Centene (CNC), Cityblock Partner to Enhance Value-Based Care

Centene Corporation’s CNC wholly-owned subsidiary Sunshine Health recently partnered with Cityblock to offer care coordination and primary care services to Medicaid members in 11 Central Florida Countries. This move is aimed at providing whole health services, seamless care coordination and clinical services. This partnership is an extension of CNC’s partnership with Cityblock in Ohio and New York.

This move bodes well for Centene as it will be able to provide value-based care to its customers. Members will be able to access wrap-around services 24/7 and virtually see the multidisciplinary team in addition to in-home and local clinics. This highlights that CNC is addressing the growing demand for convenient and flexible healthcare services, given the rapid advancement in technology. Virtual care will also drive more engagement and adherence to plans, thereby improving health outcomes and reducing unnecessary inpatient admissions and emergency department visits.

Cityblock is the perfect partner for Sunshine Health, given its care model, to cater to members with complex care needs and who are more likely at higher risk for poor health conditions. Per Cityblock’s 2024 Equity in Action report, its care model has led to increased clinical continuity and engagement and reduced avoidable inpatient admissions. Such value propositions are expected to reduce medical costs for CNC, enabling it to report better profit margins in the future.

Moves like these should poise CNC well for growth as offering innovative value-based care services should differentiate it from its competitors. Enhanced offerings will enable it to attract providers and members who value patient-centered and integrated care. Moves like these should drive sustainability and long-term growth.

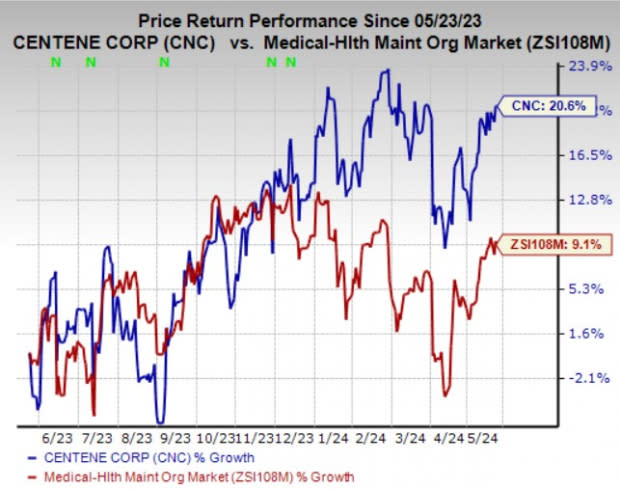

Shares of Centene have gained 20.6% in the past year compared with the industry’s 9.1% growth. CNC currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the Medical space are Medpace Holdings, Inc. MEDP, Boston Scientific Corporation BSX and DaVita Inc. DVA. While Medpace sports a Zacks Rank #1 (Strong Buy) at present, Boston Scientific and DaVita carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.8%. The consensus estimate for MEDP’s 2024 earnings and revenues suggests an improvement of 27.1% and 14.9%, respectively, from the 2023 reported figures.

The consensus estimate for Medpace’s 2024 earnings has moved 4.5% north in the past 30 days. Shares of MEDP have gained 92.4% in the past year.

Boston Scientific’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 7.5%. The consensus estimate for BSX’s 2024 earnings and revenues suggests an improvement of 13.2% and 12.3% from the respective 2023 figures.

The consensus estimate for Boston Scientific’s 2024 earnings has moved 3.1% north in the past 30 days. Shares of BSX have gained 45.1% in the past year.

DaVita’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 29.4%. The consensus estimate for DVA’s 2024 earnings and revenues suggests an improvement of 13.6% and 5%, respectively, from the 2023 figures.

The consensus estimate for DaVita’s 2024 earnings has moved 1.4% north in the past seven days. Shares of DVA have gained 40% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance