SITE Centers (SITC) Disposes Two Properties for $50M in Q2

SITE Centers Corp. SITC has provided an update on its transaction and financing activities for the second quarter of 2024.

In the second quarter of 2024 to date, the company disposed of two properties for $50.2 million bringing total dispositions since Jun 30, 2023, to $1 billion. It has $650 million of additional assets under contract, expected to close by the end of the second quarter of 2024 subject to standard closing conditions.

According to the management, overall pricing levels for the completed and expected 2024 asset sales demonstrate the quality of the SITE Centers portfolio.

The company is expected to repay all unsecured debt prior to the spin from the disposition proceeds and $1 billion of mortgage proceeds, showcasing SITC’s prudent capital-management practices.

The pace and scale of dispositions have resulted in an increased capital available for the acquisition of additional convenience properties before the expected spin-off of Curbline Properties. Additionally, it has allowed for the repurchase of the company’s senior unsecured notes at a price lower than their face value.

Further, in the second quarter to date, the company purchased two wholly-owned convenience properties for $8.4 million. It has also repurchased $15.9 million of outstanding senior unsecured notes.

The company has executed contracts to acquire $78 million worth of convenience properties and has secured more than $150 million worth of convenience properties on a nonbinding basis, highlighting the opportunity outlined in the October 2023 announcement of the spin-off of Curbline Properties.

SITE Centers has been following an aggressive capital-recycling program through which it is divesting slow-growth assets and redeploying the proceeds for the acquisitions of premium U.S. shopping centers.

However, given the conveniences of online shopping, growing e-commerce adoption is concerning for SITE Centers. Potential tenant bankruptcies in the near term could affect its profitability and hurt occupancy. A high interest rate environment adds to its woes.

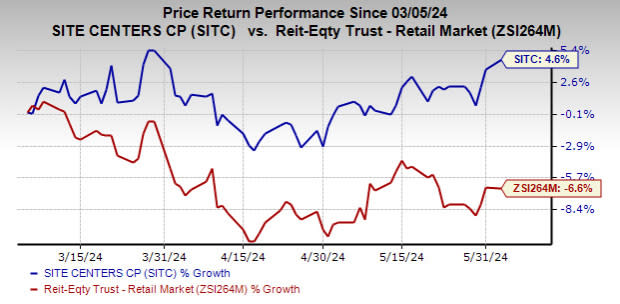

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 4.6% against the industry’s decline of 6.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Acadia Realty Trust AKR and Kite Realty Group Trust KRG, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for AKR’s 2024 FFO per share has moved marginally northward over the past two months to $1.28.

The Zacks Consensus Estimate for KRG’s ongoing year’s FFO per share has been raised marginally upward over the past two months to $2.05.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acadia Realty Trust (AKR) : Free Stock Analysis Report

Kite Realty Group Trust (KRG) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance