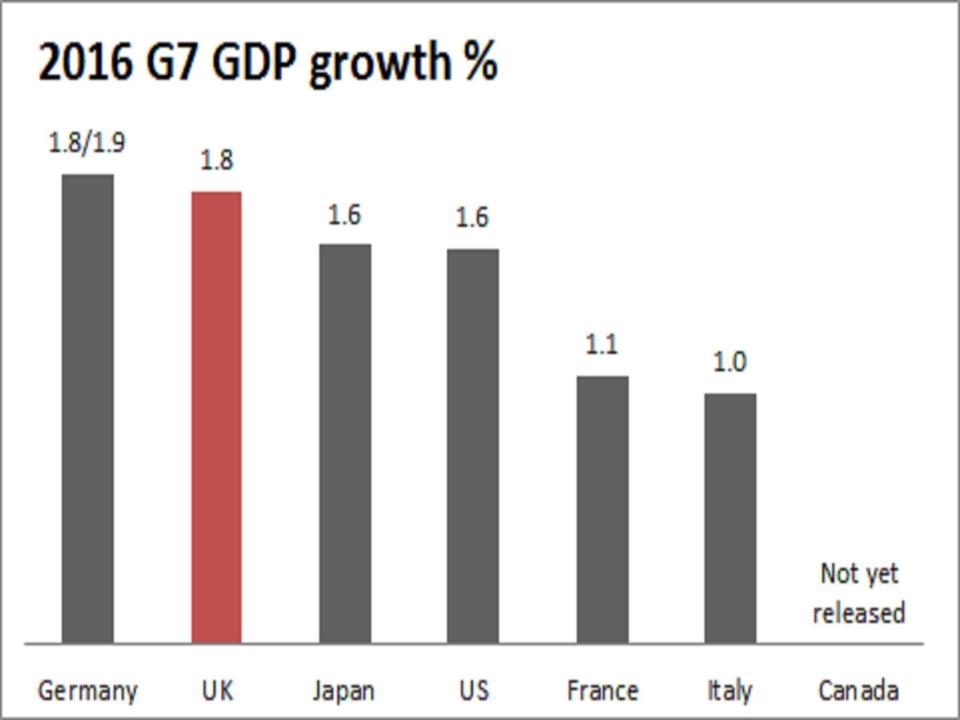

The chart that shows the UK is no longer the fastest growing G7 economy

The UK can no longer claim to have been the fastest growing G7 economy in 2016.

Berlin's official statistics agency confirmed Thursday that the German economy grew by 1.9 per cent, or 1.8 per cent on a calendar adjusted basis.

This came after the Office for National Statistics on Wednesday revised down its initial estimate for UK growth in the 2016 calendar year to 1.8 per cent, down from 2 per cent previously.

That means UK growth is now estimated to have been level-pegging, or even slightly behind, Germany last year, rather than leading the pack of large, advanced economy nations.

According to the latest statistical releases from national agencies, the UK continues to outstrip the rest of the G7.

No longer top

The per capita GDP data for the G7 is still very incomplete. But the data available shows that the UK per head GDP growth in 2016 (1.1 per cent) was below that of Germany (1.9 per cent) and the US (1.2 per cent).

Last month a Times front page headline declared that the UK had "the world's top economy" and the fact has been a common talking point from pro-Brexit politicians seeking to dismiss the view of most economists that the Brexit vote will ultimately have a negative impact.

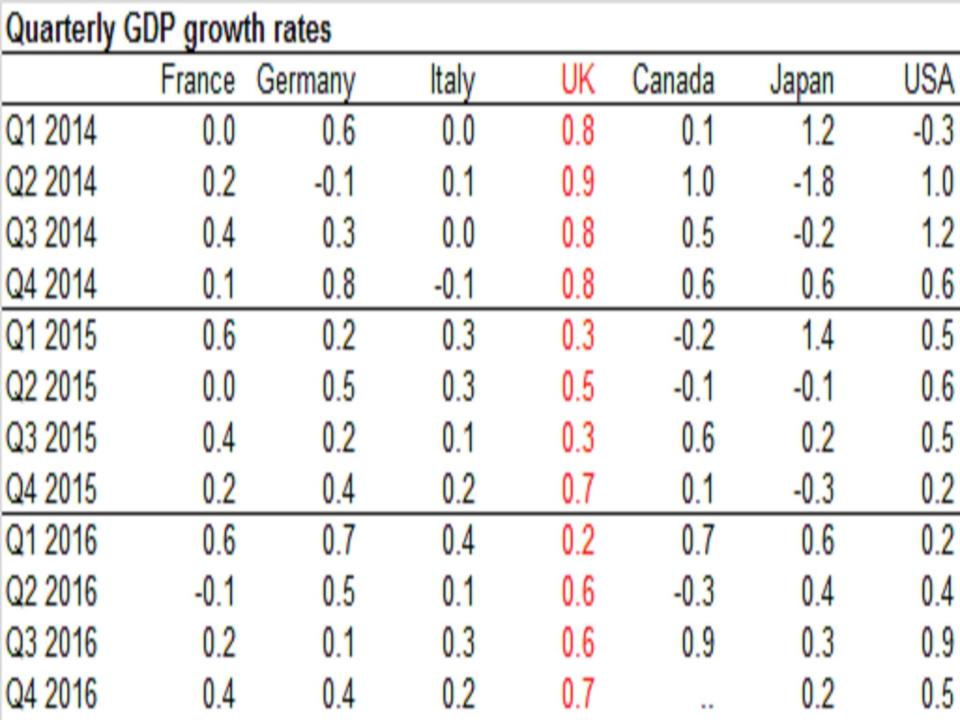

Nevertheless, on a quarterly basis, the UK still outstripped most the rest of the G7 in the second half of 2016, growing by 0.6 per cent in the the third quarter and 0.7 per cent in the final three months of the year.

This is much stronger than the vast majority of economists expected in the immediate wake of last June's leave vote.

The detail of the ONS statistics shows that growth has been overwhelmingly powered by household consumption. Business investment fell on a calendar basis in 2016 for the first time since 2009.

In January the International Monetary Fund forecast growth for the UK would drop to 1.1 per cent in 2017 as inflation from the post-Brexit vote slump in the pound finally crimps household spending and more businesses delay investment due to uncertainty about the UK's future trade relations with the rest of the EU.

That would take us below the projected GDP growth rates of France, Germany and Canada.

The 2017 outlook

The IMF expected growth in the US to accelerate to 2.2 per cent owing to President Donald Trump's promised tax cuts and infrastructure spending.

The Office for Budget Responsibility, the Treasury's official watchdog, in November projected 1.4 per cent growth for the UK in 2017, although that is likely to be upgraded in the Budget next month.

In its Inflation Report the Bank of England earlier this month upgraded its UK 2017 growth forecast to 2 per cent, although the Bank still expects growth to fall to 1.6 per cent in 2018 and 1.6 per cent in 2019 owing to the negative economic impact of Brexit.

Its forecast show that the level of UK GDP by 2019 will be around 1.5 per cent lower relative to its pre-Brexit vote forecasts from last May, a hit equivalent to some £30bn in today's money.

Yahoo Finance

Yahoo Finance