Carlisle (CSL) Q3 Earnings & Revenues Surpass Estimates

Carlisle Companies Incorporated CSL reported impressive third-quarter 2021 results wherein both the bottom line and the top line surpassed the Zacks Consensus Estimate.

The company’s adjusted earnings were $2.99 per share, beating the consensus estimate of $2.73 by 9.5%. The bottom line increased 54.1% on a year-over-year basis supported by higher sales, partially offset by a rise in corporate expense.

Inside the Headlines

In the reported quarter, Carlisle’s revenues came in at $1,315.6 million, up 24.5% year over year. This increase was attributable to 19.4% rise in organic revenues, 4.8% benefit from acquired assets and a positive impact of 0.3% from changes in foreign exchange rates.

The top line surpassed the Zacks Consensus Estimate of $1,259 million by 4.5%.

The company reports results under three segments — Carlisle Construction Materials (“CCM”), Carlisle Interconnect Technologies (“CIT”) and Carlisle Fluid Technologies (“CFT”). The quarterly segmental results are briefly discussed below.

Revenues from CCM totaled $1,065.8 million, increasing 29.4% year over year. It represented 81% of the company’s revenues. Organic revenues grew 23.3% on the back of strong demand for U.S. commercial roofing, the Henry acquisition, and strength across all product lines.

CIT revenues, representing 13.6% of total revenues, were $178.7 million, up 6.1% year over year. The increase was driven by 5.2% growth in organic revenues on account of a rise in orders from aerospace and medical customers.

CFT revenues, representing 5.4% of total revenues, were $71.1 million, up 9.4% year over year. Organic revenues increased 6.3% on account of strength in its businesses in China and Europe, and solid price realization.

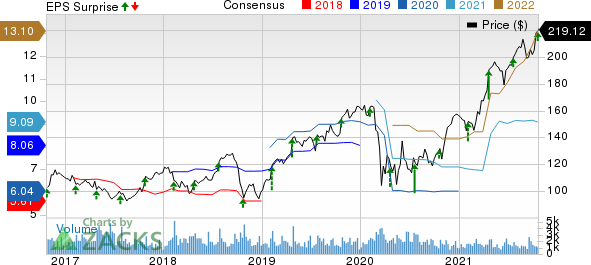

Carlisle Companies Incorporated Price, Consensus and EPS Surprise

Carlisle Companies Incorporated price-consensus-eps-surprise-chart | Carlisle Companies Incorporated Quote

Operating Margin Details

In the reported quarter, Carlisle’s cost of sales increased 27.7% to $944 million. It represented 71.8% of net sales compared with 69.9% a year ago.

Selling and administrative expenses increased 25.9% to $192.6 million. It represented 14.6% of net sales compared with 14.5% in the year-ago quarter. Research and development expenses totaled $12.8 million, up 11.3%.

Operating income was $166.5 million, up 7.6% year over year while margin contracted 190 basis points to 12.7%. The company hiked its quarterly dividend rate by 3% in August 2021. In September, the company completed the acquisition of California-based Henry Company for $1.575 billion in cash.

Balance Sheet and Cash Flow

Exiting the third quarter, Carlisle had cash and cash equivalents of $295.6 million compared with $713.3 million at the end of previous quarter. Long-term debt (including current portion) was $2,926.4 million, up from $2,081.6 million sequentially.

In the first nine months of 2021, the company generated net cash of $283.9 million from operating activities compared with $440.2 million a year ago.

In the first nine months of 2021, the company rewarded shareholders with a dividend payout of $84.2 million. Amount spent on buying back shares totaled $290.6 million, down 15%.

Outlook

In 2021, Carlisle expects revenue growth in the mid-20% range for the CCM segment, driven by strength across U.S. commercial roofing market and the Henry acquisition. The CIT segment is expected to decline in the mid-single digit range while the CFT segment is likely to witness revenue growth in mid-teens on the back of strength in markets.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same space are Raven Industries, Inc. RAVN, Griffon Corporation GFF, and Danaher Corporation DHR. While Raven currently sports a Zacks Rank #1 (Strong Buy), Griffon and Danaher carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Raven delivered an earnings surprise of 42.59%, on average, in the trailing four quarters.

Griffon delivered an earnings surprise of 26.02%, on average, in the trailing four quarters.

Danaher delivered an earnings surprise of 25.29%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

Raven Industries, Inc. (RAVN) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance