 6.8 gigawatts (GW) to 6.9 GW of solar panels, which would have been the entire world's supply only a decade ago.

On the stock market, Canadian Solar is up 26% over the past year and its run higher may just be getting started if operations continue to improve. Here's why Canadian Solar may finally be a good bet in solar.

image source: Getty Images.

A potential buyout

One potential outcome for Canadian Solar in 2018 is the company could be bought out. CEO Dr. Shawn Qu has offered to take the company private for $18.47 per share, a 16.9% premium to Friday's closing price. But the offer is non-binding and it's possible he won't follow through.

Nevertheless, it's worth taking note of the fact that the CEO is bullish enough on Canadian Solar to offer to take it private, which can be seen as a good sign for investors.

Why investors should be bullish on Canadian Solar

The solar industry has matured a lot in the last few years, and right now we're starting to see power consolidate among a few big players. Canadian Solar is one of those companies with a brand that's recognizable worldwide.

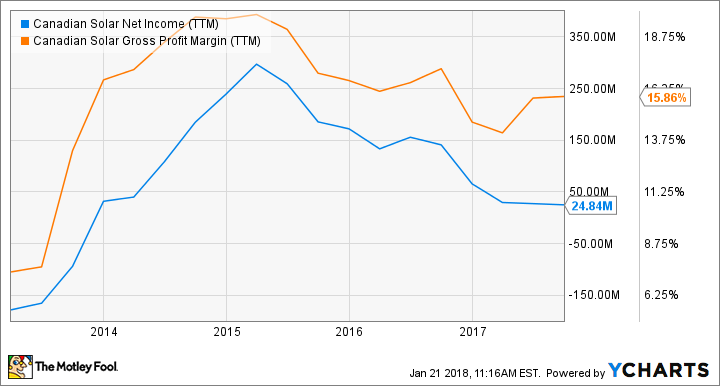

You can see below that Canadian Solar has also been profitable over the last three years, and gross margin has stabilized in the mid-teens.

CSIQ Net Income (TTM) data by YCharts.

If the company's scale and brand allow it to slowly expand margins, we could see a highly profitable solar manufacturer emerge.

Investors' biggest worry

The downfall of every major solar manufacturer in the last decade has been driven by debt. That's why Canadian Solar's $4.3 billion of debt, payables, and financing liabilities are a big concern for investors. If the company can't make a profit from the manufacturing capacity it has built, it could be in financial trouble in a hurry.

One thing to consider is that Canadian Solar says it has $2 billion in project assets on the balance sheet, some of which it will sell in the next year. That should reduce leverage for the business. There's also $1.1 billion of cash on the balance sheet, which could be used to pay down debt or fund an expansion.

The balance sheet is a risk, but it's also what has made Canadian Solar the manufacturing power it is today. So, it's a risk solar investors are going to have to live with.

Is Canadian Solar a buy?

I think Canadian Solar has shown enough improvements financially to be a buy for investors. If the buyout goes through, shareholders will get a nice gain for the year and be able to cash out. But if the company stays public, it's well-positioned to be one of the most profitable solar manufacturers in the world. That's why I'm giving this stock a thumbs-up CAPS call on my CAPS page.

More From The Motley Fool

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance