Cardinal Health (CAH) Up 7.5% Since Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Cardinal Health CAH. Shares have added about 7.5% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is CAH due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

However, excluding 20 cents benefit from the legislated tax reform, adjusted earnings came in at $1.31. Meanwhile. adjusted earnings in the year-ago quarter was 1.34 per share.

Revenues increased 6.1% on a year-over-year basis to almost $35.19 billion and beat the Zacks Consensus Estimate of $34.69 billion.

Segmental Analysis

Pharmaceutical Segment

Pharmaceutical revenues soared 4.7% to $31.15 billion on a year-over-year basis. The segment witnessed strong growth in the Specialty business and also gained a huge number of Pharmaceutical Distribution customers.

However, the segment witnessed a 4% drop in profits to $514 million, thanks to generic pharmaceutical pricing and the company's recent investments in its Pharmaceutical IT platform and lackluster generics program performance. However, solid performance by the Specialty Solutions business has partially offset the negative effect in the segment.

Medical Segment

Revenues at the segment increased a whopping 18.6% to $4.04 billion primarily on higher contributions from new and existing customers.

Medical segment profits increased 38% to $220 million, courtesy of higher contributions from new and existing customers and acquisition of the Patient Recovery business.

Share-Repurchase Program

Board of directors at Cardinal Health approved a new authorization to repurchase up to $1 billion of the company’s common shares, which will expire on Dec. 31, 2020.

With the latest authorization, Cardinal Health is now authorized to repurchase up to $1.3 billion of its common shares.

Margins

As a percentage of revenues, gross margin contracted 50 basis points (bps) to 5.3% of net revenues. However, gross profit in the quarter was $1.86 billion, up 16% year over year.

Distribution, selling, general and administrative (SG&A) expenses increased 24% on a year-over-year basis to $1313 billion in the reported quarter.

Guidance

Taking into consideration 40 cents per share of benefit from the lower federal rate due to U.S. tax reform, Cardinal Health raised its fiscal 2018 outlook. The company expects adjusted earnings per share from continuing operations in the range of $5.25-$5.50 per share, higher from the previously guided range of $4.85-$5.10 per share.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been four revisions higher for the current quarter compared to five lower.

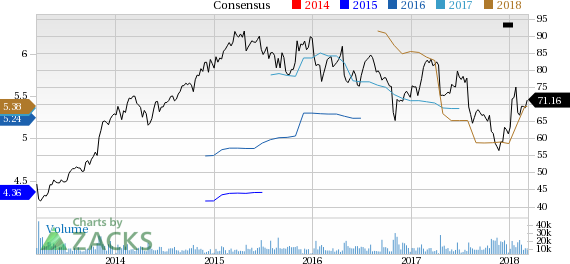

Cardinal Health Price and Consensus

Cardinal Health Price and Consensus | Cardinal Health Quote

VGM Scores

At this time, CAH has a subpar Growth Score of D, however its Momentum is doing a lot better with an A. Following the exact same course, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and momentum investors.

Outlook

Estimates have been trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, CAH has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health (CAH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance