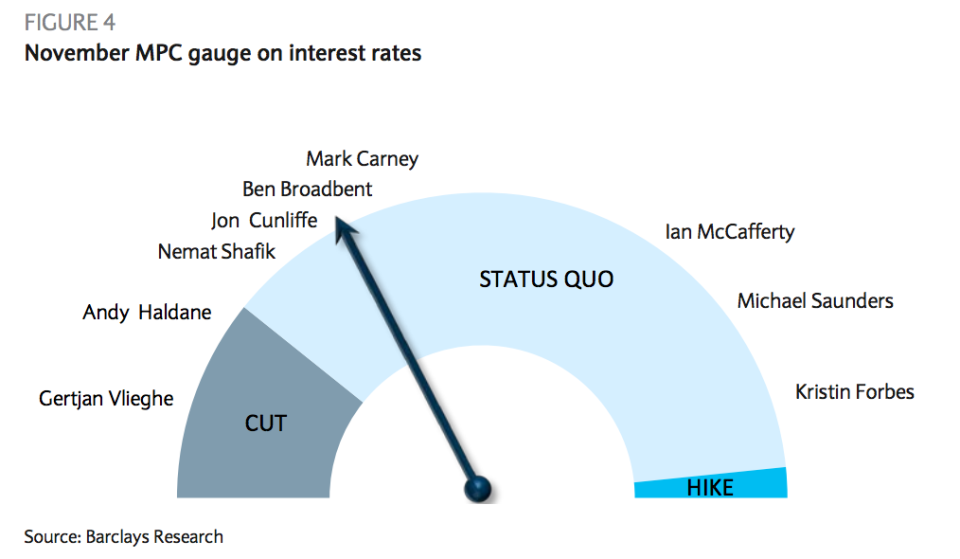

This chart shows where all of the Bank of England's most important staff stand on monetary policy

REUTERS/Guadalupe Pardo

When the Bank of England cut interest rates to a new record low and unleashed a substantial package of quantitative easing on August 4, the bank said that the majority of its Monetary Policy Committee expected to "support a further cut in Bank Rate to its effective lower bound."

In the two and a half months since the decision, the British economy has held up much better than forecast (with the exception of the crashing pound) and as a result, expectations of another rate cut at the bank's November 3 meeting have dwindled significantly.

As a note circulated to clients by Barclays analysts Fabrice Montagne, and Andrzej Szczepaniak on Friday says:

"The BoE’s commitment to cut was tied to growth being in line with its August Inflation Report forecast, which translated into Q3 GDP at 0.1% q/q. With growth now likely higher, we believe the MPC will not find a majority to back a cut. In particular, we believe that MPC members who opposed QE in August are now also likely to oppose a further cut in Bank rate."

It may be highly unlikely that the bank will cut, but inevitably, there will be divisions in the Monetary Policy Committee given the unsteady state of Britain's economy, so it is worth looking at where members of the committee might stand.

A handy graphic, produced by Montagne and Szczepaniak, illustrates where Barclays thinks the members of the bank's MPC stand on a possible rate cut at the coming BoE meeting in November.

Two members of the MPC — Gertjan Vlieghe and chief economist Andy Haldane — are expected to vote for a further cut, while American Kristin Forbes, who has been the most hawkish member of the committee since the referendum, is the most likely to vote to actually increase rates. As might be expected, Governor Mark Carney is right near the middle.

Check it out below:

REUTERS/Guadalupe Pardo

NOW WATCH: Here's how much $100 is worth in every state

See Also:

SEE ALSO: The Bank of England governor is under attack again by Brexiteers for failing to predict the future

DON'T MISS: BANK OF ENGLAND OFFICIAL: Relax, Brexit doesn't mean the death of the City of London

Yahoo Finance

Yahoo Finance