Carnival Corporation & plc (NYSE:CCL) is Expected To Breakeven Within a Year

This article first appeared on Simply Wall St News.

It is no secret that cruising companies got a significant hit in the pandemic. Most of them are still recovering, including the Carnival Corporation & plc (NYSE:CCL), which is currently sailing only 3 ships from the United States.

A recent slide in coronavirus-sensitive stocks proves that the pandemic worries are not yet behind us. The travel & leisure sector remains sensitive, with the latest news stoking volatility. The Beta is currently at 1.93, meaning that the sector volatility is close to twice compared to the market average.

Just days ago, the state of Florida successfully appealed to Supreme Court for an emergency order to block the restrictions imposed by the Centers for Disease Control and Prevention (CDC) that affect the cruising industry. Lifting this restriction is a major success for cruising stocks and for the state of Florida that is heavily reliant on tourism.

Following an ambitious announcement to have a majority of the fleet back in operation by the end of 2021, we examine the company's path back to profitability.

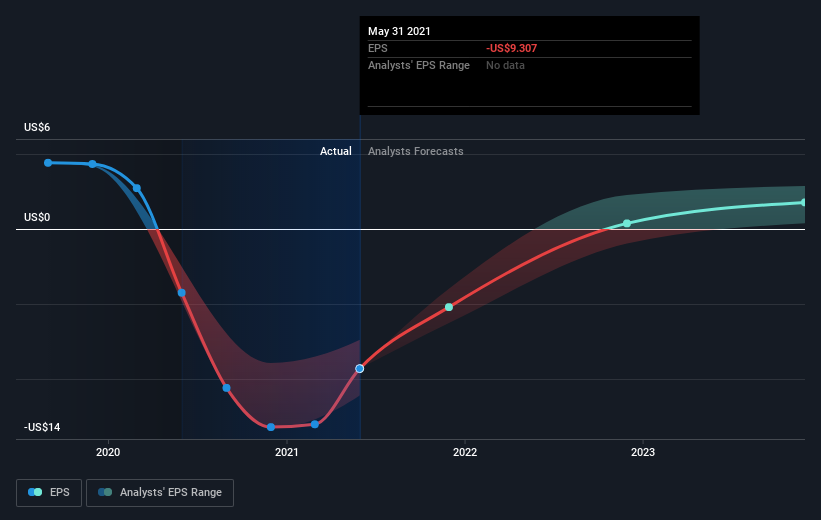

Carnival Corporation & plc operates as a leisure travel company. With the latest financial year loss of US$10b and a trailing-twelve-month loss of US$9.1b, the US$26b market-cap company alleviated its loss by moving closer towards its target of breakeven. Many investors wonder about the rate at which Carnival Corporation & will turn a profit, with the big question being - when will the company break even?

View our latest analysis for Carnival Corporation &

According to the 20 industry analysts covering Carnival Corporation &, the consensus is that breakeven is near. They expect the company to post a final loss in 2021 before turning a profit of US$254m in 2022. Therefore, the company is expected to break even just over a year from now. To meet this breakeven date, we calculated the rate at which the company must grow year on year. It turns out an average annual growth rate of 70% is expected, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable later than expected.

One thing we would like to bring into light with Carnival Corporation is its debt-to-equity ratio of 172%. Typically, debt shouldn't exceed 40% of your equity, and the company has considerably exceeded this. A higher level of debt requires more stringent capital management, which increases the risk around investing in the loss-making company.

While the Delta variant remains the elephant in the room, the vaccinations keep adding up, most prominently in the key markets like the U.S and EU. Additionally, just because the company plans to operate most of the fleet within this year, it doesn't mean the profitability will return to the pre-2020 levels. Adhering to safety guidelines and regulations in different countries will likely incur additional costs.

Ultimately, Carnival Corporation offers good risk-reward for patient investors that can stomach the short-term volatility.

Next Steps:

Carnival Corporation's key fundamentals are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Carnival Corporation, take a look at Carnival Corporation &'s company page on Simply Wall St. We've also compiled a list of important aspects you should further examine:

Valuation: What is Carnival Corporation & worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether The market currently misprices carnival Corporation.

Management Team: An experienced management team at the helm increases our confidence in the business - take a look at who sits on the Carnival Corporations board and the CEOs background.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance