Casey's (CASY) to Add 63 Convenience Stores, Up 16.7% in a Year

Casey’s General Stores, Inc. CASY has been making notable efforts to enrich guests’ experience. In latest move, the company has unveiled plans to acquire 63 convenience stores from EG America, LLC. EG America is a subsidiary of EG Group Ltd. The deal is expected to conclude later in the current year and is subjected to the customary regulatory approvals.

We note that these stores, presently operated under the Minit Mart and Certified Oil banners, are located in Kentucky and Tennessee. The employees at each store are likely to be retained by CASY. This deal strategically fits with the acquirer’s store-growth plan. This plan aims to expand stores in the coming three years and reach out to more customers.

Casey’s, being one of the leading convenience store retailers in the United Stated, boasts a strong brick-and-mortar footprint. During fiscal 2023, Casey's constructed 34 new stores, acquired 47 stores and closed 10 stores. It expects to add approximately 350 stores by the end of fiscal 2026, including 110 stores in fiscal 2024. Earlier, the acquisition of Buchanan Energy added more than 90 retail stores and 80 dealer sites to Casey's business. The company also acquired 48 Circle-K stores primarily in Oklahoma City as well as 40 Pilot stores primarily in Knoxville, TN market.

What’s More?

Casey's has successfully integrated digital technologies, such as mobile app and online ordering capabilities, to create a seamless shopping experience for customers, leading to a boost in same-store sales growth. The company's strategic focus on price and product optimization, along with efforts to contain costs and improve distribution efficiency, have been instrumental in driving sales and expanding profit margins.

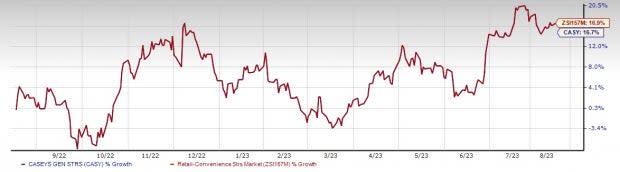

Image Source: Zacks Investment Research

Markedly, the company's Rewards program has exceeded 6.5 million members, indicating a strong customer response. Additionally, it has expanded its delivery capabilities by partnering with DoorDash and Uber Eats. Casey's continues to prioritize customer convenience by offering in-store pickup and curbside pickup options. Notably, the company's ownership and operation of distribution centers and a dedicated transportation fleet provide further operational control and efficiency.

Casey’s focus on technology advancements, merchandise ordering efficiency, inventory management and data analytics, position it well for growth. The company has been strengthening pizza promotions for guests who are seeking meal solutions and has also been enhancing breakfast lineups. It has been increasing penetration of private brands. These efforts have been aiding this Zacks Rank #3 (Hold) company. In a year’s span, shares of the company have increased 16.7%, compared with the industry’s 16.9% growth.

Solid Picks in Retail

We have highlighted three better-ranked stocks, namely Boot Barn BOOT, American Eagle Outfitters AEO and Urban Outfitters URBN.

Boot Barn, a leading apparel and footwear retailer, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 5.1% from the year-ago reported figure. BOOT delivered an average trailing four-quarter earnings surprise of 13.5%.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently carries a Zacks Rank #2 (Buy). AEO delivered an average trailing four-quarter earnings surprise of 9.2%.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year earnings per share (EPS) suggests growth of 7.2%, from the year-ago reported figure.

Urban Outfitters, a sporting goods retailer, currently carries a Zacks Rank of 2. The company has an average trailing four-quarter earnings surprise of 12.2%.

The consensus estimate for Urban Outfitters’ current financial-year sales and EPS suggests growth of 5.3% and 60.6%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance