Celanese (CE) Wraps Up Santoprene Elastomers Business Acquisition

Celanese Corporation CE recently completed the buyout of the Santoprene TPV elastomers business of Exxon Mobil Corporation.

Per the agreement, the buyout is worth $1.15 billion on a cash-free and debt-free basis. Through this deal, Celanese acquired Santoprene, Dytron, and Geolast trademarks and product portfolios, all customer and supplier contracts as well as agreements. It also purchased two world-scale production sites in Pensacola, FL and Newport, Wales with more than 190 kt of total annual production capacity.

The buyout also includes the comprehensive TPV intellectual property portfolio with related technical and R&D assets as well as around 320 highly-skilled employees, including world-class manufacturing, technical and commercial organizations.

Celanese expects the acquisition to be immediately accretive to 2022 adjusted earnings per share and free cash flow. The acquisition further broadens the company’s portfolio of engineered solutions and enables it to offer a wider range of functionalized solutions to targeted growth areas, including future mobility, medical and sustainability.

The company stated that it looks forward to the partnership of its commercial and technical teams to take a broad range of Engineered Materials’ solutions into targeted growth areas, thereby boosting shareholders’ value.

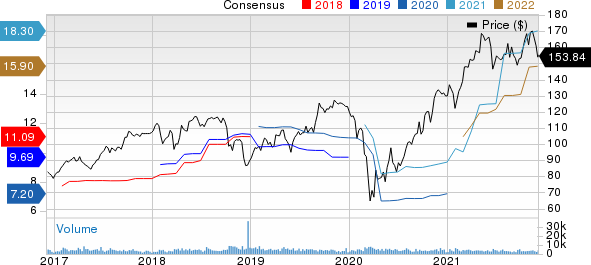

Shares of Celanese have increased 16% in the past year compared with a 1.3% rise of the industry.

Image Source: Zacks Investment Research

Celanese, in its last earnings call, stated that demand for its products remains strong in most end markets as it enters the fourth quarter. It sees pent-up demand across Engineered Materials and Acetyl Chain units to more than offset any impact of typical year-end seasonality. Notwithstanding the sourcing and logistics headwinds, the company expects to deliver fourth-quarter adjusted earnings of roughly $5.00 per share.

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Zacks Rank & Other Key Picks

Celanese currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and The Mosaic Company MOS.

Nucor has an expected earnings growth rate of 583.2% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 7.7% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missing the same twice. The company has a trailing four-quarter earnings surprise of roughly 2.74%, on average. The stock has surged around 90.7% in a year. NUE currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. CC has increased around 14.6% over a year. CC currently sports a Zacks Rank #2.

Mosaic has a projected earnings growth rate of 500% for the current year. The consensus estimate for the current year has been revised 0.8% upward in the past 60 days.

Mosaic beat the Zacks Consensus Estimate for earnings in three of the last four quarters. MOS has a trailing four-quarter earnings surprise of 38.1%, on average. The company’s shares have gained around 52.1% in a year. It currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance