Carpetright shares crash after huge profit warning

Carpetright shares have crashed by nearly half after the retailer issued a shock profit warning and blamed a reduction in consumer confidence for sales cratering.

The flooring chain’s grim update dragged its stock down by as much as 45pc to 90p and knocked shares in other furniture and DIY groups lower as spooked investors fretted that consumers may be delaying spending on big-ticket items.

Shares in B&Q owner Kingfisher fell 3.5pc to 331.3p, sofa retailer DFS lost 3.8pc to 198.2p, and smaller rival SCS dropped 4.9pc to 212p in mid-morning trading.

Carpetright’s second profit warning in less than two months is particularly painful for investors who had already been told in December to lower their profit expectations.

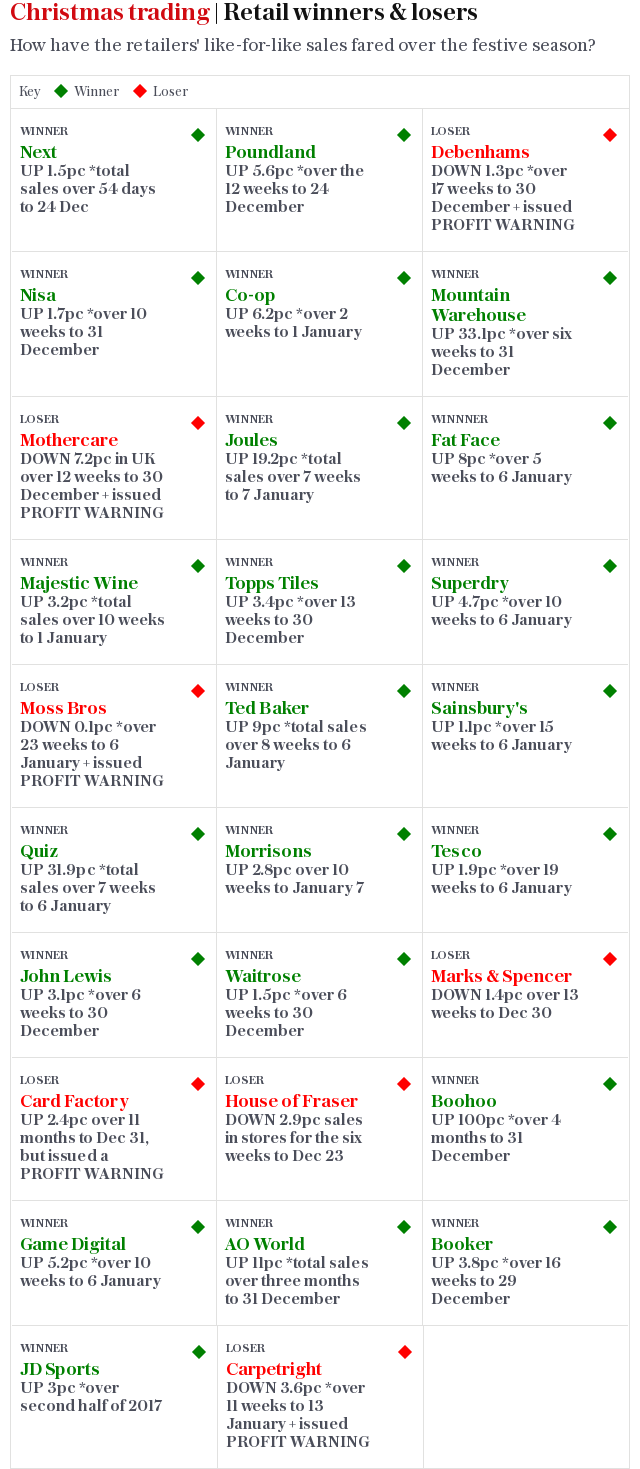

Analysts at Peel Hunt said that while Carpetright had blamed the wider consumer outlook, the City has “seen solid sales elsewhere (Topps & Headlam) and there are elements of Carpetright-specific issues, most notably the complete re-ranging of the bed offer ahead of peak [trading]”.

The company, which has 416 shops in the UK and 136 in Europe, said that there had been a “sharp deterioration” in trade with sales in stores open more than a year slumping by 3.6pc in the 11 weeks to January 13. Total sales dropped 4.5pc after it closed 10 stores.

The post-Christmas period was "significantly behind expectations" with "lower customer footfall", Carpetright said. This had resulted in a "significant impact on profitability and our outlook for the reminder of the year".

As a result Carpetright has slashed profit forecasts to between £2m and £6m, well below City expectations of £16.5m. The retailer has a long history of profit warnings, issuing its first in 2003 and at least nine more over the last 15 years.

Prizes for anyone who can name a UK company that's had more profit warnings than Carpetright. First I can see was in 2003, then 2005, 2007, 2008, 2010, 2011, 2012, 2013, 2014, 2017 and now 2018. Shares now at all-time low of 93p. Bets on this being the last?

— Ben Marlow (@benjaminmarlow) January 19, 2018

Wilf Walsh, chief executive, said: "Despite a positive start to our third quarter, we have seen a significant deterioration in UK trading during the important post-Christmas trading period. While average transaction values were up year on year, the number of customer transactions since Christmas was sharply down, which we believe is indicative of reduced consumer confidence."

Like-for-like sales in its core flooring business, which had previously been performing well, sank 7.1pc in the post Christmas period.

There was a slightly better picture in its European business, where it has shops in the Netherlands, Belgium and the Republic of Ireland; like-for-like sales in that division rose 4.3pc during the third quarter.

In December Carpetright blamed “fragile” consumer confidence and “intensified competition” for a collapse in half-year profits, which fell 93pc to just £300,000. At the time it blamed higher staff costs and discounting for the hit to its bottom line. In October it warned that first-half trading was "volatile", with floor sales failing to offset declining demand for its beds.

"It’s the same old story as with other brands that have failed to adapt to changing consumer trends – lower footfall has left transaction numbers down significantly from last year," said Neil Wilson of ETX Capital. "We must also consider weaker consumer sentiment for big ticket items as a factor, as well as tougher competition from a more diverse marketplace."

Yahoo Finance

Yahoo Finance