Caxton Associates Amplifies Stake in Micron Technology, Revealing Strategic Portfolio Adjustments

Insight into Caxton Associates (Trades, Portfolio)' Q2 2024 Investment Moves and Strategic Shifts

Caxton Associates (Trades, Portfolio), the renowned global macro hedge fund established by Bruce Kovner in 1983, has recently disclosed its 13F filing for the second quarter of 2024. Known for its dynamic trading strategies that capitalize on macroeconomic trends, Caxton Associates (Trades, Portfolio) actively engages in a variety of liquid assets including stocks, bonds, currencies, and commodities. The fund's investment philosophy emphasizes short-term market trends over long-term holdings, with a particular focus on sectors characterized by low volatility.

New Strategic Acquisitions

Caxton Associates (Trades, Portfolio) expanded its portfolio by adding a total of 174 stocks. Noteworthy new acquisitions include:

Intel Corp (NASDAQ:INTC), purchasing 5,250,000 shares, making up 5.56% of the portfolio at a value of $162.59 million.

Advanced Micro Devices Inc (NASDAQ:AMD), with 750,000 shares, representing 4.16% of the portfolio, valued at $121.66 million.

Tesla Inc (NASDAQ:TSLA), adding 600,000 shares, accounting for 4.06% of the portfolio, totaling $118.73 million.

Significant Position Increases

During the quarter, Caxton Associates (Trades, Portfolio) also increased its stakes in 137 stocks, with significant boosts to:

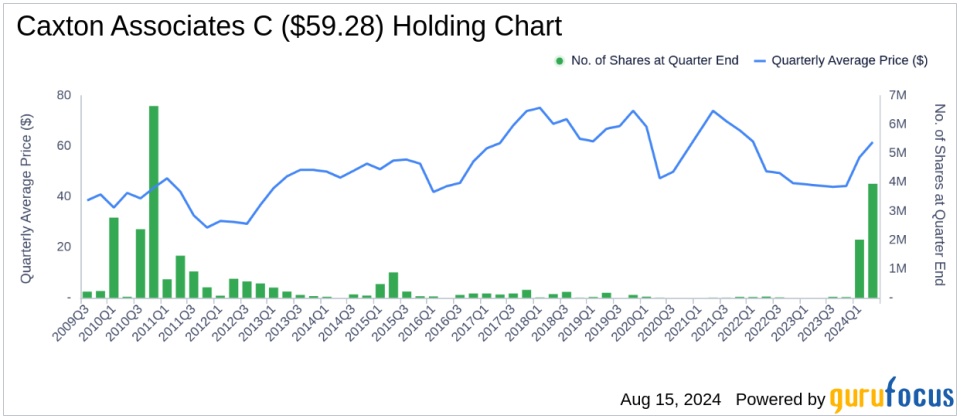

Micron Technology Inc (NASDAQ:MU), where an additional 1,250,000 shares were acquired, bringing the total to 1,300,000 shares. This adjustment marks a 2500% increase in share count and a 5.62% impact on the current portfolio, valued at $170.99 million.

Citigroup Inc (NYSE:C), increasing by 1,937,038 shares to a total of 3,952,428 shares, a 96.11% increase in share count, valued at $250.82 million.

Complete Portfolio Exits

In a strategic move, Caxton Associates (Trades, Portfolio) exited 157 holdings in the second quarter of 2024, including:

Pioneer Natural Resources Co (PXD), selling all 191,531 shares, impacting the portfolio by -2.82%.

Synopsys Inc (NASDAQ:SNPS), liquidating all 25,948 shares, resulting in a -0.83% portfolio impact.

Reductions in Key Holdings

The fund also reduced its positions in 111 stocks, with significant reductions in:

Broadcom Inc (NASDAQ:AVGO), cutting down by 35,157 shares, a 74.04% decrease, impacting the portfolio by -2.61%. The stock traded at an average price of $140.14 during the quarter.

Amazon.com Inc (NASDAQ:AMZN), reducing by 255,251 shares, a 46.51% decrease, impacting the portfolio by -2.58%. The stock traded at an average price of $183.7 during the quarter.

Portfolio Overview and Sector Focus

As of the second quarter of 2024, Caxton Associates (Trades, Portfolio)' portfolio included 465 stocks. The top holdings were:

8.57% in Citigroup Inc (NYSE:C)

5.84% in Micron Technology Inc (NASDAQ:MU)

5.56% in Intel Corp (NASDAQ:INTC)

5.22% in Microsoft Corp (NASDAQ:MSFT)

4.16% in Advanced Micro Devices Inc (NASDAQ:AMD)

The holdings are predominantly concentrated across 11 industries, with significant exposure in Technology and Financial Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.