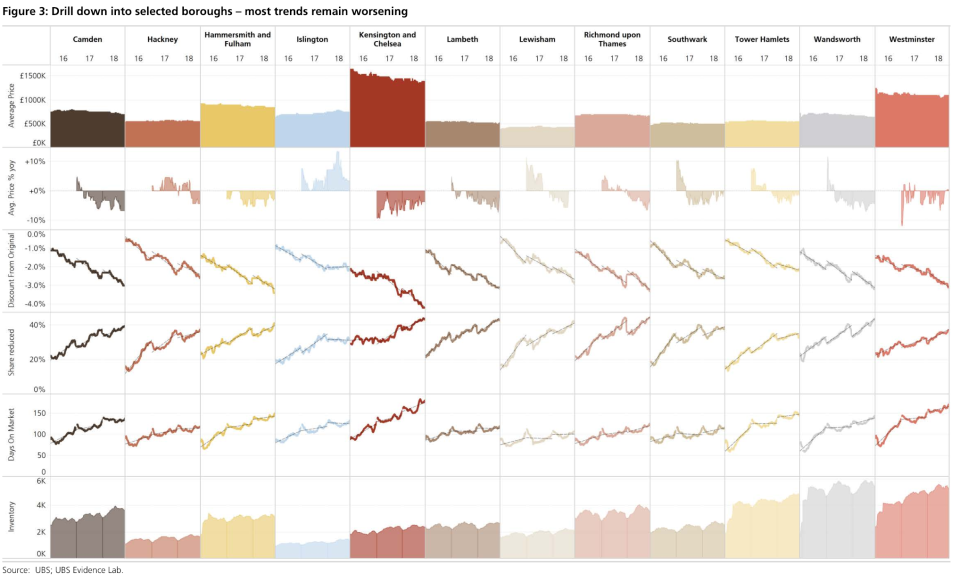

This chart shows how badly house prices are faring in central London boroughs

Key measures of the health of central London’s housing market are trending downwards, according to a new graphic produced by UBS.

The Swiss investment bank sent its third ‘London residential monitor’ note to clients on Wednesday, which is based on analysis of over 100,000 listings on online property portals. UBS’ analysis found that:

More and more property listings in London are cutting their asking prices

Asking prices are being reduced on average by 2.6% versus historic prices

Most houses remain on the market for 128 days, a high since UBS has been measuring

Expensive houses in boroughs like Kensington & Chelsea are taking longer to sell

“The London housing market remains weak,” UBS analyst Osmaan Malik and his team wrote. “Stretched affordability, high levels of supply at prime price points, and numerous changes to stamp duty have all taken their toll, at a time where Brexit uncertainties linger.

“In past cycles, a London downturn has pre-empted a wider loss of momentum and decline in consumer confidence. The Bank of England appears to think this time may be different, as the capital is more exposed than the national market to stamp duty changes and is more likely to be impacted by the departure of European Union nationals.”

UBS’ data shows that the steepest house price discounts are in Kensington and Chelsea, where average listing prices are over 4% lower than historic averages. The borough also had the highest average asking price and listings in the area spend the longest time on the market.

Land values in prime central London declined by 2.8% in the fourth quarter of 2018, according to recent Knight Frank data, taking the annual decline to 5.6%.

Economists believe house price growth across the UK could be sluggish this year. Britain’s official exit from the EU in March is seen as the most important influencing factor on house prices across the country in 2019.

———

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

There’s a new buzzword in crypto: the ‘STO’

The challenge for cryptocurrency firms in 2019: don’t die

A shocking stat shows venture capital’s diversity problem — and there’s a ‘moral’ duty to address it

This ex-Googler wants to help high street banks be more like Monzo

UK government prepares to spend £2bn on Brexit prep as no deal looms

Yahoo Finance

Yahoo Finance