Central Pacific Financial Corp Reports Q1 2024 Earnings: A Close Look at Performance Against ...

Net Income: Reported $12.9 million, surpassing the estimated $12.26 million.

Earnings Per Share (EPS): Achieved $0.48 per diluted share, exceeding the estimate of $0.45.

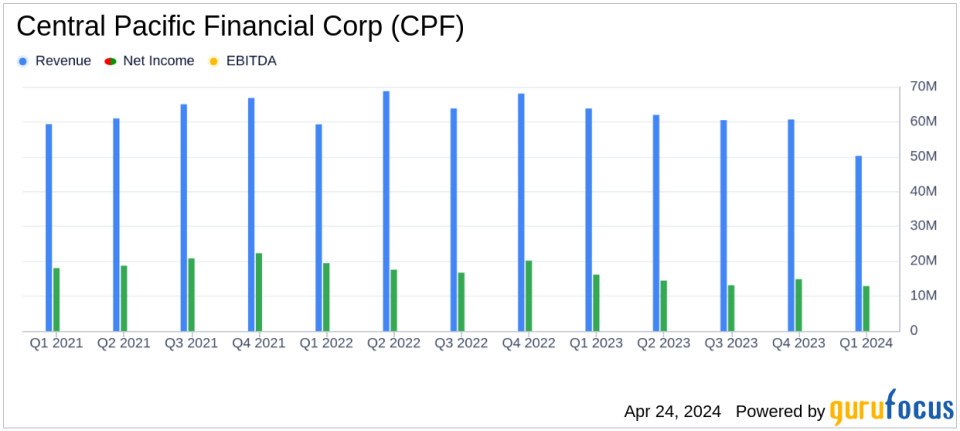

Revenue: Net interest income for the quarter was $50.2 million, aligning closely with the estimated revenue of $50.23 million.

Provision for Credit Losses: Recorded $3.9 million, compared to $4.7 million in the previous quarter and $1.9 million in the same quarter last year.

Total Loans: Decreased to $5.40 billion, down by $37.6 million from the previous quarter.

Total Deposits: Fell to $6.62 billion, a decrease of $228.7 million from the previous quarter.

Dividend: Board of Directors approved a quarterly cash dividend of $0.26 per share.

On April 24, 2024, Central Pacific Financial Corp (NYSE:CPF) disclosed its financial results for the first quarter of 2024, revealing a net income of $12.9 million or $0.48 per diluted share. This performance slightly exceeded analyst expectations, which projected earnings of $0.45 per share and a net income of $12.26 million. The company's net interest income for the quarter was reported at $50.2 million, aligning closely with estimated revenues of $50.23 million. These details were outlined in their recent 8-K filing.

Central Pacific Financial Corp, a key player in the financial services sector in the United States, operates primarily through its subsidiary, Central Pacific Bank. The bank offers a comprehensive suite of banking products and services, including loans and deposit acceptance. These services are crucial as they form the backbone of the bank's revenue through interest and fees.

Quarterly Financial Performance

The first quarter saw a slight decrease in net interest margin (NIM) to 2.83% from 2.84% in the previous quarter, reflecting tighter margins that could impact future profitability. Total loans decreased to $5.40 billion, down by $37.6 million from the previous quarter, while total deposits saw a reduction of $228.7 million, settling at $6.62 billion. These figures suggest a contraction in both lending and deposit activities, which are critical indicators of the bank's growth trajectory.

CPF also reported a provision for credit losses of $3.9 million, an increase from $1.9 million in the year-ago quarter, indicating a cautious approach to potential credit risks in the market. Importantly, the bank's efficiency ratio deteriorated slightly to 66.05%, compared to 64.12% in the prior quarter, suggesting higher costs relative to revenue.

Strategic Initiatives and Challenges

Arnold Martines, President and CEO of CPF, highlighted the bank's focus on optimizing the balance sheet and maintaining robust liquidity and asset quality. Celebrating its 70th year, CPF continues to champion local small businesses in Hawaii, a testament to its community-focused business model. However, the reduction in loan and deposit volumes poses challenges that could impact the bank's ability to expand its services and profitability in upcoming quarters.

Capital and Liquidity

CPF's total assets decreased by 3.0% to $7.41 billion, and the bank maintained strong capital ratios, with a total risk-based capital ratio of 14.8% and a common equity tier 1 ratio of 11.6%. These ratios are crucial for assessing the bank's financial stability and its ability to withstand economic fluctuations.

Looking Ahead

As CPF navigates through 2024, the focus will likely remain on enhancing asset quality and managing costs effectively to improve the efficiency ratio. The bank's ability to adapt to economic conditions and regulatory environments will be pivotal in sustaining growth and profitability. Investors and stakeholders will also look forward to the strategic initiatives CPF might undertake to bolster its market position in a competitive banking landscape.

For more detailed insights and ongoing updates, stakeholders are encouraged to follow CPF's developments through upcoming financial disclosures and analyst briefings.

Explore the complete 8-K earnings release (here) from Central Pacific Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance