How Will Carnival's (CCL) Top Line Shape Up in Q1 Earnings?

Carnival Corporation CCL is slated to release fiscal first-quarter 2018 results on Mar 22, before market opens.

In the to-be-reported quarter, Carnival’s Passenger Tickets business, and Onboard and Other segment are expected to perform impressively on a year-over-year basis. However, the Tour and Other segment is likely to remain weak.

Notably, shares of Carnival have rallied 1.9% in the past three months, slightly outperforming the industry’s gain of 1.5%.

Let’s see how the company’s segments are integrating to give shape to its top line.

Passenger Tickets

Segment revenues are expected to increase year over year driven by price improvements in Carnival’s European, Caribbean and Alaska programs. The Zacks Consensus Estimate for revenues is pegged at $3.04 billion, reflecting a year-over-year increase of 8.3%. In the fourth quarter, passenger tickets revenues improved 9% year over year.

Onboard and Other

Carrying on the momentum of the fourth quarter (up 7.1% year over year), the segment is expected to record improvement in the quarter to be reported. Growth is expected to be driven by higher onboard spending by guests and capacity rise in available lower berth days (ALBD).

The Zacks Consensus Estimate for revenues is pegged at $1.04 billion, reflecting a year-over-year increase of 7.3%.

Tour and Other Revenues

Revenues are expected to decline due to weak performance of Holland America Princess Alaska Tours — the tour company that Carnival owns and operates. The Zacks Consensus Estimate is pegged at $8.40 million, reflecting a year-over-year decrease of 6.7%. Revenues from this segment decreased 14.6% year over year in the fourth quarter.

Notably, the Zacks Consensus Estimate for total revenues is pegged at $4.11 billion, representing a year over year increase of 8.4%.

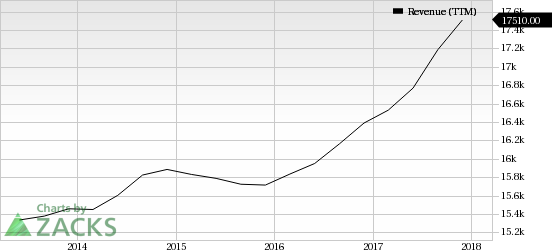

Carnival Corporation Revenue (TTM)

Carnival Corporation Revenue (TTM) | Carnival Corporation Quote

Zacks Rank and Key Picks

Carnival carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the Zacks Consumer Discretionary sector include International Speedway Motorsports TRK, Wynn Resorts, Limited WYNN and Las Vegas Sands Corp. LVS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Speedway Motorsports, Wynn Resorts and Las Vegas Sands earnings in 2018 are expected to increase 35.2%, 43.2% and 10.2%, respectively.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Carnival Corporation (CCL) : Free Stock Analysis Report

Speedway Motorsports, Inc. (TRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance