How Cerner Is Capitalizing on Growth in Healthcare IT

The U.S. healthcare system is notoriously inefficient. Administrative expenses account for as much as 25% of total U.S. hospital spending, which is more than anywhere else in the world. Technology can help make healthcare more efficient by streamlining records and helping administrators better manage their systems.

Enter Cerner (NASDAQ: CERN), one of the leading healthcare IT companies. Hospitals aren't exactly early adopters when it comes to technology, but Cerner already has a large install base and is helping its clients further adopt software that can help hospitals upgrade their capabilities. Because Cerner is tackling such a large and important problem, it has strong growth prospects for the coming years.

Image Source: Getty Images.

Cerner's product offerings

Cerner is a behemoth in the healthcare IT space. Founded in 1980, the company was a pioneer in the electronic health records industry. Today, Cerner is still a leading electronic health records player, but it has expanded into adjacent software offerings, including revenue cycle management, IT consulting, and data analytics.

The company's core business is its electronic health records product, which accounts for roughly 75% of revenue. Electronic health records software is a foundational piece of hospital IT infrastructure and is considered mission critical because it houses much of the patient data. The records system connects to other applications within a hospital's system and touches everything from billing to prescription management.

Because Cerner has a strong position in the market for electronic health records software, it has a strong ability to cross-sell other related software. The company's second-largest product is its revenue cycle management software, which accounts for roughly 13% of sales. Revenue cycle software manages billing, insurance claims, and collections. As one could imagine, managing revenue is extremely complicated in the healthcare industry because of various billing schemes and different types of health insurance coverage.

Cerner has a couple of smaller businesses that it hopes to grow over time. The company has a healthcare IT consulting operation that helps manage IT systems for hospitals and provides business process outsourcing services. Healthcare IT consulting accounts for roughly 7% of the company's revenue. Finally, Cerner has a nascent business called population health management, which is a data analytics software program. The population health software aims to provide predictive analytics that can help inform areas of need for health systems or health insurance plans.

Putting the pieces together, Cerner's business is anchored by its electronic health records platform, but it has a few offshoots that provide more specialized applications.

Cerner's growth prospects

Cerner's growth strategy has been to get a healthcare provider onto its electronic health records platform and then cross-sell additional services. Cerner is tied for the No. 1 market share position in electronic health records with its archrival Epic Systems. The two companies together account for about half of the market for electronic health records, with several smaller players holding smaller pieces of the pie. Cerner has an opportunity to take share from its competitors and is somewhat competitively advantaged to do so because it has a strong brand name and a strong platform with additional capabilities beyond health records management.

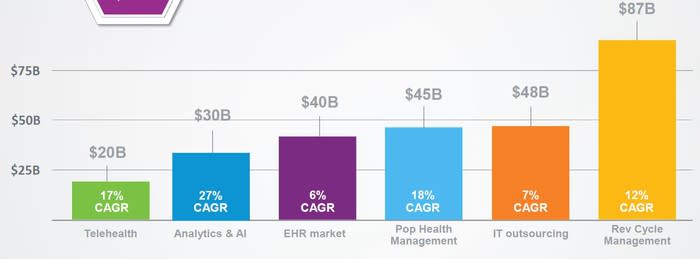

Cerner is expanding into other aspects of healthcare IT because the electronic records business is fairly mature; the market is only expected to grow about 6% per year over the next 5 to 10 years. The table below, from a recent investor presentation, highlights where the company sees growth in the healthcare IT industry.

Image Source: Cerner investor presentation.

Cerner isn't particularly strong in revenue cycle management, which is why it acquired Siemens' revenue cycle software business in 2014 for $1.3 billion. Cerner's population health management business could see strong growth, since the industry for that product is expected to grow by 18% per year. Population health management is tangential to healthcare analytics and AI predictive analytics, which is also expected to grow at a rapid rate. Cerner doesn't have a solution for the telehealth market at this time.

The company has guided investors to expect annual revenue growth in the range of 6% to 9% over the next five years. This is a solid pace for top-line growth for a large-cap company.

Looking forward

Cerner is an innovative technology company tackling the massive problem of inefficiency in the healthcare system. The company's software products are mission critical for healthcare providers and the company stands to benefit from healthcare spending growing faster than the overall economy.

Although the electronic health records business is maturing, Cerner has a few promising avenues of growth from tangential healthcare IT businesses. Altogether, investors can expect high-single-digit annual growth for the foreseeable future.

More From The Motley Fool

Luis Sanchez has no position in any of the stocks mentioned. The Motley Fool recommends Cerner. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance