Cap rent-to-own lending like payday loans, MPs told

Charities have called for rent-to-own lending and other forms of high interest credit to have their charges capped.

The demand came as lenders and debt management charities were quizzed by MPs on the Treasury select committee as part of an investigation into household finances.

Rent-to-own forms of borrowing, where a consumer might pay a weekly amount over time, in order to pay for a product were a serious problem for “very vulnerable” people, the charities warned.

These forms of lending are used by half a million consumers each year, Mr Andrew said. Rent-to-own often led the poorest customers to pay a much high premium for items, such as washing machines. A low weekly payment often masked the fact that it would be cheaper if a consumer could afford to buy an item upfront. This price inflation was in-part due to bundling in unnecessary warranties on products.

Rent-to-own practices were deeply under-regulated, Mr Andrew said. The charities called for charges on the loans to have a 100pc cap, like that imposed on payday lending. They acknowledged, however, that such forms of credit are often useful for consumers.

Credit firms, Brighthouse, a rent-to-own lender, cash-lender Morses Club and pawnbroker The Cash Shop, told MPs that their average borrower was on a low income of around £15,000 a year.

These borrowers were “more vulnerable than other members of society”, Hamish Paton, BrightHouse chief executive told MPs.

BrightHouse charges a representative APR of 69.9pc, Morse Club of 756.5pc, The Cash Shop 152.52pc according to their respective websites. Mr Paton said that BrightHouse makes a 50pc gross profit on its loans.

Illiterate or semi literate people could sign up to loans if they were determined to do so according to one of the lenders. “If a customer is lying to us [about being literate] we’ve got no way of knowing that,” said Paul Smith, chief executive of Morses Club.

Phil Andrew, chief executive of StepChange, a debt advice charity, said the organisation was helping 1 in every 100 people in the UK on an annual basis. Matt Upton of Citizens Advice said 350,000 clients to sought debt help from the charity each year.

John Montague, managing director of the Big Issue Group also criticised credit adverts. Such ads were “sexy”, “predatory” and reminiscent of old-fashioned cigarette advertisements. Mr Montague said that the widespread promotion of debt, particularly on television, made it seem more acceptable.

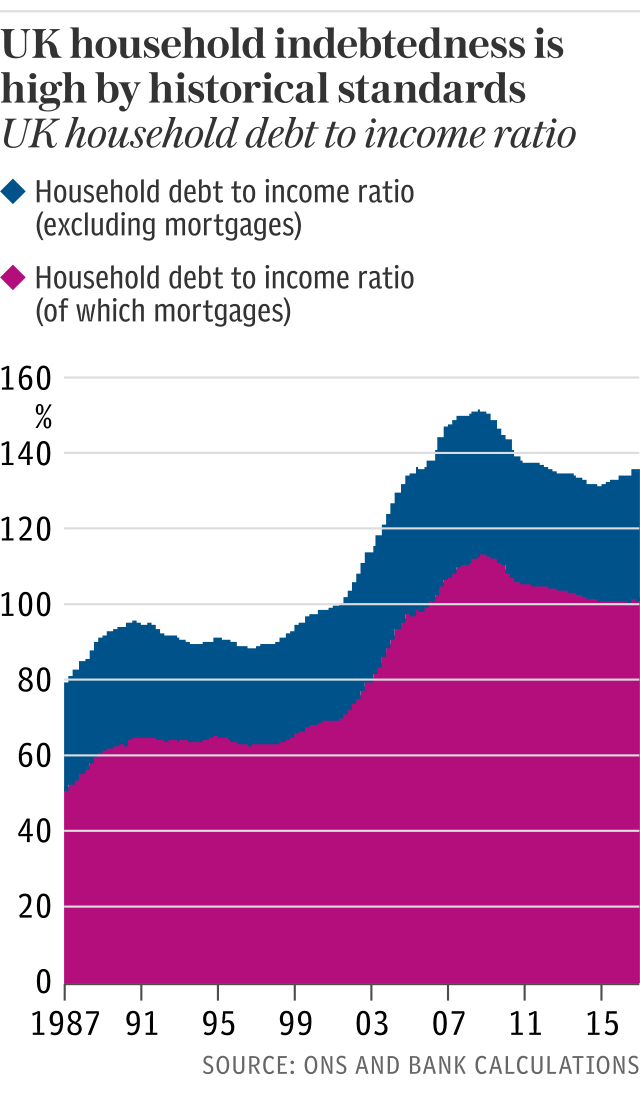

Consumers were facing increasingly volatile and insecure incomes, due to “stagnant wages, inflation and Universal Credit”, Mr Upton said. These combined with other factors to leave households with “fewer pounds in their pocket to ride out shocks”.

Mr Upton added that the Bank of England (BoE) had examined consumer debt bubbles in areas such as credit cards, but that there was no attention paid to more damaging forms of debt, such as rent arrears, tax arrears or energy debt.

The worst debt collection practices were those of governmental organisations according to StepChange and Citizens Advice. These were “very aggressive”, and there was a “quick jump” to the use of bailiffs in instances of council tax arrears.

Yahoo Finance

Yahoo Finance