Carillion in crunch talks with Government after lenders reject business rescue plan

Calls were mounting for the Government to step in to prop up stricken outsourcer Carillion this evening amid fears the company is teetering on the edge of administration.

Shares in the outsourcer plunged 28.9pc to an all-time low of 14.2p on Friday, leaving its £1.5bn debts dwarfing its market value of just £61m.

Separate government departments are hashing out contingency plans in case Carillion collapses, in the latest sign ministers are losing confidence in whether the company can come to an agreement with banks, such as a debt for equity swap.

The Ministry of Justice, for example, is pulling together proposals to take back prison contracts from Carillion into public ownership.

A spokesman for 10 Downing Street said: “Of course the Government will make contingency plans for many different situations. We are monitoring the situation closely and are in regular contact with the management team there. The Government remains supportive of Carillion’s ongoing discussions with their stakeholders.”

Carillion is a key government contractor, working across departments on projects including the HS2 rail link. It employs around 20,000 people across the UK. Senior Cabinet ministers, including Business Secretary Greg Clark, Transport Minister Jo Johnson and Justice Minister Rory Stewart, were updated on the situation earlier this week, while this evening rumours swirled that PricewaterhouseCoopers had been called in to advise Cabinet Office on contingency plans.

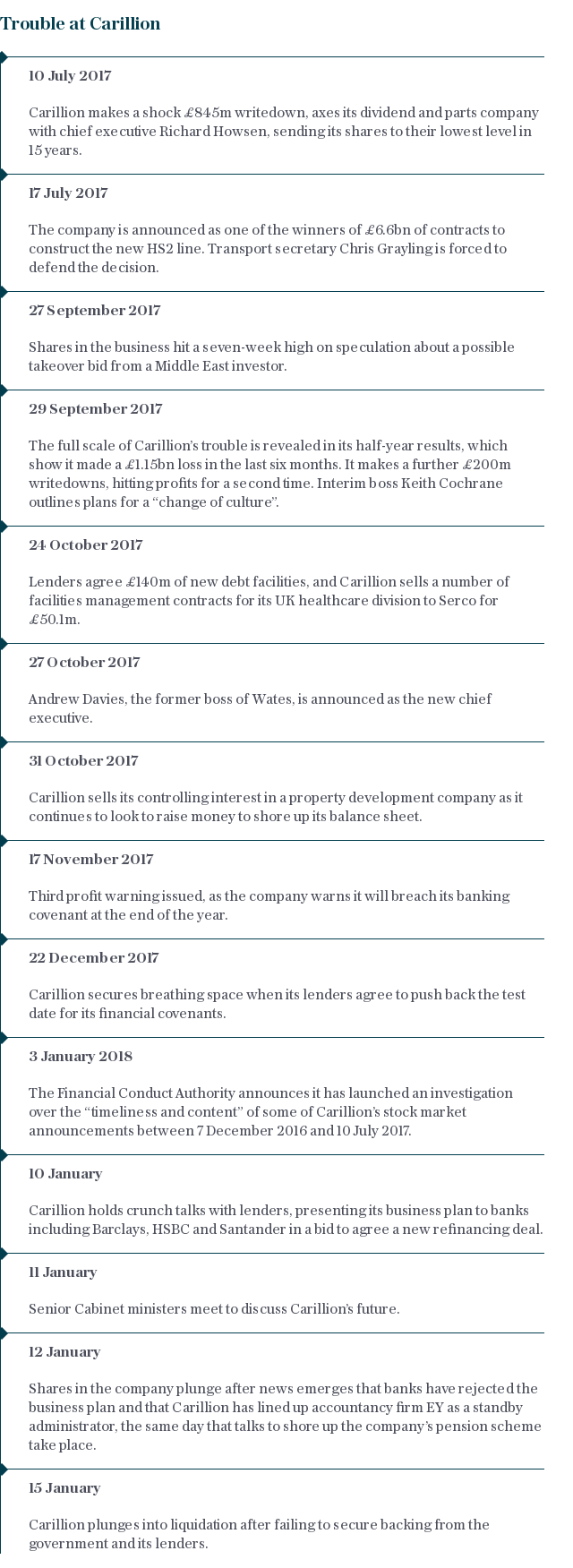

The outsourcer’s troubles began last summer, after its share price plunged almost 90pc on a shock profit warning, but concerns have spiralled recently amid suggestions it needs £300m of funding by the end of this month.

Carillion presented a business plan to banks including Barclays, HSBC and Santander on Wednesday, hoping to agree a refinancing deal. However, it is understood that the banks said the status quo at Carillion was no longer sustainable, rejecting the initial plan and calling for the Government to step in given it is a major source of cash flow for it. In a bid to save the company from falling into administration and to protect its pensioners, a crunch meeting was held between Carillion, the Government and pension bodies, including the Pension Regulator and Pension Protection Fund, on Friday.

The Daily Telegraph understands that a conference call with its lenders was then held after the meeting.

“Following a presentation of our business plan to lenders on Wednesday, conversations with financial creditors and other key stakeholders are continuing. Suggestions that the plan has been rejected or that talks have terminated are incorrect,” Carillion said in a statement.

“It is too early to predict the outcome of these discussions but Carillion expects that any such agreement is likely to involve the raising of new capital and the conversion of existing financial indebtedness to equity which would result in significant dilution to existing shareholders.”

However, Sky News reported that accountancy firm EY has been put on standby to oversee an administration if it is unable to secure a rescue deal. "going through the process and engaging actively with stakeholders".

The banks declined to comment.

Yahoo Finance

Yahoo Finance