Cars & Bikes To Get Cheaper From 1 August: Here’s Why

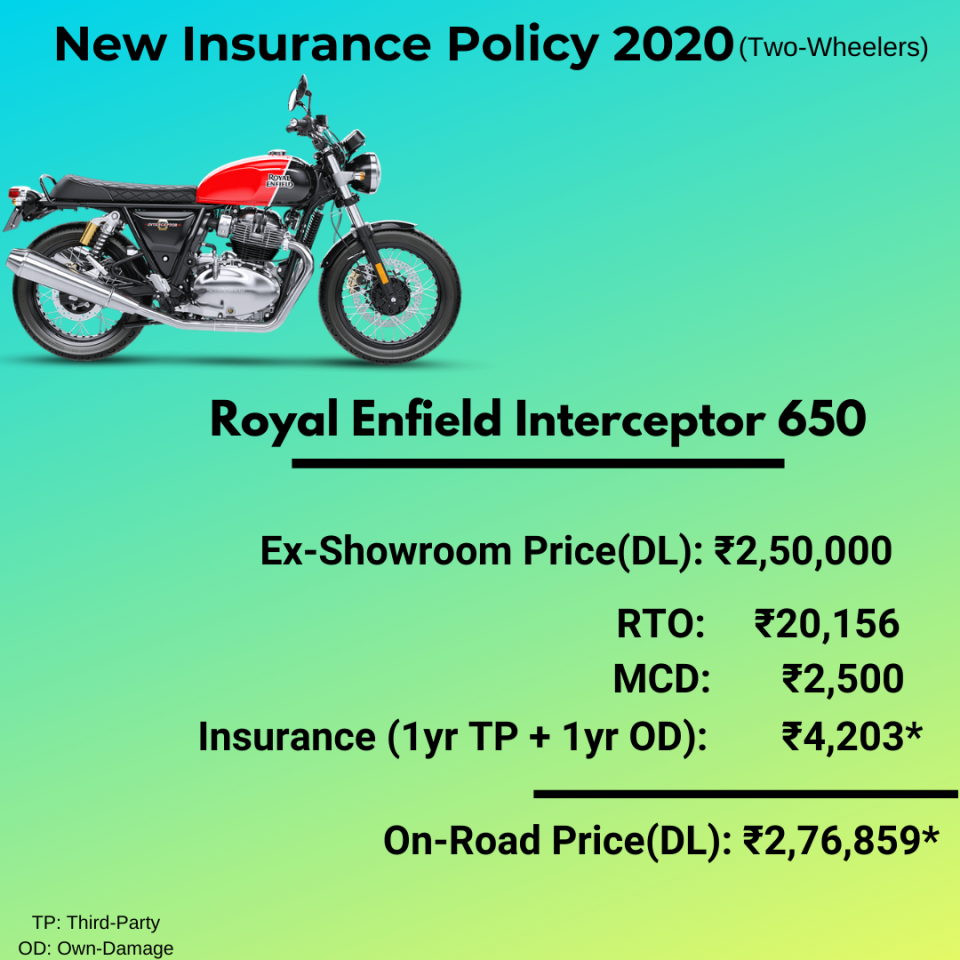

As per a recent mandate issued by the Insurance Regulatory and Development Authority of India (IRDAI), long-term motor insurance packages that cover both own damages (OD) and third-party (TP) damages, will be discontinued.

The change will come into effect from 1 August 2020 and will only apply to those cars that have been purchased post this date.

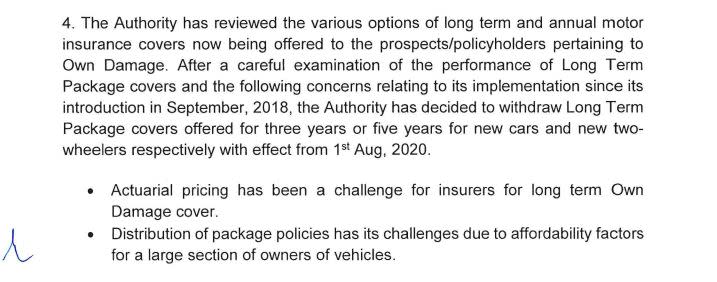

As per the older 2018 policy, it was mandatory for a four or two-wheeler owner to have third-party insurance, 3-years for cars and 5-years for bikes and scooters. They could also buy long-term comprehensive insurance which bundled OD and TP for a longer period.

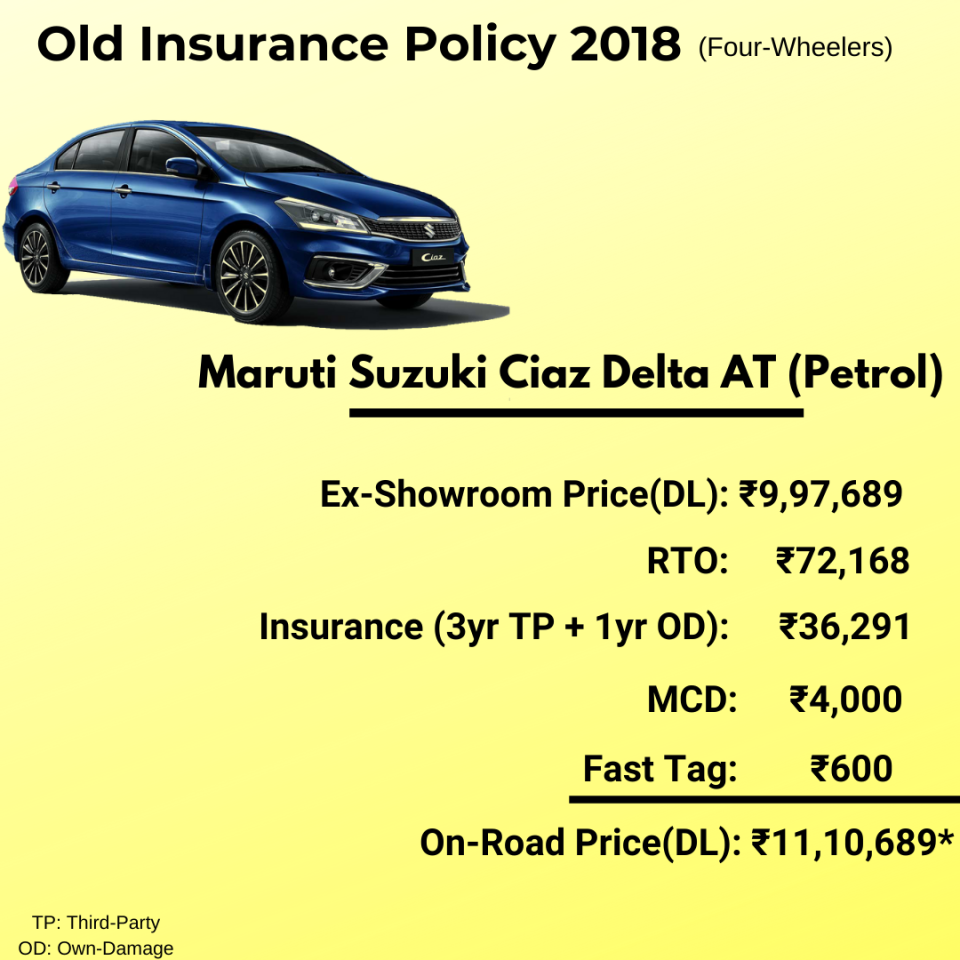

As per sources at insurance portal RenueBuy, however, the new mandate requires a vehicle owner to have just 1-year third-party insurance as mandatory and they can opt for 1-year OD cover with it while making the purchase. All long-term TP and OD insurance plans have been discontinued.

Own damage insurance was and still remains optional.

How Will Cars & Bikes Get Cheaper?

The insurance premium, road tax and ex-showroom price of the car may differ as per the region and the insurance provider.

The fact that buying long-term third-party insurance is no longer mandatory implies that the owner does not have to pay extra money for 3-years of TP insurance which gets added to the overall price while buying the vehicle.

So the money you were paying for a 3-year package for cars and 5-year package for two-wheelers now comes down to just a 1-year payment.

To break it down, if the ex-showroom price of a Maruti Suzuki Ciaz Delta (Automatic) is around Rs 9.97 lakh in Delhi, you earlier had to pay the RTO: Rs 72,168, MCD: Rs 4,000, Fast Tag: Rs 600 and the Insurance (3yr TP + 1yr OD): Rs 36,291 – which brought the on-road price of the car to Rs 11,10,689.

Now, as per new IRDAI regulations, the Insurance clause in the break-up now is (1yr TP + 1yr OD) which brings the gross insurance you have to pay down to roughly Rs 23,689*.

So now, if you buy a Ciaz Delta AT post 1 August 2020, you’ll be able to save around Rs 12,602 on insurance which will also bring the on-road price of the car down.

Just to be clear, these are rough estimates and the actual figure will vary as per the insurer and cost of the car.

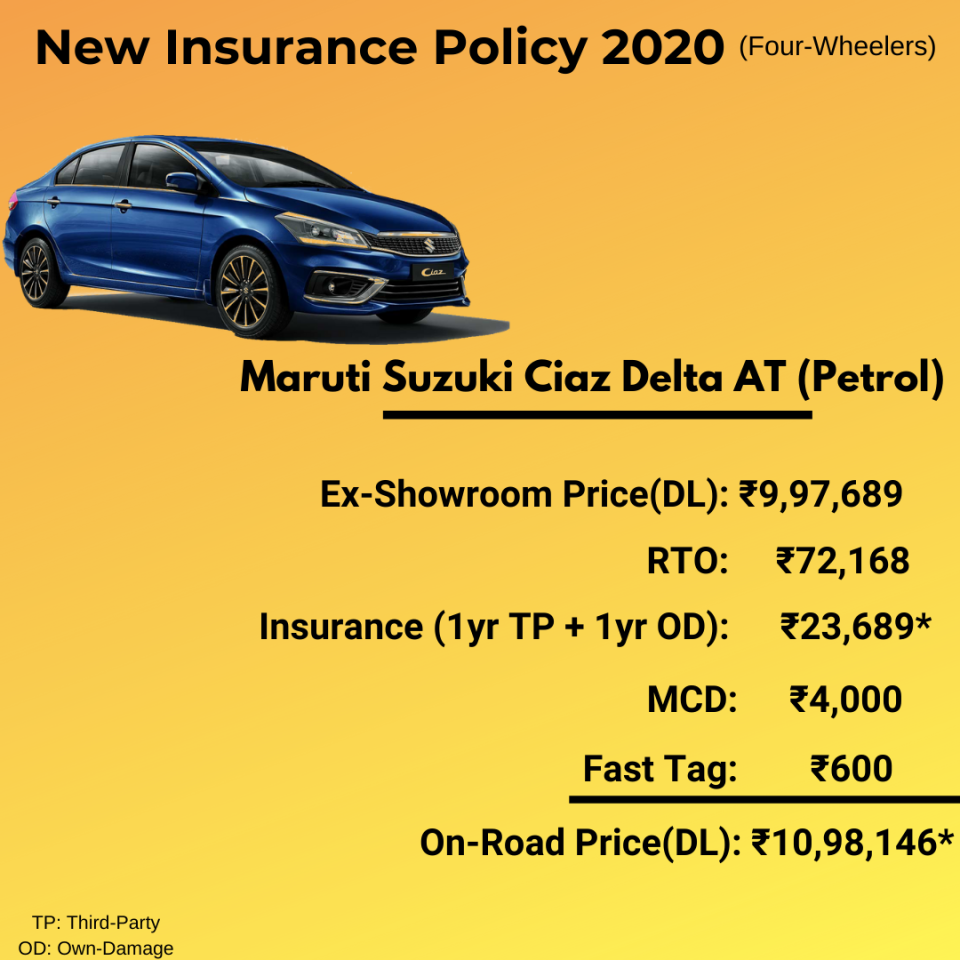

The case is the same for two-wheelers as it was mandatory to buy 5-year thrid-party insurance until 1 August 2019. As per the new mandate, you can buy a two-wheeler now by paying just for one-year of TP insurance.

This helps you save a lot depending on the ex-showroom price of the motorcycle and the deal you get from the insurance provider.

The new IRDAI mandate also means that customers don’t have to stick to a single insurance provider for longer than a period of one year and have the option to switch if they find a better option.

This is surely going to affect the insurance industry as earlier they could reel in more money.

"“The decision will help the customer with flexibility to switch to some other insurer for the OD part post one year of expiry. Also this reduces the upfront cost while purchasing a new vehicle that will have an impact on the motor insurance industry.”" - Animesh Das, Head of Product Strategy, Acko General Insurance

Earlier, the long-term option was made mandatory as many people did not renew their third-party insurance, which caused a lot of problems for commuters.

"“It may be mentioned that third party deaths due to uninsured vehicles deprive the dependent of the deceased bringing immense difficulties in their lives.”" - Parthanil Ghosh, President - Motor Business, HDFC ERGO General Insurance.

Since the pandemic has slowed down the automobile industry, the government is looking to push the sale of passenger vehicles, and it is expected that this move will be welcomed by potential car and two-wheeler buyers.

. Read more on Car and Bike by The Quint.Jahnvi Kapoor Shines in 'Gunjan Saxena' Trailer, Watch HereCars & Bikes To Get Cheaper From 1 August: Here’s Why . Read more on Car and Bike by The Quint.

Yahoo Finance

Yahoo Finance