CF Industries' (CF) Earnings & Sales Miss Estimates in Q4

CF Industries Holdings, Inc. CF recorded profits of $55 million or 25 cents per share in the fourth quarter of 2019, up from $49 million or 21 cents in the year-ago quarter. However, earnings per share missed the Zacks Consensus Estimate of 26 cents.

Net sales fell 7% year over year to $1,049 million in the quarter. It also lagged the Zacks Consensus Estimate of $1,057.8 million.

The top line was hurt by lower year-over-year selling prices across all major products that more than offset increased sales volumes. Prices in the quarter were affected by greater global supply availability due to increased global operating rates.

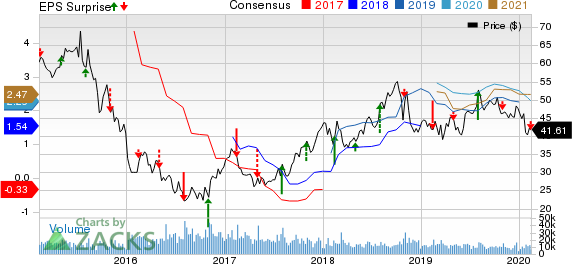

CF Industries Holdings, Inc. Price, Consensus and EPS Surprise

CF Industries Holdings, Inc. price-consensus-eps-surprise-chart | CF Industries Holdings, Inc. Quote

Full-Year Results

For 2019, earnings were $2.23 per share, up from $1.24 per share a year ago.

Revenues were $4,590 million for the full year, up around 4% year over year, driven by higher average selling prices across most key products. Sales volumes for the year were flat year over year.

Segment Review

Net sales in the Ammonia segment rose roughly 6% year over year to $266 million in the reported quarter. Ammonia sales volume rose year over year due to increased supply availability as a result of higher production. Average selling prices of ammonia fell year over year due to higher global ammonia supply availability.

Sales in the Granular Urea segment declined roughly 31% year over year to $239 million. Sales volumes fell year over year due to lower volumes of product availability as a result of planned maintenance activities and the company’s move to build inventory ahead of the spring fertilizer application season. Average selling prices for urea fell year over year due to increased global supply availability.

Sales in the UAN segment went down around 2% year over year to $336 million. Sales volumes and average selling prices were both flat year over year in the quarter.

Sales in the AN segment rose roughly 21% year over year to $117 million. Sales volumes rose year over year on the back of higher demand in the United States. Average selling prices declined year over year due to increased global supply availability.

Financials

CF Industries’ cash and cash equivalents fell roughly 58% year over year to $287 million at the end of 2019. Long-term debt was $3,957 million at the end of the year, down roughly 18% year over year.

Cash flow from operation was $320 million for the reported quarter, up around 19% year over year. The company repurchased roughly 1.9 million shares during the reported quarter. It is currently executing a share repurchase program worth $1 billion that is authorized through 2021.

Outlook

The company expects global nitrogen demand to be positive over the near term as application seasons develop in different regions globally. In North America, crop futures and an expected return to traditional planting conditions in the region are projected to support a rise in nitrogen-consuming planted corn and coarse grain acres in 2020 on a year-over-year basis.

CF Industries also envisions demand to remain strong in India this year. It expects a new urea tender in India in late March or early April 2020. CF Industries also sees demand in Brazil to be favorable in 2020, backed by reduced domestic urea production.

Price Performance

Shares of CF Industries are down 2.4% in the past year compared with the industry’s 17.3% decline.

Zacks Rank & Key Picks

CF Industries currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include Daqo New Energy Corp. DQ, Agnico Eagle Mines Limited AEM and Pretium Resources Inc. PVG.

Daqo New Energy has projected earnings growth rate of 326.3% for 2020 and sports a Zacks Rank #1 (Strong Buy). The company’s shares have surged roughly 119% in a year’s time. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle has estimated earnings growth rate of 99.6% for 2020 and carries a Zacks Rank #1. The company’s shares have shot up roughly 42% in a year’s time.

Pretium Resources has projected earnings growth rate of 105.3% for 2020 and carries a Zacks Rank #2 (Buy). The company’s shares have gained around 2% over a year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pretium Resources, Inc. (PVG) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance