Cardinal Health (CAH) Lowers Medical Segment Income Guidance

Cardinal Health CAH provided updated guidance for its Medical segment. The company now expects the segment to record a loss $25 million to $55 million during first-quarter fiscal 2023. The company previously expected a loss of $20 million to a profit of $20 million for the segment.

The change in guidance for the Medical segment primarily reflects the impact of the company’s ongoing simplification efforts that are likely to result in approximately $25 million in inventory charges related to the gloves portfolio. The $25 million charge includes the negative impact of the company’s decision to stop distributing certain disposable gloves to non-healthcare industries like restaurant supply.

Cardinal Health’s Medical segment has been facing declining sales following the divestiture of the Cordis business in 2021. Moreover, a decrease in products and distribution volumes hurt the segment’s top line during fourth-quarter fiscal 2022. During the same quarter, the segment’s bottom line was hurt primarily due to net inflationary impacts and global supply chain restrictions in products and distribution. The Medical segment recorded a loss of $16 million in the fourth quarter fiscal 2022.

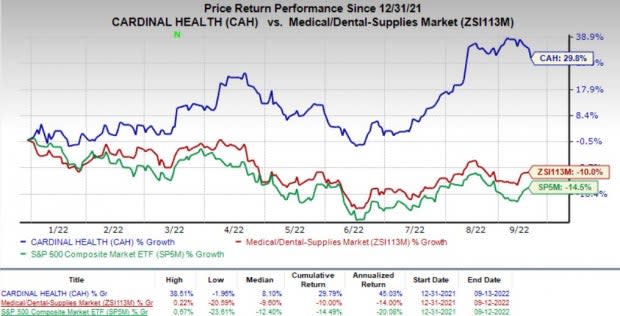

Shares of Cardinal Health have gained 29.8% so far this year against the industry’s decrease of 10%. In the same period, the S&P 500 index declined 14.5%.

Image Source: Zacks Investment Research

Although Cardinal Health lowered its income guidance for the Medical segment, the company maintained its total adjusted earnings for fiscal 2023. The company continues to expect its adjusted earnings per share (EPS) for the year in the range of $5.05 to $5.40. This reflects that although the company is expecting a wider loss from its medical segment, strong demand for its pharmaceutical products will help it to more than offset the loss.

In the fiscal fourth quarter, pharmaceutical revenues amounted to $43.3 billion, up 13.1% on a year-over-year basis. The performance highlights branded pharmaceutical sales growth from existing and net new Pharmaceutical Distribution and Specialty Solutions customers. Pharmaceutical profit was $451 million, up 26% on a year-over-year basis.

In a separate press release, Cardinal Health announced that it launched a robust suite of revenue cycle management (RCM) solutions and consulting services. The RCM solutions are believed to help specialty physician practices simplify payer contracting, streamline prior authorization and maximize financial performance.

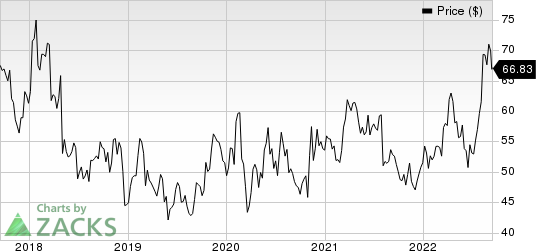

Cardinal Health, Inc. Price

Cardinal Health, Inc. price | Cardinal Health, Inc. Quote

Zacks Rank & Stocks to Consider

Currently, Cardinal Health carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the broader medical space are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.7%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcarehas lost 15.3% compared with the industry’s 26.2% fall so far this year.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has gained 61.3% against the industry’s 26.7% fall so far this year.

McKesson, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.9%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average beat being 13%.

McKesson has gained 40% against the industry’s 10% fall so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance