Car finance boom is 'unlikely to crash the industry' despite Bank of England worries

The boom in motorists taking out leases in order to buy new cars is unlikely to trigger a new credit crunch because such finance is "asset backed" and conservatively modelled, according to leading figures in the car industry.

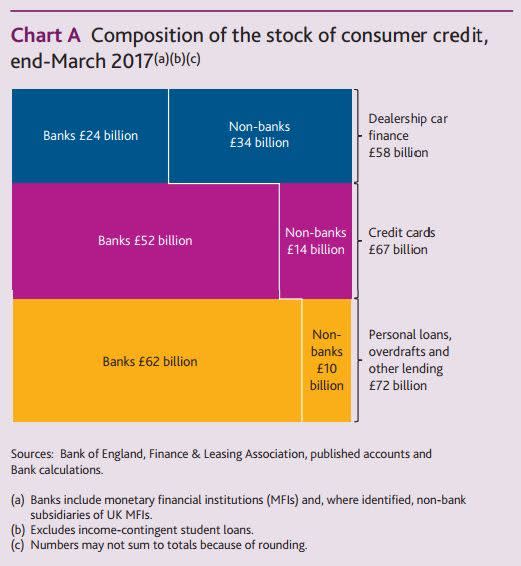

The Bank of England’s financial stability report noted the surge in consumer credit over the past five years, with car finance now making up 29pc of the £198bn total.

Of the £58bn of car finance, £24bn is held by the banks with the bulk - £34bn - on the balance sheets of auto manufacturers and dealers.

Borrowers are ten times more likely to default on consumer credit than mortgages the Bank said, causing worries about the stability of the market.

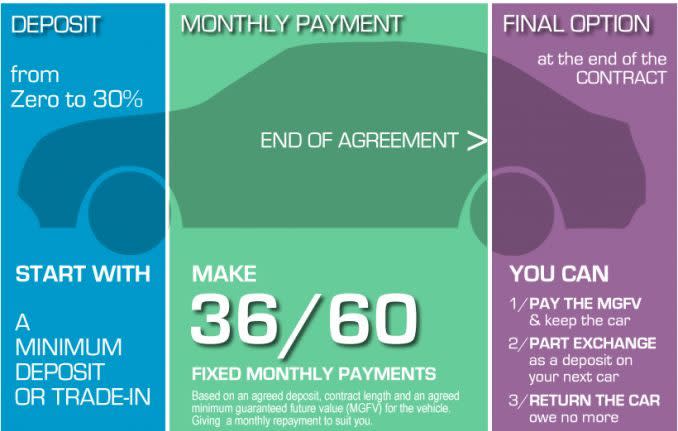

However, industry figures denied the growth in borrowing to finance new cars - particularly in “personal contract plans” (PCPs), where the car is assigned a guaranteed value at the end of the term when it can be handed back with no strings - is likely to cause a shock to the financial system.

“The industry is conservative,” said George Galliers, an auto industry analyst at Evercore. “Manufacturers offering PCPs look at what the value of the car is likely to be at the end of the PCP and offer something lower.

“Say they think it will be worth £12,000, then they say it is £10,000. It gives them a ‘buffer’ against a fall in car prices.”

Equity built up as motorists using PCPs effectively finance the depreciation of a new car is often used as a deposit on a new PCP deal, creating continuous demand for car manufacturers.

Mr Galliers added he had not seen manufacturers or finance houses express concern about the potential for PCPs to crash the market.

“My view is that PCPs are not going to be the cause of the next credit crunch,” he said, noting that PCPs are backed by assets - the cars themselves - unlike many forms of consumer lending.

Bank Governor Mark Carney said that if used car prices fall by 30pc - the worst case modelled by the central bank, which would mean hundreds of thousands of motorists hand back their vehicles - this could create an issue for the industry but would only knock 0.1 percentage points off the capital ratios of banks.

Mr Carney pointed out that - unlike many products bought on credit - “people need their cars in general” so are more likely to keep making repayments.

Adrian Dally, head of motor finance at the Finance and Leasing Association added that “worst case scenario modelled by the bank is something we have never seen happen before”, referring to the 30pc drop.

“We have granular detail on the market and manufacturers model the risk very carefully,” he said. “This is not like the property market where prices can go in any direction. Car values only go one way - down - and in a very predictable way.”

The view was echoed by the Society of Motor Manufacturers and Traders, which said: “Motor finance is governed by strict rules, and anyone taking out a package will have the terms and conditions explained to them. Being asset-backed, it is much lower risk.”

James Baggott, editor in chief of Car Dealer magazine, warned that there could be one speed bump for the industry, though. “PCPs are like a drug, once you are on them it’s hard to stop and you always ‘buy’ a new car every few years,” he said.

“Manufacturers work hard to set realistic residual values for cars so there is unlikely to be a drop because they are inflated. This means that people on PCPs effectively have a savings account by paying a little more each month than needed to cover the depreciation so they build up equity - that can only be a good thing.”

Yahoo Finance

Yahoo Finance