Cardlytics Inc (CDLX) Reports Q1 2024 Earnings: A Detailed Analysis

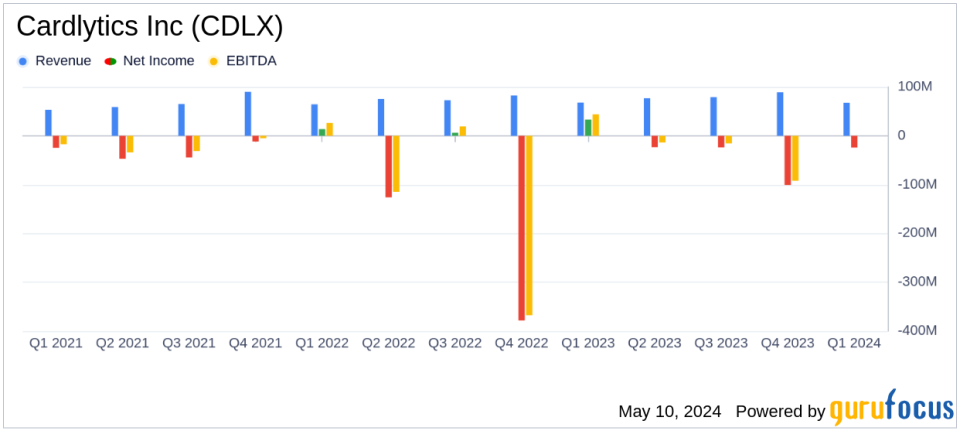

Revenue: Reported at $67.6 million, marking a 5% increase year-over-year, falling below the estimated $71.69 million.

Net Loss: Widened to $(24.3) million from a net income of $13.6 million in the previous year, significantly above the estimated net loss of $4.78 million.

Earnings Per Share (EPS): Recorded at $(0.56) per diluted share, a substantial decline from the previous year's $0.40 per diluted share, and below the estimated EPS of -$0.11.

Adjusted EBITDA: Showed a slight gain of $0.2 million, an improvement from a loss of $(6.1) million in the first quarter of 2023.

Free Cash Flow: Deteriorated to $(22.4) million, compared to $(12.9) million in the first quarter of 2023.

Billings: Increased to $105.2 million, up by 10% year-over-year, indicating growth in the volume of business processed.

Monthly Active Users (MAUs): Grew by 7% year-over-year to 168.5 million, showing enhanced platform engagement.

On May 8, 2024, Cardlytics Inc (NASDAQ:CDLX) released its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company, known for its digital advertising platform integrated within financial institutions, reported a mix of progress and challenges during the quarter.

Company Overview

Cardlytics operates through two main segments: the Cardlytics platform in the U.S. and U.K., and the Bridg platform. The former, being the primary revenue generator, offers a unique bank advertising channel that allows marketers to reach consumers through trusted online and mobile banking channels. The latter contributes via subscription-based customer-data platforms and associated professional services.

Financial Performance

The company reported a revenue of $67.6 million for Q1 2024, marking a 5% increase year-over-year, which falls short of the estimated $71.69 million projected by analysts. This discrepancy highlights a potential area of concern regarding the company's ability to meet market expectations. The adjusted contribution grew by 27% excluding Entertainment, and a modest adjusted EBITDA gain of $0.2 million was noted, compared to a loss in the previous year.

Challenges and Net Loss

Despite the revenue growth, Cardlytics faced significant challenges, including a substantial net loss of $24.3 million, a stark contrast to the net income of $13.6 million reported in the first quarter of 2023. This loss translated to a per-share value of -$0.56, diverging from the estimated earnings per share of -$0.11. The increased net loss can be attributed to various operational and strategic investments aimed at long-term growth but raises immediate financial stability concerns.

Operational Highlights and Future Outlook

Cardlytics' Monthly Active Users (MAUs) saw a 7% increase, reaching 168.5 million, although the Average Revenue Per User (ARPU) slightly decreased from $0.41 to $0.40. Looking ahead, the company anticipates billings to be between $115.0 million and $126.0 million for Q2 2024, suggesting optimism for improved performance excluding the Entertainment segment.

Management's Commentary

"Our results in the first quarter reflect the progress we have made at delivering more value to both consumers and our advertising partners," stated Karim Temsamani, CEO of Cardlytics. "We are driving deeper engagement in the form of higher redemptions, demonstrating that our investments are working, and signaling the potential for higher billings growth in the future."

"Q1 was a good start to the year. We are seeing strong momentum in our international business and are making progress on our longer-term initiatives," added Alexis DeSieno, CFO of Cardlytics.

Conclusion

While Cardlytics Inc (NASDAQ:CDLX) demonstrates strategic growth initiatives and a robust increase in user engagement metrics, the financial outcomes, particularly the significant net loss and missed revenue forecasts, present challenges that may concern investors. The company's future quarters will be crucial in determining the effectiveness of its current strategies in achieving sustainable profitability and aligning closer with market expectations.

Explore the complete 8-K earnings release (here) from Cardlytics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance