Carl Icahn Bolsters Stake in Icahn Enterprises LP

On April 18, 2024, Icahn Capital Management LP, led by renowned activist investor Carl Icahn (Trades, Portfolio), made a significant addition to its holdings in Icahn Enterprises LP (NASDAQ:IEP). The firm acquired an additional 18,016,077 shares of IEP at a trade price of $16.89, marking a 4.90% change in the firm's previous stake. This transaction had a 2.71% impact on the portfolio, bringing the total shares held to 385,895,979 and solidifying the firm's commanding position in the company with a 58.1% portfolio weight and an 86.32% ownership stake in IEP.

Activist Investor Carl Icahn (Trades, Portfolio)

Carl Icahn (Trades, Portfolio) is a prominent figure in the investment world, known for his activist approach. The firm takes substantial positions in public companies and often advocates for strategic changes to unlock value. Icahn's investment vehicles include hedge funds and publicly traded private equity firms, with GuruFocus tracking the portfolio of Icahn Capital Management. The firm's investment philosophy revolves around purchasing undervalued and out-of-favor assets, improving them, and selling when they regain favor. This contrarian approach has been a hallmark of Icahn's success.

Overview of Icahn Enterprises LP

Icahn Enterprises LP, trading under the symbol IEP in the USA since its IPO on July 24, 1987, is a diversified conglomerate providing a range of business services. With operations spanning across Automotive, Energy, Food Packaging, Real Estate, Pharma, and Home Fashion, the Energy segment is a significant revenue driver for the company. IEP's business model is focused on leveraging its diversified segments to generate sustainable revenue, primarily within the United States.

Financial Health of Icahn Enterprises LP

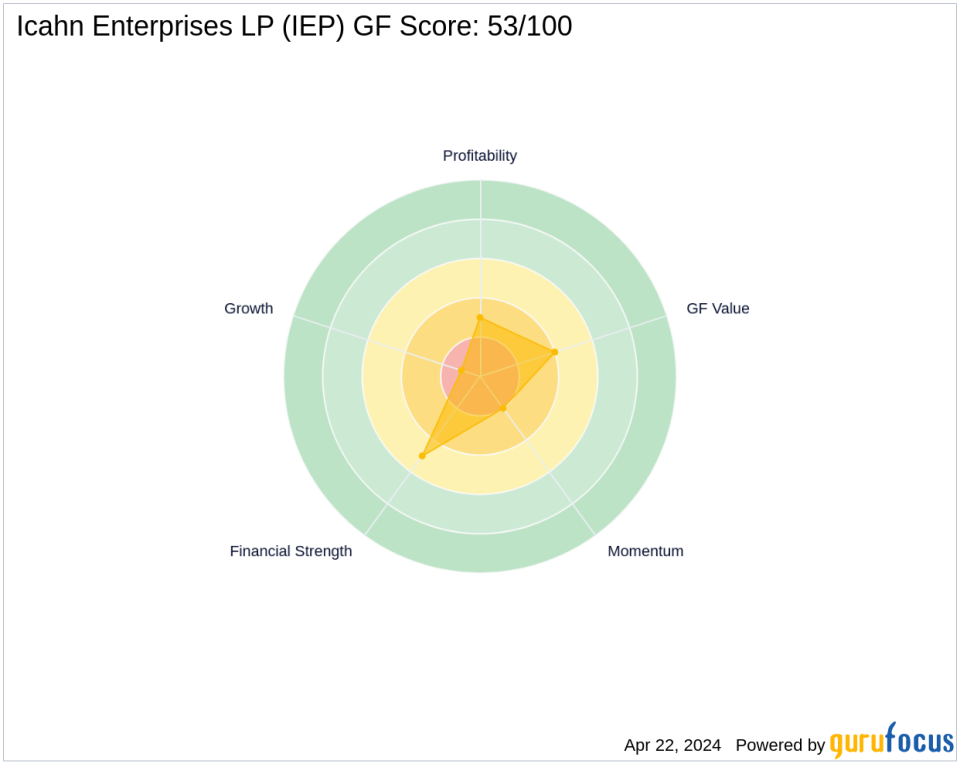

As of the latest data, Icahn Enterprises LP boasts a market capitalization of $7.15 billion, with a current stock price of $16.67. However, the company's PE percentage stands at 0.00, indicating that it is not generating net profits at the moment. The GF Score for IEP is 53/100, suggesting a poor potential for future performance. This score is derived from various factors, including financial strength, profitability, growth, and momentum.

Carl Icahn (Trades, Portfolio)'s Position in IEP

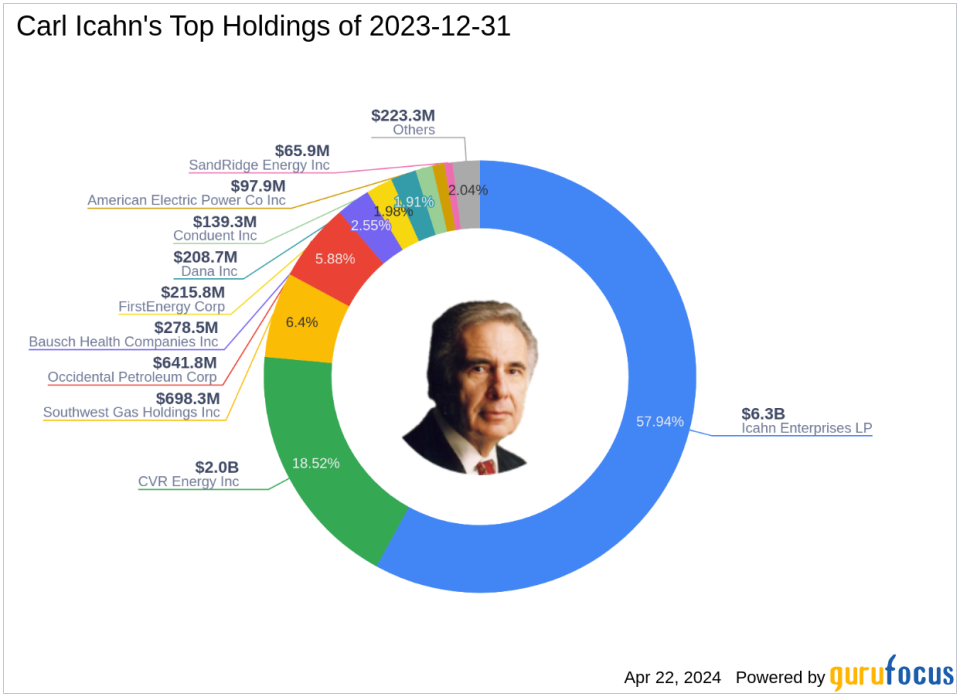

The recent acquisition further cements Icahn Enterprises LP as a cornerstone of Carl Icahn (Trades, Portfolio)'s portfolio, alongside other top holdings such as CVR Energy Inc (NYSE:CVI) and Southwest Gas Holdings Inc (NYSE:SWX). With a portfolio equity of $10.91 billion, IEP remains the firm's largest holding, reflecting a strong conviction in the company's value proposition and strategic direction. The firm's top sectors include Energy and Utilities, aligning with IEP's business focus.

Market and Valuation Perspectives

Icahn Enterprises LP's GF Value stands at $34.63, with the stock trading at a Price to GF Value ratio of 0.48, suggesting that the stock may be undervalued. However, the designation of "Possible Value Trap, Think Twice" indicates that investors should exercise caution. Since the trade, the stock has experienced a slight decline of 1.3%, and its performance since the IPO has seen a modest increase of 4.84%. The year-to-date price change ratio is currently at -5.55%.

Industry Context and Financial Metrics

In the context of the Oil & Gas industry, Icahn Enterprises LP's financial health is mixed. The company's Financial Strength and Profitability Rank are 5/10 and 3/10, respectively, while the Growth Rank is a low 1/10. The GF Value Rank and Momentum Rank are 4/10 and 2/10, respectively, indicating challenges in these areas. The Piotroski F-Score is 3, and the Altman Z-Score is 1.50, which could raise concerns about financial stability. The firm's interest coverage ratio is 1.60, and the Cash to Debt ratio is 0.83, suggesting a need for careful financial management.

Conclusion

For value investors, Carl Icahn (Trades, Portfolio)'s increased stake in Icahn Enterprises LP is a significant move that underscores the firm's confidence in the company's future prospects. While the current financial metrics present a mixed picture, the firm's substantial investment suggests a belief in the company's potential to overcome its challenges and deliver value. As always, investors should conduct their due diligence, considering the complex dynamics of the Oil & Gas industry and the broader market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance