Change Healthcare (CHNG) Q4 Earnings, Revenues Top Estimates

Change Healthcare Inc. CHNG reported fourth-quarter fiscal 2020 adjusted earnings per share of 42 cents, which beat the Zacks Consensus Estimate by 13.5%. However, the bottom line declined 16% year over year.

For fiscal 2020, the company reported adjusted earnings per share of $1.55, down 4.3% from the previous year. The figure beat the consensus mark by 4.7%.

Revenue Details

Revenues inched up 0.8% from the prior-year period to $843.4 million in the reported quarter. The top line also beat the Zacks Consensus Estimate by 0.5%.

For fiscal 2020, the company reported revenues of $3.30 billion, up 0.6% from the previous year. The figure came in line with the Zacks Consensus Estimate.

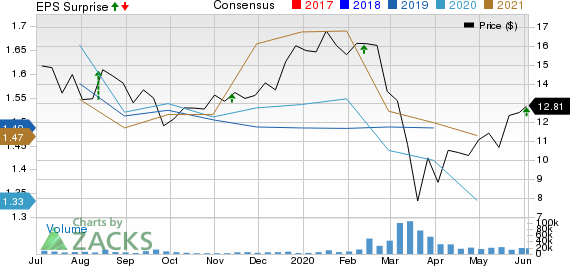

Change Healthcare Inc. Price, Consensus and EPS Surprise

Change Healthcare Inc. price-consensus-eps-surprise-chart | Change Healthcare Inc. Quote

Segmental Analysis

Change Healthcare operates through three segments — Software and Analytics, Network Solutions, and Technology-Enabled Services.

Software and Analytics

Revenues at this segment totaled $418.7 million, down 0.1% on a year-over-year basis.

Network Solutions

Revenues at this segment came in at $152.2 million, up 8.6% year over year.

Technology-Enabled Services

Revenues at this segment came in at $242.4 million, down 0.6% year over year.

Margin Analysis

In the quarter under review, Change Healthcare reported operating loss of $661.5 million, much narrower than the year-ago operating loss of $971 million.

Financial Position

The company exited the quarter with cash and cash equivalents of $410.4 million compared with $3.4 million in the prior quarter.

Cumulative cash used in operating activities at the end of fourth-quarter fiscal 2020 came in at $153.9 million compared with cash flow from operating activities of $3.4 million in the year-ago period.

Guidance

Due to uncertainty surrounding the COVID-19 pandemic, Change Healthcare has only issued quarterly guidance.

For first-quarter fiscal 2021, the company projects Solutions revenues between $595 million and $620 million. Adjusted EBITDA is estimated in the range of $160-$175 million.

Adjusted EPS is estimated between 14 cents and 18 cents.

Wrapping Up

Change Healthcare exited fourth-quarter fiscal 2020 on a strong note, with both earnings and revenues beating the Zacks Consensus Estimate. The Network Solutions recorded solid performance in the quarter. Strong guidance also instills investors’ optimism in the stock.

During the quarter under review, it completed the buyout of PDX — which is a company committed toward delivering patient centric and innovative technologies for pharmacies and health systems — for a purchase price of $208 million. Further, Change Healthcare closed the acquisition of eRx Network for a purchase price of $212.9 million together with cash on the balance sheet. The company also completed the sale of Connected Analytics for a total consideration of $55 million.

Also, Change Healthcare introduced COVID-19 Information Hub, which will help it in the maintenance of administrative, financial and operational stability during the pandemic.

Additionally, the company completed McKesson Corporation's disposition of its ownership interest in Change Healthcare. Resultantly, McKesson no longer owns any voting or economic interest in Change Healthcare.

These developments have impacted the company’s overall performance and are likely to accelerate growth in the near term.

However, cut-throat competition remains a concern. Also, weak performance of the Software and Analytics, and Technology-Enabled Services segments is a woe.

Zacks Rank

Currently, Change Healthcare carries a Zacks Rank #5 (Strong Sell).

Key Picks

Some better-ranked stocks in the broader medical space include Aphria Inc. APHA, Biogen Inc. BIIB and Eli Lilly and Company LLY.

Aphria reported third-quarter fiscal 2020 adjusted EPS of 2 cents against the Zacks Consensus Estimate of a loss of 4 cents. Net revenues of $64.4 million surpassed the consensus mark by 14.6%. The company carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biogen currently carries a Zacks Rank #2. It reported first-quarter 2020 adjusted EPS of $9.14, surpassing the Zacks Consensus Estimate by 18.1%. Revenues of $3.53 billion outpaced the consensus mark by 3.2%.

Eli Lilly reported first-quarter 2020 EPS of $1.75, outpacing the Zacks Consensus Estimate by 12.9%. Revenues of $145.3 million surpassed the consensus estimate by 6.3%. The company currently sports a Zacks Rank #1.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Aphria Inc. (APHA) : Free Stock Analysis Report

Change Healthcare Inc. (CHNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance