The ChannelAdvisor (NYSE:ECOM) Share Price Is Up 231% And Shareholders Are Boasting About It

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example ChannelAdvisor Corporation (NYSE:ECOM). Its share price is already up an impressive 231% in the last twelve months. Also pleasing for shareholders was the 60% gain in the last three months. Also impressive, the stock is up 170% over three years, making long term shareholders happy, too.

View our latest analysis for ChannelAdvisor

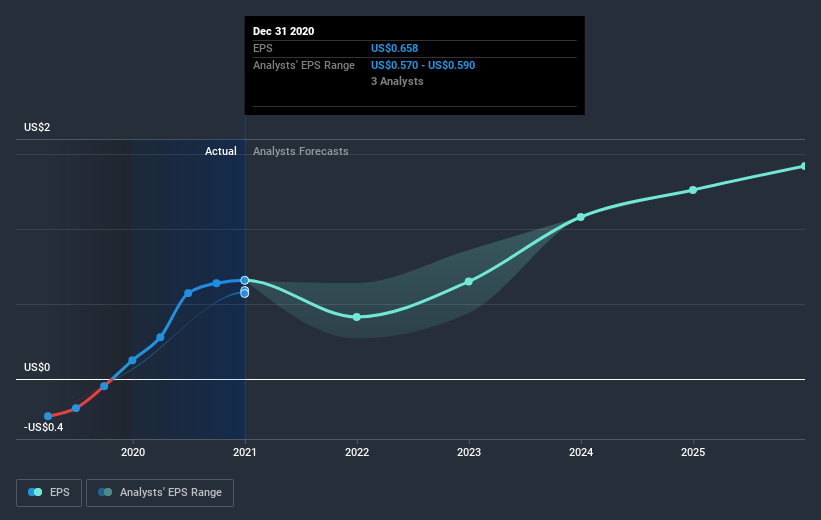

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year ChannelAdvisor saw its earnings per share (EPS) increase strongly. This remarkable growth rate may not be sustainable, but it is still impressive. So we'd expect to see the share price higher. To us, inflection points like this are the best time to take a close look at a stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that ChannelAdvisor has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that ChannelAdvisor shareholders have received a total shareholder return of 231% over the last year. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand ChannelAdvisor better, we need to consider many other factors. Take risks, for example - ChannelAdvisor has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance