Causeway Capital Commentary: Investing Across the AI Cycle

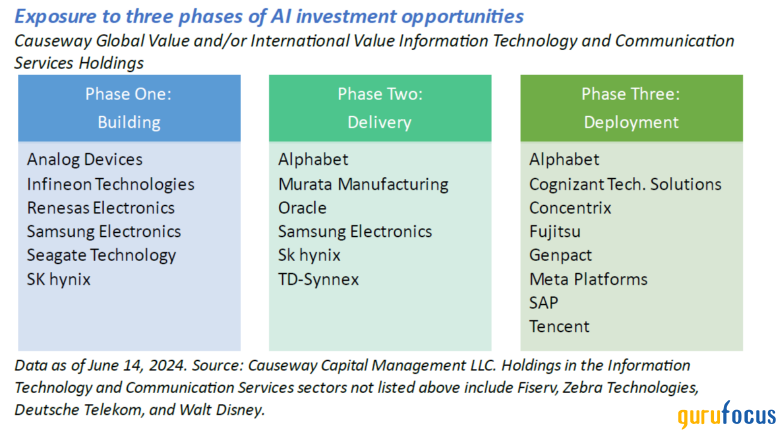

Major technology cycles typically offer three phases of investment opportunities: building, delivery, and deployment. In the first phase, semiconductor companies provide the essential building blocks for computing infrastructure. The second phase features network and end-device manufacturers, the conduits for the technology. In the third phase, software and service providers apply the technology to drive productivity, innovation, and market expansion.

Currently we are in phase one of generative AI's technology cycle, as evidenced by strong stock returns for the direct and immediate beneficiaries: AI server and component suppliers.

Causeway Global Value and International Value strategies currently are invested in what we believe are underappreciated beneficiaries that span all three phases. Fundamental client portfolios have meaningful exposure to the AI cycle via holdings that, in our view, have reasonable valuations not yet incorporating the next five years of growth.

Here, we outline the phases of the AI investment cycle, with Causeway fundamental portfolio holdings highlighted in blue.

Phase One | Building: Semiconductors for AI Computing Infrastructure

Memory

The memory essential for AI data center functions is sold by three key suppliers: Samsung Electronics (XKRX:005930), SK Hynix (XKRX:000660), and Micron Technology (NASDAQ:MU). AI applications need more memory, including high-bandwidth memory (HBM) for faster, lower-latency data transfer. According to our analysis, we expect AI server growth to drive over 100% HBM annual demand growth over the next three years. SK Hynix currently leads in HBM technology and production. Micron matches SK Hynix in technology but lags in production capacity. Samsung Electronics has similar production capacity to SK Hynix but faces challenges in HBM technology and production, which we believe should be resolved within a year.

DRAM

The rise of AI data centers should drive a meaningful dynamic random-access memory (DRAM) pricing cycle as HBM production crowds out conventional DRAM. We expect limited factory space and shifts in production capacity to HBM to squeeze DRAM memory supply through mid-2026. This should lead to stronger DRAM pricing in late 2024.

Data Storage

We believe databoth quantity and qualitywill become the most important differentiating factor for any generative AI applications. High-density solid-state drives (SSDs) are the premium data storage solutionsdevices designed to provide large but compact storage capacity. Samsung Electronics and SK Hynix are currently the dominant SSD suppliers. Seagate Technology (NASDAQ:STX),which produces hard disk drives for cost-effective data storage, should also benefit.

Power Management

AI data centers need effective power and thermal management to optimize their performance. Infineon Technologies (XTER:IFX), Analog Devices (NASDAQ:ADI), and Renesas Electronics (TSE:6723) specialize in advanced semiconductor solutions for these challenges, such as integrated circuits that optimize energy efficiency, and power delivery and thermal monitoring and management equipment.

Phase Two | Delivery: Network Infrastructure and End-Devices

Cloud Migration

Enterprises will need to modernize IT infrastructure for generative AI applications, which should benefit cloud hyperscalers like Alphabet (NASDAQ:GOOG) and Oracle (NYSE:ORCL) that offer cloud computing and infrastructure services. We expect an AI-driven enterprise cloud migration to continue for years.

End-Devices

PCs and smartphones likely will offer more AI features locally (on the device) requiring powerful processors and more memory in the coming years. This should accelerate the replacement cycle for these devices. Samsung Electronics, as a leader in smartphones and memory, appears well-positioned to benefit from on-device AI. Electrical component supplier Murata Manufacturing (TSE:6981) should see robust growth from AI PCs and smartphones. TD-Synnex (NYSE:SNX), the largest IT distributor, also should benefit from this accelerating replacement cycle.

Phase Three | Deployment: AI Software and Services

Digital Ads

Companies like Alphabet (NASDAQ:GOOG), Meta Platforms (NASDAQ:META), and Tencent (TCEHY) already use AI to enhance advertising efficiency and automate customer processes, which has led to revenue growth. Alphabet and Meta will soon introduce consumer-facing generative AI services, such as enhanced search and chat functionality, content creation tools, and tailored advertising and shopping recommendations. These features should allow them to capture more user engagement market share from smaller competitors.

Enterprise AI

Unlike consumer applications, generative AI adoption in businesses may progress more gradually. Outdated IT infrastructure, potential data and brand risks, and the complexity of integrating new AI applications into existing workflows could lead to this slower pace of implementation. Critical considerations include improving data quality and managing the unique requirements of AI training and inference.

Contrary to the prevailing view that generative AI will supersede people-driven IT service businesses, we believe IT and business process outsourcing companies like Cognizant Technology Solutions (CTSH), Genpact (G), Concentrix (CNXC), and Fujitsu (TSE:6702) should play a critical role assisting enterprises adopt and integrate AI technologies. Successful IT services companies will be those that best collaborate with their clients to design and maintain AI applications, sharing the associated benefits and risks. This cooperation should gradually shift the IT services business model from headcount-based to outcome-based. IT services companies that adapt should thrive.

A post-COVID slowdown in IT project spending has put additional pressure on valuations for these IT services companies. However, our analysis indicates that the spending environment has stabilized and should improve later this year and into 2025. Businesses cannot defer their necessary transformation and growth initiatives indefinitely.

We believe SAP (SAP) is another potential beneficiary of enterprise AI adoption. By embedding AI technologies in its software, SAP enables its customers to enhance supply chain resiliency, better manage human and other resources, and improve the pace and accuracy of financial reporting.

Historically, each technological wave, such as cloud computing and mobile technology, has expanded the market size for technology service providers. We expect generative AI to drive additional growth.

Through diligent fundamental research anchored in valuation analysis, we aim to identify lesser-known beneficiaries across all three phases of the technology cycle, so that our clients may potentially participate in the full spectrum of opportunities presented by the evolution of AI.

This market commentary expresses Causeway's views as of June 2024 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

The views herein represent an assessment of companies at a specific time and are subject to change. There is no guarantee that any forecast made will come to pass. This information should not be relied on as investment advice and is not a recommendation to buy or sell any security. The securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. Our investment portfolios may or may not hold the securities mentioned. The reader should not assume that an investment in the securities identified was or will be profitable. For full performance information regarding Causeway's strategies, please see www.causewaycap.com.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Please see https://www.causewaycap.com/wp-content/uploads/Risk-Disclosures.pdf for additional information on the risks of investing using Causeway's strategies.

This article first appeared on GuruFocus.